Taxation on rural sector: tax burden, land value and property right

Texto completo

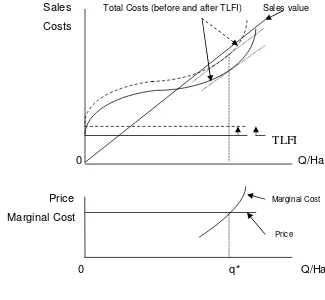

Figure

Documento similar

In the preparation of this report, the Venice Commission has relied on the comments of its rapporteurs; its recently adopted Report on Respect for Democracy, Human Rights and the Rule

The draft amendments do not operate any more a distinction between different states of emergency; they repeal articles 120, 121and 122 and make it possible for the President to

1) People who interact only with PKTFTFI people on the internet: this category includes users who stated that they only interact with friends, acquaintances, colleagues

linguistically and methodologically, as they take part of their school bilingual programs. The remainder are teachers in the process of training, who are potentially

But why does the government provide a tax subsidy to charitable organizations and to their donors, rather than solving the market failure by imposing taxes, raising revenue

When the Properties window appears, select the property you want to copy and click on Copy in the lower right corner of the window.. When the Properties window disappears, click

a) Persons who accredit the status of resident in the Canary Islands and declare under their responsibility that they have not left their territory in the 15 days prior to

The structural inability of the government to pay its army imposed a heavy burden on the garrison towns *"". In the spring of 1572 it housed no less than eight