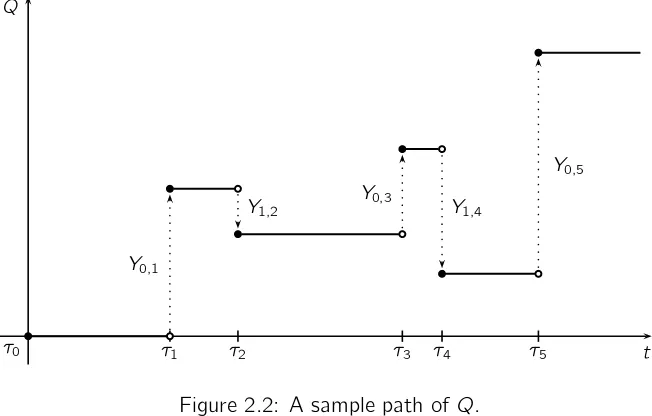

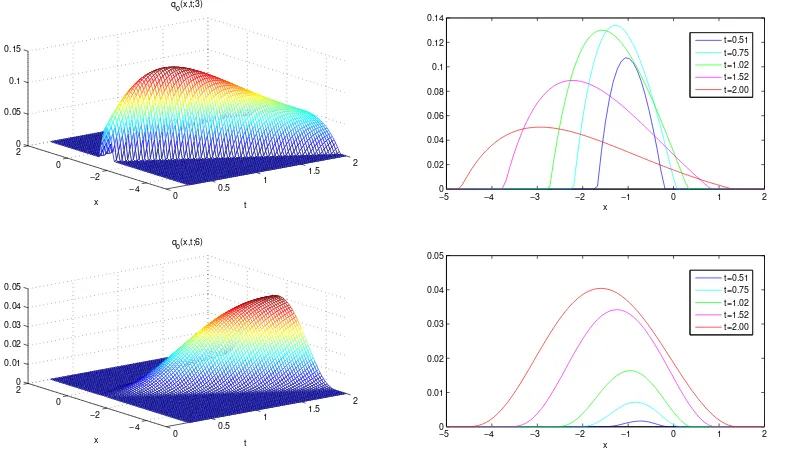

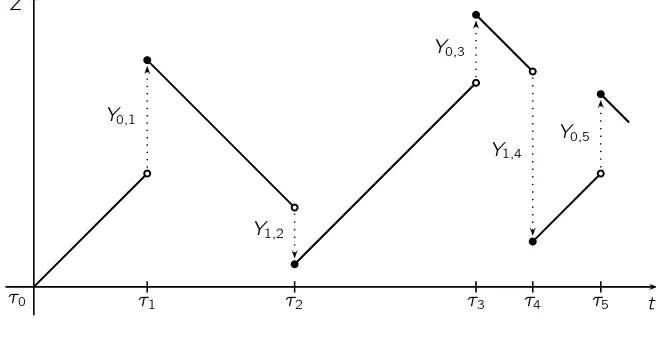

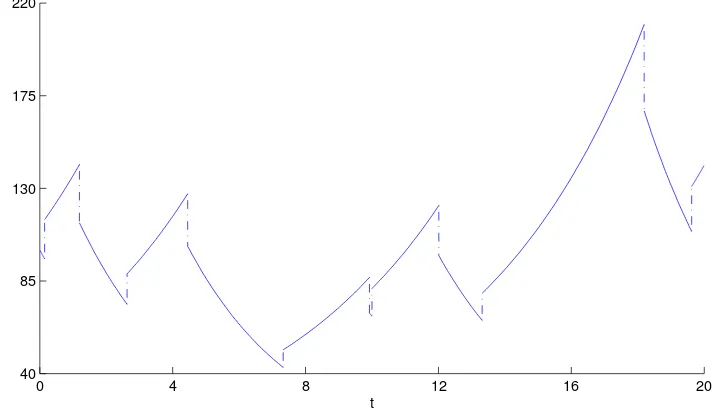

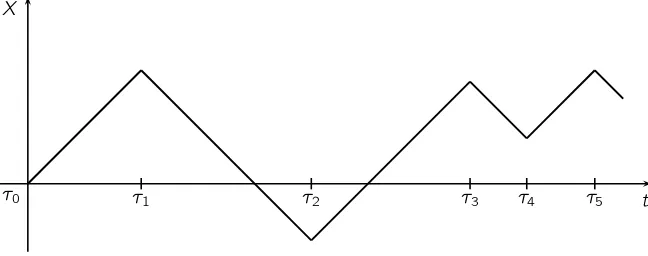

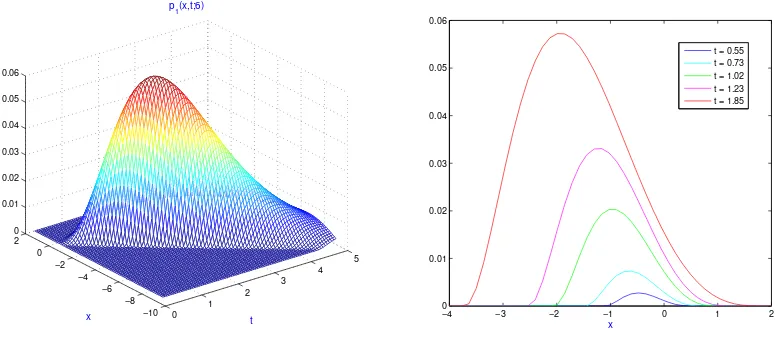

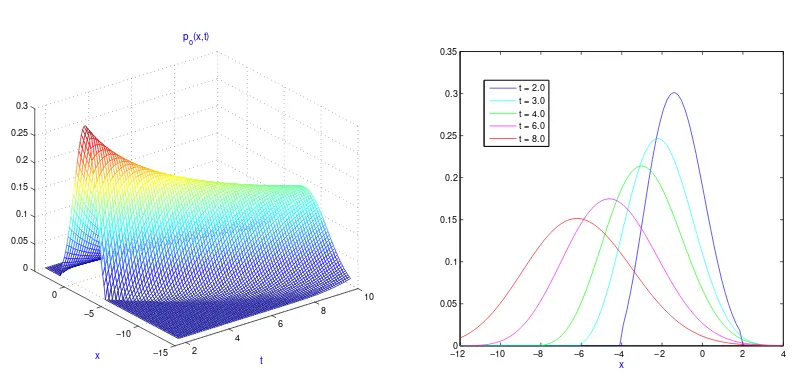

Option pricing in market models driven by telegraph processes with jumps

Texto completo

Figure

Documento similar

Finally we observe that several types of analysis can be con- ducted on the models built with this approach: (i) a performance model with a set of security requirements can be

Then, § 3.2 deals with the linear and nonlinear size structured models for cell division presented in [13] and in [20, Chapter 4], as well as with the size structured model

Graphical analysis compared between the two jumps (first jump and second jump) in the four experimental conditions (0%, 2.5%, 5% and 7.5%), for vertical takeoff speed (v (Y)CM

Current challenges behind the deployment and applicability of this technology have driven the necessity for new models that analyze the behavior of RIC links in Mul- tiple

First, in accord with the theoretical results derived in lower-dimensional instances of the models and simulations on simple networks, the effect of local market size on

En estas circunstancias, como ya demostrara hace una dé- cada Faulhaber, el sistema de precios de regulación basados en el siste- ma de costes totalmente distribuídos, en

As we argue the benefits of this type of interaction for people with special needs, we present a theoretical framework to define it and propose a proof of concept based on

This paper presents a systematic prequalification procedure, based on Fuzzy Set Theory, whose main differences and advantages in comparison with other models are the use of