Stock markets, banks and economic growth in a context of common shocks and cross country dependencies (Supplement)

Texto completo

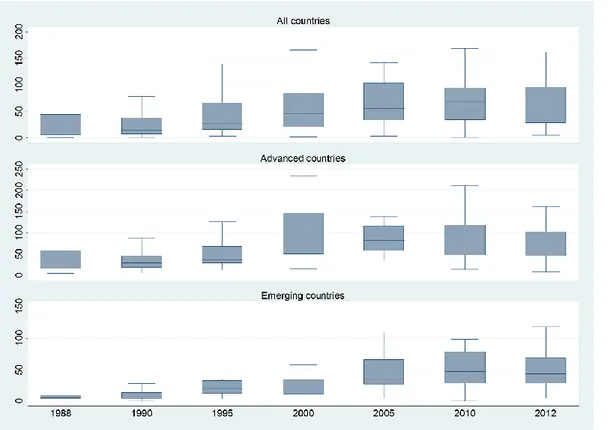

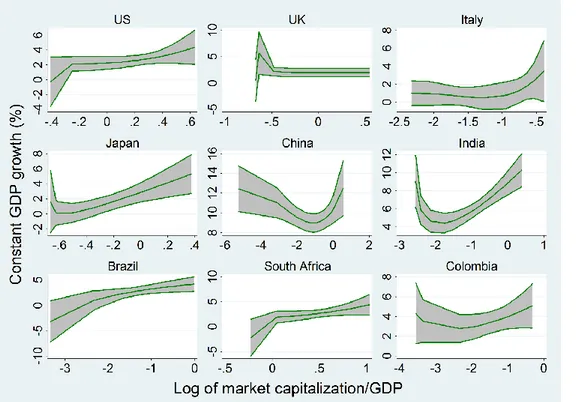

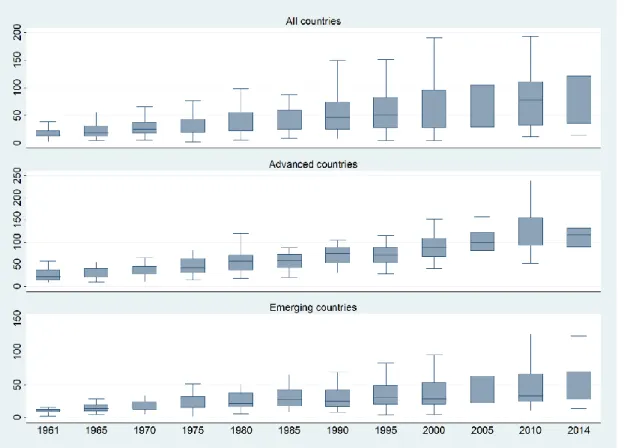

Figure

Documento similar

From the point of view of economic security, the new prospects of economic growth (NPEG), based on the innovative type of reproduction, may facilitate

In the preparation of this report, the Venice Commission has relied on the comments of its rapporteurs; its recently adopted Report on Respect for Democracy, Human Rights and the Rule

Globalization does have a negative effect on economic growth, and although a positive effect of openness on growth is observed in the short-run, both increasing openness

Considering these individual effects, Benhabib and Spiegel (2000) estimate various growth equations under the underlying framework of both neoclassical and endogenous models

Analyzing the impact of institutional factors, capital accumulation (human and physical), foreign investment, economic growth and other indicators of economic development, it

How can be these alternative uses of entrepreneurial capacity –and their different conse- quences in terms of economic growth- be integrated in a single model without assuming

Artadi (2002), "Economic Growth and Investment in the Arab World”, Columbia University Discussion Paper, No. 37 The country article on Syria provides a comprehensive

Even when accounting for the potential benefits of relationship lending, in the most concentrated banking markets banks exploit their monopoly of information when they are the