Essays on learning, information, and expectations in macroeconomics and finance

Texto completo

Figure

Documento similar

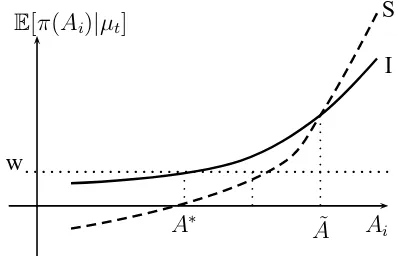

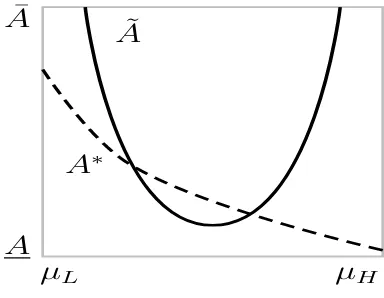

tionship between firms’ intangible intensity and the accu- racy of analyst information, our empirical analysis sheds light on the role of the accuracy of analyst forecasts as a

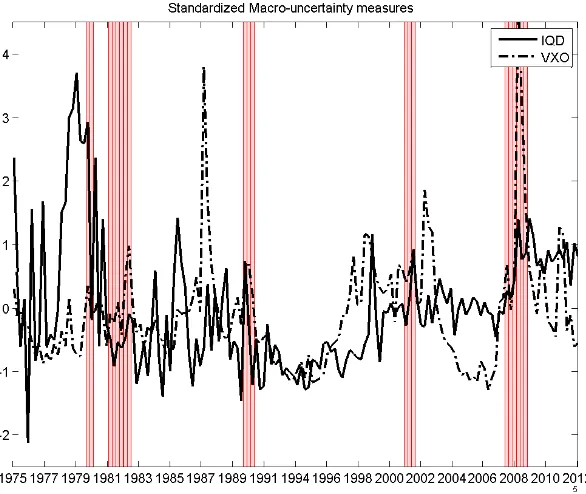

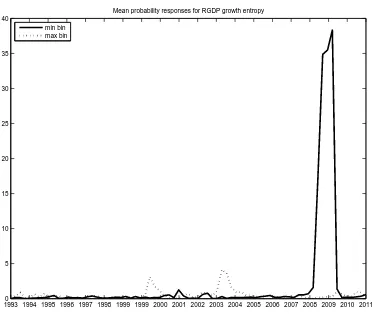

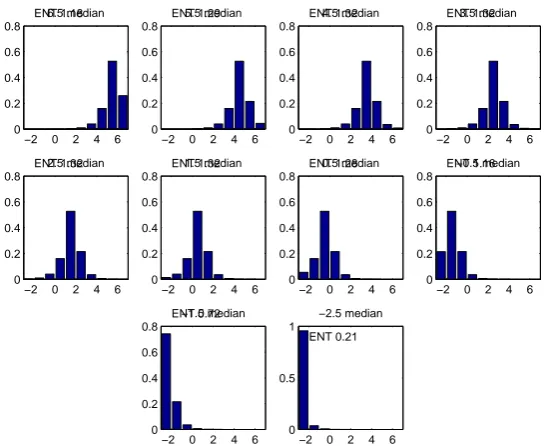

7 Weight assigned to best forecaster (cont.). e) Using density forecasts of unemployment one year ahead.. 8 Weighted averages of individual measures of uncertainty using the

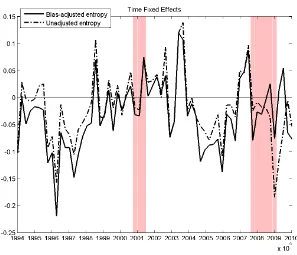

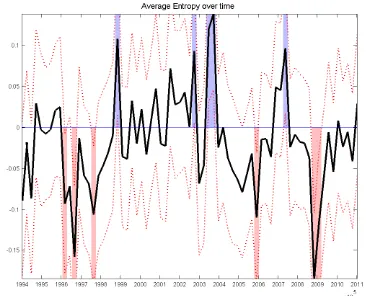

This expectation is based on the relationship between forecast errors of quarterly GDP growth and subsequent revisions to GDP-growth forecasts in the Funcas survey shown in Figure

This expectation is based on the relationship between forecast errors of quarterly GDP growth and subsequent revisions to GDP-growth forecasts in the Funcas survey shown in Figure

In particular, we want to analyse if a time varying coefficient specification of the Okun’s law provide better forecasts than alternative models in two different periods: a

The expansionary monetary policy measures have had a negative impact on net interest margins both via the reduction in interest rates and –less powerfully- the flattening of the

This raises the question to what extent the real effects of liquidity shortages observed during the crisis extend to cases that occur during more normal times and thus are not

Mean absolute error (MAE) of the different forecasts: (i) initial competing forecasts (M1, M2, M3, M4, M5, M6 and M7 models) represented in grey color; NR has not been included in