DATA SHEET

2 0 1 8

MAIN ECONOMIC

INDICATORS FOR THE

3

Table of

Contents

4 Privileged location

5 Population and surface area

5 Foreign population

6 Accessible and well-connected

7 Airport

7 Port of Barcelona

8 Driving force of a large diversified

economic area

10 Economic activity

10 Production specialisation 12 Foreign investment 13 Exports

14 Diversified economic activity

16 Manufacturing and 4.0 industry17 ICT Sector / Information and Communication 18 Green and circular economy

18 Health and Biotech

18 Social and solidarity economy 19 Retail and commerce

20 Tourism

20 Congress activity

21 Digital city, creativity, research and

innovation

22 Business Innovation and Research 23 Innovation Ecosystem

24 Creative industries

25 Talent generation and pole of attraction

26 Jobs in Barcelona26 Labour market participation 26 Salaries

26 Universities and business schools

27 Entrepreneurial city with competitive

costs

28 Companies 28 Business creation

29 Offices and industrial land market 29 Cost of living and other costs

30 Compact city with social cohesion

31 Disposable Gross Household Income by District 31 Foreign-resident population by district 31 Population at risk of poverty32 Safe city

33 Quality of life and sustainability

34 Climate34 Energy and environment 35 Sustainable mobility 35 Culture and Education

GDP per capita

≤ 15.000

15.001 - 20.000 25.001 - 30.000

≥

European

megaregions

Barcelona-Lyon megaregion Catalonia

Barcelona province

Barcelona Metropolitan Region

Barcelona Metropolitan Area

Barcelona

10.3%

of Spain’s population in the

Metropolitan Region

Barcelona, at the centre of a mega-region

with 27 million inhabitants

• Barcelona, the capital of Catalonia, has a population of 1,600,000 people and is at the heart of a

metropolitan region of close to 2,500 km2 with nearly 5,000,000 inhabitants, representing 63.8% and 10.3% of the Catalan and Spanish population, respectively.

• In relation to the consolidated metropolitan agglomerations, the population volume of the metropolitan region of Barcelona is approximately 25% that of New York, while it is higher than the areas of Berlin, Montreal and Stockholm.

• The cosmopolitan, diverse and intercultural spirit of Barcelona can be seen in the fact that 18.5% of the city’s residents are foreign - the highest percentage in history - and for the first time ever, this collective exceeds 300,000 residents.

• The current development of the metropolitan regions goes beyond their geographical area, creating the mega-region or polycentric agglomeration of cities as a natural unit of economic influence in a geographical area. Most notable is the one in the south of

Europe formed by the Barcelona-Lyon corridor, which encompasses 27.3 million inhabitants and a production of over 700,000 million euros, ascribing it a significant critical mass among the 12 European mega-regions.

• Barcelona has easy access to very dynamic large markets: the EU common market, which provides access to 510 million people. In addition, it forms part of the axis of the Mediterranean corridor, a Trans-European Network for transporting goods with a direct impact on an area of 250 million inhabitants (50% of the EU population), so improving this connection would be a strategic opportunity to increase the market share of the port traffic of goods coming from Asia. It also offers the strategic potential of relations with the 43 countries that form the Union for the Mediterranean, which include the territories of those in Eastern Europe, Africa and the Middle East.

5

Demographic indicators of Barcelona

Age structure (2018)

12.6%

0-14

65.9%

15-6421.5%

65 i mésLife expectancy (2015)

80.8

Men

86.6

Women83.9

TotalBirth rate (2017) Mortality rate (2016)

8.3‰

9.6‰

Fertility rate* (2016)

37.1‰

* Births for every 1,000 women between 15 and 49 years

Source: Department of Statistics of the Barcelona City Council, Public Health Agency, Barcelona Health Consortium

FOREIGN POPULATION

Percentage of foreign people over the total population 2000 1.9% 2008 17.4% 2013 17.4% 2015 16.3% 2016 16.6% 2017 17.8% 2018 18.5%

Note: data from 1 January of each year

Source: Department of Statistics of Barcelona City Council

Population of foreign nationals in Barcelona according to country of origin , 2018 (%)

Source: Department of Statistics of Barcelona City Council GDP per capita

≤ 15.000 15.001 - 20.000 20.001 - 25.000

25.001 - 30.000

≥ 30.001

European

megaregions

Barcelona-Lyon megaregion Catalonia Barcelona province Barcelona Metropolitan Region Barcelona Metropolitan Area Barcelona10.3%

of Spain’s population in theMetropolitan Region

POPULATION AND SURFACE AREA

Population and surface area, January 2017

POPULATION

(INHABITANTS) O/ SPANISH TOTALPOPULATION SURFACE AREA(KM2) (INHAB/KMDENSITY2)

Metropolitan

Area* 4,812,948 10.3% 2,464.4 1,953

Catalonia 7,534,813 16.1% 32,108 234.7

Spain 46,659,302 100.0% 505,968.4 92.2

* Barcelonès, Baix Llobregat, Maresme, Vallès Oriental and Vallès Occidental Source: Department of Statistics of Barcelona City Council, Idescat, INE

Population in 20 agglomerations around the world,

2018* Tokyo 38,050,000 Shanghai 24,115,000 New York 21,575,000 Mexico City 20,565,000 Los Angeles 15,620,000 Buenos Aires 15,520,000 Paris 10,980,000 London 10,585,000 Hong Kong 7,380,000 Boston-Providence 7,315,000 Toronto 6,635,000 San Francisco 6,540,000 Madrid 6,385,000 Milan 5,290,000 Barcelona 4.812.948 Sydney 4,390,000 Berlin 4,120,000 Seattle 3,860,000 Montreal 3,585,000 Stockholm 1,565,000

* Estimate updated July 2018. For Barcelona, Idescat data 1 January 2018 Source: Demography World Urban Areas: 12th Annual Edition April 2017

PRIVILEGED LOCATION

Barcelona

1,628,936

inhabitants as % of Spain

3.5%

102.2

km2

surface area

15,944.9

inhab/km2Malaga Murcia

Alicante Cartagena Madrid

Irun

ValenciaCastellón

PerpignanMarseille Geneva

Bern

Barcelona Tarragona

Montepellier Avignon

Lyon Freiburg

Clobenza Duisburg

Hamburg Copenhagen

Stockholm

Hällsberg Saint Petersburg

Helsinki

Metz Dijon

London

Milan

Genova Brussels

Mediterranean Corridor FERRMED network

Ports

Transport by Ferry

Mediterranean

Corridor

3M

TEU 32.3% annual

increase

Accessible and

well-connected

Source: FERRMED

Great potential as a logistics hub of the

Mediterranean

• With regard to access and economic infrastructures, in an area of 5 kilometres, the city offers an international airport, the port, the trade fair, Zona Franca logistics and industrial area and a logistics platform, which altogether offer huge potential as a logistics centre of the Mediterranean.

• In 2017, a record figure of 47.3 million passengers was reached at El Prat airport, which is an increase of 7.1% on the previous year. This result ensures that the city holds on to its seventh position amongst the principal European airports in the ranking of the Airport Council

International. The dynamism of the international

passenger traffic at El Prat makes it close to three-quarters (73.1%) of the total.

7

Malaga

Algeciras MotrilAlmeria Murcia Alicante Cartagena Madrid Irun ValenciaCastellón PerpignanMarseille Geneva Bern Barcelona Tarragona Montepellier Avignon Lyon Rabat Freiburg Clobenza Duisburg Hamburg Copenhagen Stockholm

Hällsberg Saint Petersburg

Helsinki Metz Dijon London Milan Genova Brussels Mediterranean Corridor FERRMED network Ports

Transport by Ferry

Mediterranean

Corridor

3M

TEU 32.3% annual increaseACCESSIBLE AND WELL-CONNECTED

AIRPORT

Barcelona airport

Source: Spanish airports and air navigation (AENA)

Main European airports according to volume of passengers,

2017

VARIATION (%) 2017/16 London Heathrow (LHR)

78,010,074 +3.0

Paris Roissy (CDG)

69,472,922 +5.4 Amsterdam (AMS) 68,515,425 +7.7 Frankfurt (FRA) 64,500,386 +6.1 Istanbul (IST) 63,727,448 +6.0 Madrid (MAD) 53,402,506 +5.9 Barcelona (BCN) 47,284,500 +7.1

London Gatwick (LGW)

45,554,606 +5.7

Munich (MUC)

44,573,176 +5.5

Rome-Fiumicino (FCO)

41,281,749 -1.1

Source: Airports Council International. Airport Traffic Report, 2017 and Barcelona Air Routes Development Committee (CDRA)

Barcelona airport. International flights, 2017

GEOGRAPHICAL AREA INCREASE FOR 2016/2017 NUMBER PASSENGERS

North America 30.2% 1,457,620

Africa 8.1% 1,003,827

Middle East 4.3% 1,376,748

Latin America 34.7% 603,904

Asia 73.8% 258,421

Source: AENA and Barcelona Air Routes Development Committee (CDRA)

AVE Barcelona - Madrid high-speed rail

Source: Department of Statistics, Barcelona City Council

PORT OF BARCELONA

Traffic (millions)

2016 2017

Goods (tonnes) 47.6 60.1

Containers (TEU*) 2.2 3.0

Passengers 4.0 4.1

* TEU: Measure of sea transport capacity equivalent to a twenty-foot container Source: Barcelona Port Authority

Infrastructures

Land surface area Wharfs and moorings

1,081 ha

22 km

Source: Barcelona Port Authority

Cruise ships indicators

2016 2017

Cruise passengers 2,683,594 2,712,247

Embarkation 773,601 720,512

Disembarkation 776,610 719,871

Traffic 1,133,288 1,271,864

Cruise ship visits 758 778

Source: Barcelona Port Authority

4,700,520

Intercontinental passengers44,154,693

20163.9

2016133,635

201647,284,500

20174.1

2017

2 h 30 m

157,763

2017

Total passengers

Passengers (millions) Journey duration Goods (in tonnes)

+18.5%

Intercontinental passengers45

Intercontinental destinations47.3M

passengers at its airportin 2017

7

thDriving force

of a large

diversified

economic area

Barcelona is a dynamic economic

engine with a diversified structure and

international recognition

• Barcelona continues to work on strengthening its capacity to attract companies, employment, talent and foreign investment with the support represented by the city’s good international positioning.

• The gross domestic product (GDP) of the city of Barcelona in 2016 was 43,700 euros per inhabitant. With regard to the distribution of gross added value by sector - according to the estimate calculated in 2017 - most notable is the weight of business services (14.8%), commerce and repairs (13.2%), education, health and social services (12.2%), information and communications (8.1%) and the hotel sector (7.3%).

• In 2017, Catalonia generated a GDP of 234,651 million euros, representing 20.1% of Spain’s total GDP. In the same year, the GDP per capita of the Principality was 15% above that of the European Union.

• In 2017, the GDP of the city of Barcelona and Catalonia grew by +3,3% and +3,4%, - respectively - in real terms.

20.1%

Catalonia generates

9

Barcelona has an open economy connected

to the world

• The attractiveness of the Barcelona territory for foreign investment is confirmed by the various prestigious rankings: according to the KPMG Global

Cities Investment Monitor 2018, Barcelona was in

ninth place among the principal urban areas across the world for attracting foreign investment projects in 2017, gaining 135 greenfield projects.

• In fact, Barcelona is the European city that presents the best strategy for promoting and attracting foreign investment for 2018/19, according to the FDi report

Cities and Regions of the Future 2018/19 (Financial

Times Group). This prestigious source states that Catalonia has the best future prospects out of all the regions in the south of Europe - ahead of the Community of Madrid - and Barcelona is second place out of the cities in the south of Europe in the same category.

• Productive foreign investment1 in Catalonia was €3,171.3 million in 2017. Foreign investment from within the European Union makes up nearly three-quarters of the foreign investment in Catalonia (74% of the total). The main investors were are the Netherlands, France and the United Kingdom.

1 Productive investment is considered to be investment that does not take ETVEs into account, which are companies established in Spain that hold the securities of foreign companies.

• On the other hand, according to the FDI Markets data from the Financial Times, during the five-year period 2013-2017, the Principality was the territory with the highest number of foreign investment projects in Spain, having attracted 591 projects (44% of the total of the main destination regions), involving an investment of €16,075 million and creating 44,061 direct jobs, therefore attaining 4th position in Europe for job creation in the period 2013-2017.

• The Catalan territory is home to the headquarters of approximately 8,600 foreign companies in 2018, the main countries of origin being Germany (13.1%), France (12.4%) and the United States (11.7%).

• In 2017, exports from the province of Barcelona reached €54,771.6 million, which means that it achieved a new historical record for the seventh consecutive year. In comparison with the previous year, sales outside the Barcelona area grew by 7%, in a favourable context facilitated by the expansive measures of the European Central Bank and industry’s improved competitiveness.

• The area of Barcelona continues to lead the exports ranking of the Spanish state, accounting for one-fifth (19.8%) of total sales abroad and 40,634 export companies, which represent a quarter of the total of the State (25,1%).

DRIVING FORCE OF A LARGE DIVERSIFIED ECONOMIC AREA

exporting urban area in Spain

1

st

New historicalrecord in exports volume for the 7th

ECONOMIC ACTIVITY

Gross domestic product at market prices* (GDP), 2016

(Current prices in € millions)

GDP GDP PER INHABITANT

MILLIONS OF EUROS THOUSANDS OF EUROS INDEX CATALONIA-100

Barcelona 69,420.3 43.7 144.5

Barcelona Metropolitan

Area* 148,144.7 31.3 107.8

* Base 2010. Market value

Source: Statistical Institute of Catalonia (IDESCAT)

Gross domestic product at market prices

(current prices in € millions)

CATALONIA SPAIN (%) CAT/SP

2015 215,772 1,081,165 20.0

2016 224,751 1,118,743 20.1

2017 234,651 1,166,319 20.1

Source: Statistical Institute of Catalonia and INE (National Statistics Institute)

Harmonised per capita GDP on purchasing power parity,

2017 125 100 75 50 25 0

Catalonia Spain Euro Zone

Index UE 28 = 100

Source: Statistical Institute of Catalonia (IDESCAT)

GDP growth at constant prices, 2011-2017

(Variation rate for volume %)

4 3 2 1 0 -1 -2 -3 -4

2011 2012 2013 2014 2015 2016 2017

Barcelona Catalonia

Sources: City Council Data Office. GTP Analysis Department of Barcelona City Council and Idescat

PRODUCTION SPECIALISATION

Productive structure. Employees by economic sector,

2017 (%)

BARCELONA BMR CATALONIA SPAIN

Agriculture 0.0 0.1 0.3 0.4

Industry 7.4 14.0 16.3 14.1

Construction 2.7 4.1 4.7 5.3

Services 89.9 81.8 78.7 80.0

TOTAL 100.0 100.0 100.0 100.0

Source: Department of Statistics of Barcelona City Council and Idescat

Main branches of activity according to GVA in Barcelona,

2017 (% of total)

Business services 14.8% Commerce 13.2% Information and communications 8.1%

Hotels and catering

7.3%

Education

6.3%

Health and social services

5.9%

Transport and storage

5.3% Public authority 5.2% Property activities (excluding imputed income) 5.2% Financial and insurance activities 4.6% Manufacturing industry 4.5% Construction 3.0%

Energy, water and waste

2.9%

Artistic and recreational activities

2.3%

Source: City Council Data Office. GTP Analysis Department of Barcelona City Council

11 Companies classified by economic sector in Barcelona,

2017 (% of total)

Business services*

27,2%

Commerce and repairs

17,9%

Education, health and social services

10,2%

Real-estate activities

8,4%

Construction

7,9%

Hotels and catering

6,4%

Other services

5,0%

Transport and storage

4,7%

Information and communications

3,8%

Artistic, cultural and leisure activities

3,0%

Manufacturing industry

2,8%

Financial and insurance activities

2,3%

Energy and water

0,4%

* Business services contain professional, scientific, technical, administrative and auxiliary services

Source: DIRCE, INE

DRIVING FORCE OF A LARGE DIVERSIFIED ECONOMIC AREA

Business

services

Information and

communication

Education, Health

and Social Services

Commerce

Number of foreign companies established in Catalonia

COUNTRY OF ORIGIN 2018 % OF TOTAL

Germany 1,129 13.1

France 1,070 12.4

United States 1,010 11.7

Italy 746 8.6

Netherlands 681 7.9

United Kingdom 665 7.7

Luxembourg 581 6.7

Switzerland 415 4.8

Denmark 275 3.2

Japan 254 2.9

Portugal 207 2.4

Belgium 192 2.2

Sweden 134 1.6

Austria 110 1.3

China 91 1.1

Other 1,083 12.5

TOTAL 8,642 100

Source: ACCIO. Government of Catalonia

Investment abroad (in millions of euros)

2016 2017 % CAT/SPAIN

Catalonia

4,415.3

6,421.0

Spain

37,520.2

40,160.9

Note: Total gross investment excluding Foreign-Securities Holding Companies (ETVEs) Source: Datainvex, Ministry of Industry, Commerce and Tourism

Main urban areas in the world for attracting foreign investment projects, 2017

URBAN AREA POSITION PROJECTS 2017

London 1 390

Singapore 2 354

Paris 3 338

Dubai 4 248

Shanghai 5 173

Hong Kong 6 161

New York 7 156

Bangalore 8 137

Barcelona 9 135

Dublin 10 132

Source: Global Cities Investment Monitor 2018, KPMG FOREIGN INVESTMENT

Foreign investment (in millions of euros)

2016 2017

Catalonia

5,139.5

3,171.3

Spain

26,146.8

24,183.9

Note: Total gross investment excluding Foreign-Securities Holding Companies (ETVE) Source: Datainvex, Ministry of Industry, Commerce and Tourism

Foreign investment in Catalonia by country of origin,

2017 (percentage of total)

Netherlands

21.4%

France

15.6%

United Kingdom

10.0%

Luxembourg

9.0%

Germany

7.9%

United States

6.6%

Egypt

5.0%

Italy

4.3%

Andorra

3.3%

Mexico

2.9%

Switzerland

2.1%

Peru

2.0%

Israel

0.9%

Japan

0.9%

Note: Total gross investment excluding Foreign-Securities Holding Companies (ETVE) Source: Datainvex, Ministry of Industry, Commerce and Tourism

13

Main destination countries of Barcelona exports, 2017

(percentage of total)*

France

14.5%

Germany

11.9%

Italy

8.7%

Portugal

6.6%

United Kingdom

5.7%

Switzerland

4.0%

United States

3.4%

Netherlands

2.7%

China**

2.7%

Mexico

2.2%

Turkey

1.9%

* Provisional data for the province of Barcelona * Includes China, Hong Kong and Macau Source: Ministry of Industry, Commerce and Tourism

Distribution of exports of the province of Barcelona by technological content, 2017 (%)*

* Provincial data

Source: Ministry of Industry, Commerce and Tourism data EXPORTS

Exports (in millions of euros)

2016 2017* % OF SPAIN 2017

Barcelona

51,189.5

54,771.6

Catalonia

65,142.1

70,828.7

Spain

256,393.4

277,125.7

* Provisional data for the province of Barcelona

Source: Datainvex, Ministry of Industry, Commerce and Tourism

Evolution of exports from the province of Barcelona,

1997 - 2017 (in millions of euros)

1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017*

* Provisional data

Source: Ministry of Industry, Commerce and Tourism

DRIVING FORCE OF A LARGE DIVERSIFIED ECONOMIC AREA

High technology

11.4%

Medium-high technological level

48.9%

Medium-low technological level

16.6%

Low technological level

22.5%

Not classified

0.6%

19.8%

25.6%

A territory with a powerful industrial base

• In 2017, industry generated 21.4% of the Gross Added Value in Catalonia, a weight that exceeds that reached by the European Union (19.6%) and, more clearly, by Spain (18.1%), being the autonomous community with the highest industrial development in the Spanish State.

• In 2017, Catalonia was ranked as the fourth European region for jobs in manufacturing that involve medium-high to medium-high technology intensity, with 230,000 people working in these activities, exceeding the records of regions such as Piemont (Turin), Rhône-Alpes (Lyon) and Darmstadt (Frankfurt). In the same year, it was also ranked the fourth region in the continent for female employment in these activities.

• Barcelona has an important industrial sector and the metropolitan area - with 14% of the working population employed in industry- is home to more than half (60%) of this employment in Catalonia. Key areas include the chemicals and pharmaceutical clusters, the automobile cluster - one of the main producers in Europe -, food production, paper and graphic arts, and waste treatment.

• Barcelona and its area are working to develop industry 4.0 using elements such as the Big Data impetus, the rising number of companies and organisations in initiatives related to 3D printing and the work of Fab Labs to introduce digital manufacturing to schools, companies, entrepreneurs and community projects. In 2017, the Barcelona Metropolitan Area had over 400,000 jobs in activities potentially associated with industry 4.0, after creating more than 27,000 jobs in these areas since 2010, which represents an accumulated percentage increase of +7,3%.

Commitment to digital technology and ICTs

• The city, with over 54,000 jobs and more than 2,700 companies with staff working in ICTs, is the heart of the sector in Catalonia. 55% of employment in the territory and 45.9% of its business community is concentrated in the city. It is estimated that in 2017 the information and communications sector, which encompasses ICTs, generated 8.1% of Gross Added Value in Barcelona.

• According to the Networked Society City Index 2016

report, Barcelona is ranked amongst the fifteen top cities in the world in terms of its levels of digital equipment, technological maturity, social cohesion and institutions focused on the goal of sustainable development.

Towards the transformation of the

productive model

• The city of Barcelona is advancing towards a plural, innovative and socially inclusive economic model, based on sustainability in all aspects: economic, social and environmental. With this goal in mind, and the leadership of Barcelona Activa, the strategy for economic promotion during the 2016-2019 term of office prioritises the impetus of seven strategic sectors which form the backbone of the entire municipal policy and the transformation of the productive model:

Diversified

economic activity

Industry accounts for

of total GVA in Catalonia

15

the manufacturing industry, the digital economy, creative sectors, the green and circular economy, mobility, health and bio and, as an element that cuts across them all, the social and solidarity economy. • The city is working towards an economic model that is

efficient in the use of its resources and with innovation capacity based on the promotion of

the green and circular economy, which in 2017

represented 3.5% of employment and experienced growth in the number of jobs (approximately +4%) that was higher than in the city’s overall economy (+2,5%).

• In the fourth quarter of 2017 there were over 90,000 jobs and 3,090 companies with employees in the

health and bio sector in Barcelona, representing 8.5%

and 4.1%, respectively, of the city’s total. This sector features various different, yet related components: 75% of jobs in the sector are concentrated in health activities, while those linked to health-related social services account for 15.7% of employment and the pharmaceutical industry is close to 10%.

• The pharmaceutical and biotechnology industry

constitutes a dynamic cluster with a remarkable capacity for research and innovation. Catalonia holds 27% of the biotech companies in Spain, leads in investment in biotechnology R&D and has 15 university hospitals, 9 research institutes and 6,000 researchers in this field.

• Barcelona has a strong presence in the social and

solidarity economy - with people and groups at the

centre of the activity -, which include the Third Social Sector (50.9%), workers’ owned companies (25.4%), cooperatives (18.2%) and community economies (5.5%) offering a great capacity for social innovation.

• Since 2014, 193 cooperatives have been set up in

Barcelona, 80.3% of which are workers’ cooperatives and 63.2% of which were created in the past two years (2016 and 2017). On the other hand, the third social sector had 30,000 labour contracts in 2016 and the presence of these entities should be highlighted in the areas of social action aimed at children, teenagers and families, as well as care for people with mental and learning disabilities - which represent 41% and 18% of the total, respectively. Furthermore, the city has 48 special employment centres and 20 social recruitment companies which enable the social and labour market integration of people with specific needs.

Barcelona is committed to local and quality

commerce

• With 16,164 companies and 151,368 jobs, commerce is one of the areas with most weight within the economic structure of Barcelona. Indeed, the sector accounted for 21.4% of companies and 14.4% of employment in the city at the end of 2017. The number of establishments in the retail and restaurant sectors was 35,834 in 2016, which represents 17.3% of the total in the city.

• The municipal markets, with a surface area of 260,941 m2 and 2,312 stalls, are one of the benchmarks of the Barcelona trade model due to their economic and social significance in the city’s neighbourhoods, and they represent the largest

network of food markets on the continent of Europe.

International reference for urban tourism

and the organisation of congresses

• In Barcelona, tourism in hotels reached 7.7 million visitors, while overnight stays were at 19.7 million in 2017, with year-on-year variations of 2.5% and 0.7%, respectively, compared with 2016.

• Various rankings underscore the attractiveness of Barcelona for foreign visitors: The European Cities

Marketing Benchmarking Report 2016/2017 ranks

Barcelona in fifth position in Europe for international overnight stays, while Trip Advisor ranked it as the sixth most attractive worldwide for tourists in 2017. Finally, according to the Top Cities Destination Ranking report from Euromonitor International, in 2017 Barcelona was the 23rd most visited city by international tourists out of 100 cities across the world, and the 6th most visited among European cities.

• With regard to business tourism, according to the International Congress and Convention Association (ICCA), in 2017 Barcelona was the top city worldwide for the number of international meetings organised for the first time in its history and also the top city

for the number of participants in these meetings.

According to the Barcelona Convention Bureau, Barcelona hosted 2,134 meetings in 2017, with an economic impact estimated at 1,851 million in the city.

• In 2017, with 2.7 million cruise ship passengers, Barcelona held onto its position as the top base port in Europe and in the Mediterranean for cruise ships, and it is the fourth most important base port in the world.

MANUFACTURING AND 4.0 INDUSTRY

GVA industrial weight, 2017

20

15

10

5

0

Catalonia Spain EU

Source: Idescat

People employed in high-tech industries in European Regions, 2017

REGION (CITY) % PEOPLE EMPLOYED

OF TOTAL EMPLOYED WOMEN (THOUSANDS) TOTAL PEOPLE EMPLOYED (THOUSANDS)

Stuttgart (Stuttgart) 19.8 96 435

Lombardy (Milan) 9.4 109 411

Upper Baviera (Munich) 12.4 76 316

Catalonia (Barcelona) 7.0 74 230

Karlsruhe (Karlsruhe) 14.4 46 207

Istanbul (Istanbul) 3.7 43 207

Piemont (Turin) 10.5 46 190

Emilia-Romagna (Bologna) 9.3 41 183

Dusseldorf (Dusseldorf) 7.2 42 180

Rhône-Alpes (Lyon) 6.1 53 174

Darmstadt (Frankfurt) 8.1 41 164

Île-de-France (Paris) 3.0 45 160

Cologne (Cologne) 7.1 35 156

Source: Eurostat

Main industrial sectors for jobs* in Catalonia and the Metropolitan Area , 2017**

Metallurgy and machinery production and electrical and electronic equipment

129,606 81,334

Chemical and

pharmaceutical industry 92,77564,696

Transport material and

metal products 44,553 33,765

Food 84,189 26,955

Paper and printing 40,52523,915

Textiles, clothes manufacturing, leather and footwear

34,893 22,777

Catalonia Metropolitan Region

* Afiliates registered with the general Social Security system, including Self-employed Workers ** 4th Q

Source: Produced by the Economic Policy and Local Development Research Department at Barcelona City Council, based on data from Barcelona City Council Statistics Department.

Jobs* potentially associated with industry 4.0 in the Barcelona Metropolitan Region

2011 2012 2013 2014 2015 2016 2017

* Affiliates in the General and Self-Employed Social Security Schemes

Source: Economic Policy and Local Development Research Department based on data from the Department of Statistics, Barcelona City Council

Areas of development of the new industry

Source: AMB

Eix Llobregat

Corredor B-30

Besòs Delta del

Llobregat

21.4%

18.1% 19.6%

366,900

17 ICT SECTOR / INFORMATION AND COMMUNICATION

Connected and cohesive cities for sustainable development, 2016

CITY WORLD RANKING 2014 WORLD RANKING 2016

Stockholm 1 1

London 2 2

Singapore 4 3

Paris 3 4

Copenhagen 5 5

Helsinki 6 6

New York 7 7

Oslo 8 8

Tokyo 10 9

Seoul 12 10

Taipei 13 11

Los Angeles 11 12

Barcelona 18 13

Hong Kong 9 14

Berlin 16 15

Munich 14 16

Miami 15 17

Warsaw 20 18

Rome 21 19

Sydney 19 20

Moscow 17 21

Istanbul 27 22

Abu Dhabi 23 23

Athens 24 24

São Paulo 25 25

Source: Networked Society City Index 2016, Ericsson AB

Jobs* in ICT activities in Barcelona

2012 2013 2014 2015 2016 2017

* Those registered with the general Social Security system, including Self-employed Workers Source: Produced by by the Economic Policy and Local Development Research Department, based on data from the Department of Statistics at Barcelona City Council

Evolution 2011-2017 of jobs* and companies in Barcelona

2011 2017 VARIATIONS FOR 17/11

ICT jobs

Total jobs in Barcelona

ICT companies

Total Companies in Barcelona

* Those registered with the general Social Security system, including Self-employed Workers (jobs) and companies that charge Social Security contributions

Source: Produced by the Economic Policy and Local Development Research Department, based on data from the Department of Statistics at Barcelona City Council

DIVERSIFIED ECONOMIC ACTIVITY

in the ICT sector

54,000 jobs

More thanan increase of 35.9% compared to

2011

38,388

54,039

+42.0%

+4.7% +9.2% +35.9%

39,767

54,039

1,054,722

2,766

75,372 72,013

965,810

GREEN AND CIRCULAR ECONOMY

Workers* and companies in the green economy** in Barcelona, 2017***

MINIMUM VALUE MAXIMUM VALUE

Number of workers 28,014 40,302

Weight/overall employment in the city (%) 2.6% 3.7%

Number of companies 858 2,072

Weight / total companies in the city (%) 1.1% 2.8%

* Those registered with the general Social Security system, including self-employed workers ** This includes the activities of the traditional environmental core - water, waste, green energy - and administrative, education, ICT and R&D activities related to them. The minimum and maximum value are estimated using international research criteria

*** 4th quarter data

Source: Produced by the Economic Policy and Local Development Research Department at Barcelona City Council, based on data from the Employment and Productive Model Observatory of the Generalitat (regional government) of Catalonia

HEALTH AND BIOTECH

Jobs* and companies in the Health and biotech sector in Barcelona, by divisions, 2017 (%)

Jobs

Companies

* Those registered with the general Social Security system, including Self-employed Workers Source: Produced by the Economic Policy and Local Development Research Department, based on data from the Department of Statistics at Barcelona City Council

SOCIAL AND SOLIDARITY ECONOMY

Companies, associations and initiatives from the social and solidarity economy in Barcelona , 2015 (% of total)

Source: Barcelona City Council (2015), Social and Solidarity Economy in Barcelona

Number of cooperatives set up in Barcelona,

2014-2017

70

60

50

40

30

20

10

0

2014 2015 2016 2017

Consumers and Users Secondary Cooperative Dwellings

Mixed

Mixed consumers and users of associated workers’ cooperatives

Services Worker

Source: Department of Statistics of Barcelona City Council

Third social sector

50.9%

Social services associated with health

15.7%

Social services associated with health

10.6%

Cooperatives

18.2%

Pharmaceutical industry

9.6%

Pharmaceutical industry

2.3%

Health care

74.7%

Health care

87.2%

Workers Owned Companies

25.4%

Community economies

5.5%

41

31

61 61

In 2016 and 2017 the creation

of co-operatives doubles that of

19

Trends in internet purchases in Barcelona, 2000-2017

(Consumers %)

Source. Barcelona City Council, Municipal Omnibus Survey, Department of Commerce and Consumer Affairs

RETAIL AND COMMERCE

Retail establishments in Barcelona

Retail establishments 2017

16,164

Number of companies

151,368

Jobs35,834

Retail and restaurant establishments (2016)

Municipal markets 2017

40

Food

4

Special2,312

Number of stalls

260,941 m

2

Total surface area

Source: Department of Statistics and Municipal Markets Institute of Barcelona City Council

Retail establishments in Barcelona by districts, 2016

905 5,461

Source: Inventory of premises in Barcelona

61,7

5,9

Ciutat Vella

3,150

Horta-Guinardó

1,435

Les Corts

905

Sants-Montjuïc

1,838

Eixample

5,461

Sarrià-Sant Gervasi

2,184

Gràcia

2,147

Sant Martí

2,423

Sant Andreu

1,564

Nou Barris

1,640

2000 2003 2006 2009 2012 2015 2017

DIVERSIFIED ECONOMIC ACTIVITY

The biggest food market network in the European

TOURISM

Tourists and overnight stays in Barcelona

2016 2017 VARIATION 2016/17

Tourists*

7,484,276

7,675,002

Overnight stays

19,590,245 19,724,164

* Tourists staying in hotel establishments

Source: Department of Statistics of Barcelona City Council

Hotel indicators

2016 2017 VARIATION 2016/17

Establishments

639

650

Places (beds)

75,681

79,288

Source: Department of Statistics of Barcelona City Council

Country of origin of tourists, 2017 (%)

Source: Department of Statistics of Barcelona City Council

CONGRESS ACTIVITY

Indicators of congress activity, 2017

2,124

Total meetings

674,890

Total delegates551

Congresses, conferences and courses

1,573

Conventions and incentives

Source: Barcelona Tourist Consortium and Department of Statistics of Barcelona City Counci

Main cities in the world for number of international congresses and delegates, 2017

CITIES CONGRESSES DELEGATES CITIES

Barcelona 195 148,624 Barcelona

Paris 190 113,624 Vienna

Vienna 190 111,725 Paris

Berlin 185 110,438 Madrid

London 177 110,438 Prague

Singapore 160 97,549 Berlin

Madrid 153 83,762 Singapore

Prague 151 78,811 London

Lisbon 149 76,549 Lisbon

Seoul 142 75,578 Amsterdam

Source: International Congress and Convention Association (ICCA)

Main trade fairs of Fira de Barcelona that are benchmarks in Europe, 2018

Automobile Motorshow 3Rd. Expoquimia-Equiplast-Eurosurfas Mobile World Congress BB Construmat

Bcn Games World (OP) Motoh!

Sonar (day / night) Esc Congress - Cardiologia Manga Fair Smart-City Expo World Congress Education Fair 4YFN - Four Years From Now Barcelona International Comic Fair Barcelona International Boat Show Expo Sports

Spain

20.2%

United Kingdom

8.6%

United States

9.5%

France

8.0%

Italy

6.0%

Germany

5.5%

+2,5%

+0,7%

+1,7%

+4,8%

city in the world in number of international congresses and

participants

21

DIGITAL CITY, CREATIVITY, RESEARCH AND INNOVATION

Digital city,

creativity,

research and

innovation

Barcelona leads Spain’s advance towards a

knowledge economy

• Barcelona seeks to become a point of reference in the field of technology to improve the quality of life in a global context in which mobile technology is a key vector for the growth of the economy as a whole. In this context, the role of Barcelona as Mobile World Capital, hosting the Mobile World Congress and the industrial legacy project - present a strategic opportunity to position the city in this sector of activity.

• Nowadays, Barcelona offers one of the most dynamic ecosystems for digital entrepreneurship and according to the Innovation Cities Index 2018 is the 8th more innovative city in Europe and the 30th in the word.

• Similarly, the British consultancy Atomico ranks it as the 3rd favourite European city for establishing start-ups, after London and Berlin, and the fourth for the volume of investment received for start-ups in 2017 (The State of European Tech 2017).

• As regards the distribution of the investment in start-ups by sector in Barcelona, most notable is the capital invested in the mobile sector (55% of the total), followed by electronic commerce (25%) and those of a social nature (10%).

• In 2017, the area of Barcelona generated 13.9% of the applications for utility models and 13.2% of the patents in the Spanish State as a whole. Catalonia is the region with the highest number of innovative companies in Spain (23%) and 24.3% of the State’s total expenditure in innovative activities.

• Barcelona was ranked fifth in Europe and 18th worldwide in scientific production in 2017, according to data prepared by the Polytechnic University of Catalonia using the Science Citation Index.

• The expenditure in R+D in Catalonia was 1.46% of GDP in 2016, lower than the average in the European Union but higher than that of Spain and regions such as Lombardy and London. There are 46,592 members of staff dedicated to research and development in the Principality.

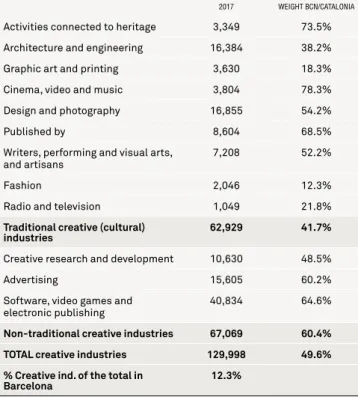

• Creative activities brought Barcelona over 130,000 jobs in 2017, representing 12.3% of employment in the city and half (49.6%) of creative jobs in Catalonia. It should be pointed out that, according to the latest research, a higher percentage of employees in creative industries is very intensely correlated to a higher level of production per inhabitant.

• The Cultural and Creative Cities Monitor 2017 from the European Commission ranks Barcelona as the ninth large city in terms of vitality and creativity.

2

nd Europeancity according to the Digital Citiy

Index 2017 (Bloom Consulting)

for establishing

start-ups

(Atomico)

3

rd

BUSINESS INNOVATION AND RESEARCH

Companies and innovation

NUMBER OF INNOVATIVE

COMPANIES IN INNOVATIVE ACTIVITIESTOTAL EXPENDITURE

2016 % OF SPAIN 2016 (1,000S €) % OF SPAIN

Catalonia 3,602 23.0 3,367,177 24.3

Spain 15,648 100.0 13,857,481 100.0

Source: Spanish National Institute of Statistics (INE)

Innovation indicators

PATENT APPLICATIONS UTILITY MODEL APPLICATIONS

2017 % OF SPAIN 2017 % OF SPAIN

Barcelona* 302 13.2 338 13.9

Catalonia 354 15.5 447 18.3

Spain 2,286 100.0 2,438 100.0

* Provincial data

Source: Spanish Office of Patents and Brands

Innovation in cities around the world. Position of Barcelona

0

10

20

30

40

50

60

2012/13 2014 2015 2016/17 2018

European ranking World ranking

Source: 2thinknow Innovation Cities™ Index

European city in terms of scientific

production

5

th

27

8 25

13

5

56 56

27

13

23

DIGITAL CITY, CREATIVITY, RESEARCH AND INNOVATION

INNOVATION ECOSYSTEM

The 10 preferred European cities for locating a start-up

RANKING 2017 CITY

1 London 2 Berlin 3 Barcelona 4 Paris 5 Amsterdam 6 Dublin 7 Stockholm 8 Lisbon 9 Munich 10 Milan

Source: Atomico. The State of European Tech 2017

Capital invested in start-ups by sector in Barcelona,

2018 (%)

Source: Start up Ecosystem Overview, 2018. Mobile World Capital Barcelona

Expenditure on R&D (% of GDP)

Berlin 3.53% United States 2.79% Rhône-Alpes** 2.76% China 2.07% Catalonia* 1.46% European Union 1.38% Lombardy 1.27% Spain* 1.19% London 1.08%

* Data for 2016 ** Data for 2014

Source: INE, Eurostat and OECD

International benchmark science and technology facilities in Barcelona

"Barcelona Supercomputing Centre - Centro Nacional de Supercomputación (BSC-CNS)

Maritime Research and Experimentation Wave Flume (CIEM) Institute of Photonic Sciences (ICFO)

Barcelona Nuclear Magnetic Resonance Laboratory (LRB) White Room of the Barcelona Microelectronics Institute (IMB-CNM) ALBA Synchrotron - Cells

National Centre for Genomic Analysis (CNAG)

Source: Ministry of Education and Science, Map of Unique Scientific and Technical Infrastructures

Top cities of the world in terms of academic scientific production, 2017

WORLD

RANKING EUROPEAN RANKING CITY PUBLICATIONS 2017*

1 Beijing 84,538

2 1 London 45,602

3 Shanghai 41,901

4 New York 36,984

5 Boston 35,885

6 Seoul 34,699

7 Tokyo 33,623

8 2 Paris 33,373

9 3 Madrid 20,652

10 4 Moscow 19,765

11 Chicago 19,457

12 Baltimore 19,451

13 Philadelphia 18,873

14 Cambridge (USA) 18,838

15 Houston 18,790

16 Toronto 18,465

17 Los Angeles 18,325

18 5 Barcelona 18,167

19 São Paulo 17,706

20 Melbourne 17,312

21 6 Rome 16,927

22 7 Milan 16,020

23 Singapore 15,646

24 8 Berlin 15,365

25 Hong Kong 15,231

* Provisional data September 2018

CREATIVE INDUSTRIES

Employment in creative activities* in Barcelona, 2017

2017 WEIGHT BCN/CATALONIA

Activities connected to heritage 3,349 73.5% Architecture and engineering 16,384 38.2% Graphic art and printing 3,630 18.3% Cinema, video and music 3,804 78.3% Design and photography 16,855 54.2%

Published by 8,604 68.5%

Writers, performing and visual arts,

and artisans 7,208 52.2%

Fashion 2,046 12.3%

Radio and television 1,049 21.8%

Traditional creative (cultural)

industries 62,929 41.7%

Creative research and development 10,630 48.5%

Advertising 15,605 60.2%

Software, video games and

electronic publishing 40,834 64.6%

Non-traditional creative industries 67,069 60.4% TOTAL creative industries 129,998 49.6% % Creative ind. of the total in

Barcelona 12.3%

* Those registered with the general Social Security system, including Self-employed Workers in the fourth quarter of the year

Source: Produced by the Economic Policy and Local Development Research Department at Barcelona City Council, based on data from the Employment and Productive Model Observatory of the Generalitat (regional government) of Catalonia

of the city's employment Creative industries

account for

12.3%

major European city in terms

of creative intensity

25

Talent

generation and

pole of attraction

Barcelona’s labour market has a critical

mass and qualified human capital

• There are 1.1 million jobs in the city and 2.5 million

in the area of Barcelona. The rates of activity (80.2%) and employment (72.1%) in Barcelona are higher than the Catalan, Spanish and European averages.

• More than half of the jobs in Barcelona (54.1%) correspond to knowledge-intensive activities, and the city is the centre of this economic segment in Catalonia, as 42.7% of the high-knowledge jobs are to be found here, while the weight of Barcelona as a percentage of the employed population of Catalonia is 35.5%.

• Barcelona has a labour market with critical mass in the sectors with high added value: In 2017, Catalonia came fourth in the ranking of European regions with the most people working in high-tech industries, fifth in terms of people working in science and technology - with more than 780,000 jobs in this area -,

and sixth in knowledge-intensive high-technology services.

• The salary level in Barcelona is at the medium-low end of salaries in more developed cities and, according to the Union of Swiss Banks, the average net salary represented 49.6% of that of New York in 2018.

• According to Decoding Global Talent 2018, Barcelona is the fourth most attractive city to work in globally, just behind London, New York and Berlin, and it has climbed 3 positions compared with 2014.

• Catalonia has 12 universities with nearly 250,000 students, and the metropolitan area accounts for 82.4% of all students in its eight universities in the public and private sectors. The Barcelona area Universities have more than 50,000 students following Masters and PhD programmes during the academic year 2016/2017.

• In 2017, more than half (51.1%) of female workers and 45.8% of the people working in Catalonia had a tertiary education, values clearly higher than the European and Spanish average.

• In terms of education, it should be pointed out that Barcelona is the only city with two educational institutions among the five best business schools in Europe, as IESE and ESADE are ranked in 3rd and 5th positions in Europe, and in 11th and 20th positions worldwide, respectively, in the Global MBA 2018

ranking published by the Financial Times. TALENT GENERATION AND POLE OF ATTRACTION

in Greater Barcelona

2.5 M jobs

4

th mostattractive city to work in

JOBS IN BARCELONA

Employed workers registered with social security, 2017*

TOTAL % OF SPAIN

Barcelona 1,087,344 5.9

Barcelona province 2,498,037 13.6

Catalonia 3,270,659 17.8

Spain 18,331,107 100.0

* Data from the 4th quarter

Source: Department of Statistics of Barcelona City Council and INSS (National Institute of Social Security)

% Workers with university studies, 2017*

WOMEN TOTAL

Catalonia 51.1% 45.8%

Spain 48.9% 43.2%

European Union 40.1% 36.1%

* % of the population between 25 and 64 years of age with university qualification Source: Eurostat

Employees* according to knowledge intensity of the activity in Barcelona, 2017** (% of total)

Barcelona

* Those registered with the general Social Security system ** Data from the 4th quarter

Source: Produced by the Economic Policy and Local Development Research Department at Barcelona City Council, based on data from the Employment and Productive Model Observatory of the Generalitat (regional government) of Catalonia

LABOUR MARKET PARTICIPATION

Participation in the job market, 2017*

(% population 16-64 years of age)

Activity rate Employment rate Unemployment rate

Barcelona Catalonia Spain European Union

* Data from the 4th quarter

SALARIES

Salary levels in cities around the world, 2018

GROSS SALARY (NEW YORK - 100) CITY NET SALARY (NEW YORK - 100)

129.8 Zurich 153.8

131.5 Geneva 133.1

89.6 Chicago 94.9

101.3 Copenhagen 92.3

86.3 Munich 87.0

79.2 Tokyo 85.3

77.3 Berlin 79.0

68.5 London 76.0

80.9 Montreal 73.5

60.3 Hong Kong 72.4

68.6 Paris 69.4

66.5 Lyon 67.0

73.9 Amsterdam 64.2

65.2 Milan 59.5

58.3 Madrid 50.0

58.4 Barcelona 49.6

30.0 Athens 28.1

Source: UBS. Prices and Earnings 2018

UNIVERSITIES AND BUSINESS SCHOOLS

Training and universities, 2016-2017

Total number of university students in Catalonia* 248,173

Total number of university students in the Area of Barcelona* 203,422

Number of Masters offered by Universities in the Area of

Barcelona 485

Number of Master's and PhD students in Universities in

the area of Barcelona 50,104

Foreign students in universities in the area of Barcelona

-degree, Master’s and PhD programmes- 23,662

* Includes bachelor’s degree and master’s students

Source: Area of Support for Planning, Analysis and Evaluation in the Area of Universities and Research. Secretary of Universities and Research.Ministry of Economy and Knowledge at the Government of Catalonia and Department of Statistics at Barcelona City Council

Best European business schools, 2018

EUROPEAN

RANKING RANKINGWORLD BUSINESS SCHOOL CITY

1 2 Insead Fontainebleau

2 4 London Business School London

3 11 IESE Business School Barcelona

4 13 University of Cambridge: Judge Cambridge

5 20 ESADE Business School Barcelona

6 21 HEC Paris Paris

7 24 IMD Lausanne

8 27 University of Oxford: Saïd Oxford

9 29 SDA Bocconi Milan

10 36 Alliance Manchester Business School Manchester High-technology industrial sectors 1.0% Knowledge-intensive services 50.0% Medium-high technology industrial sectors 3.1% Other employees 45.9%

80.8 78.5 75.1 73.5 72.1 68.6 62.668.1

27

Entrepreneurial

city with

competitive costs

Barcelona has dynamic and flexible

business activity

• The area of Barcelona is the headquarters for 460,778 companies, 14% of those in Spain. They are mainly SMEs and micro-companies, characterised by higher flexibility and capacity to adapt to

complex environments. Almost 40% of the business headquarters of the province are in the city.

• The entrepreneurial activity rate (18-64 years) of the resident population in the province of Barcelona was 8.5% in 2017, so it exceeds that of Germany (5.3%), Italy (4.3%) and France (3.9%) and the Spanish average (6.2%), with the highest value since 2007.

Barcelona has a competitive property offer

for businesses

• In relation to the cost of living, Barcelona is ranked in 79th position among the cities analysed in the annual study of Mercer Consulting (which takes New York as a reference) and it maintains competitive prices in comparison with other cities in the world, despite having climbed positions compared with the previous year due to the appreciation of the euro.

• Barcelona continues to hold a competitive position as regards rental prices of industrial land, offices and commercial premises, which makes Barcelona attractive for doing business for both new companies starting up and companies that have already been established. The evolution of the rental prices of commercial premises, offices and industrial warehouse in the past three years shows an upward trend, which reflects the improvement in the economic situation, the strength of demand and the growing attraction of the city to global markets.

ENTREPRENEURIAL CITY WITH COMPETITIVE COSTS

460,000

More than

companies in the

COMPANIES

Companies by number of employees, 2017

Barcelona

58.9%

Without employees

36.1%

1 - 9 employees

4.8%

10 - 199 employees

0.3%

Over199 employees

Source: Department of Statistics of Barcelona City Council

Barcelona province

58.5%

Without employees

36.5%

1 - 9 employees

4.8%

10 - 199 employees

0.2%

Over199 employees

Spurce: INE, Central Business Directory (DIRCE)

Business headquarters, 2017*

% OF SPAIN

Barcelona

178.607

Barcelona province

460,778

Catalonia

608,891

Spain

3,282,346

* January data

Source: INE, Central Business Directory (DIRCE)

BUSINESS CREATION

Entrepreneurial activity in European countries,

2017 (% of population 18-64 years of age)

Estonia

19.4

Latvia

14.1

Slovakia

11.8

Netherlands

9.9

Poland

8.9

Croatia

8.9

Ireland

8.9

Switzerland

8.5

Barcelona* 8.5

United Kingdom

8.4

Catalonia

8.0

EU Average

7.9

Sweden

7.3

Slovenia

6.8

Spain

6.2

Germany

5.3

Greece

4.8

Italy

4.3

France

3.9

Bulgaria

3.7

* Provincial data

Source: Global Entrepreneurship Monitor (GEM), Executive brief for Catalonia 2017-18 5.4%

14.0%

18.6%

8.5%

entrepreneurial activity rate. The highest value in

29 OFFICES AND INDUSTRIAL LAND MARKET

Offices market, 2017*

5,888,000 m

2Total office stock

432,000 m

2

Available offices offer Availability rate

7.34%

* 4th quarter data

Source: Marketbeat, Cushman and Wakefield

Office rental price, 2017* (€/m2/month)

Periphery (Sabadell, St. Cugat, Esplugues, etc.)

11

New business areas

20.25

Business district (consolidated centre)

19.25

First line

(Pg. Gràcia-Diagonal)

23.25

* 4th quarter data

Source: On point, Jones Lang Lasalle

Office rental price in European cities, 2018*

CITY VAR. YEAR-ON-YEAR

1ST Q. 2018/2017 (%) OFFICE RENTAL 2018 (€/M2/YEAR)

London 0.0 1.351

Paris -0.7 760

Stockholm 12.5 699

Dublin 0.0 646

Moscow 0.0 610

Milan 10.6 575

Luxembourg 4.4 564

Frankfurt 2.7 456

Munich 4.2 444

Amsterdam 8.1 400

Berlin 10.7 372

Dusseldorf 1.9 324

Brussels 14.5 315

Barcelona 9.1 288

Warsaw -2.1 276

* 1st quarter data

Source: EMEA Offices Interface IT 2018 (Europe). Jones Lang Lasalle

Average price of housing in Barcelona, 2018*

907.4

(€/month)Rent*

3,707.0

(€/m2)

Sale of second-hand housing

4,231.1

(€/m2)Sale of new housing*

* Housing sale prices refer to the 1st quarter, and rents to the 2nd quarter Source: Barcelona City Counci

COST OF LIVING AND OTHER COSTS

Cost of living of cities in the world, 2018

CITY RANKING 2017 RANKING 2018

Hong Kong 2 1

Tokyo 3 2

Zurich 4 3

Singapore 5 4

Seoul 6 5

Luanda 1 6

Shanghai 8 7

N'Djamena 15 8

Beijing 11 9

Bern 10 10

Barcelona 121 79

Source: Mercer Human Resource Consulting, Cost of Living City Ranking 2018

Rental price of premium logistics land in cities around the world, 2018*

RANKING CITY COUNTRY RENT LOGISTICS LAND ($/M2/YEAR)

1 Hong Kong Hong Kong 333.57

2 London United Kingdom 240.57

3 Tokyo Japan 214.85

4 Shanghai China 113.13

5 Stockholm Sweden 110.76

6 Singapore Singapore 109.36

7 Oakland United States 107.21

8 Beijing China 105.27

9 Munich Germany 103.55

10 Sydney Australia 103.44

11 Midlands United Kingdom 101.83

12 Manchester/Liverpool United Kingdom 101.83

13 Barcelona Spain 99.89

14 Auckland New Zealand 99.14

15 Shenzhen China 97.74

16 Los Angeles/Orange County United States 95.58

17 Frankfurt Germany 93.22

18 Seoul South Korea 92.78

19 Leeds/Sheffield United Kingdom 90.52 20 New Jersey United States 88.91

* 1st quarter data

Source: 2018 Global Industrial and Logistics Prime Rents, CBRE Research.

13

th

safest world city (The Economist)

Compact city

with social

cohesion

Barcelona continues its efforts to reduce

inequalities

• In 2016, Barcelona had a Disposable Household Income per capita estimated at €20,800. The

recession widened the territorial inequalities, and the value of the disposable household income per capita per district ranges between the index182.4 for Sarrià- Sant Gervasi and 55.0 for Nou Barris (100 being the average value for the city).

• Following the unfavourable evolution of living conditions and rising inequality in recent years, the poverty risk or social exclusion rate (AROPE) of Catalonia was 19.4% in 2017, and is below the Spanish rate (26.6 %) and the EU-28 rate (23.5%).

• Barcelona is among the safest cities in the world according to The Safe Cities Index 2017 prepared

by The Economist, which assesses urban safety in

31 DISPOSABLE GROSS HOUSEHOLD INCOME BY DISTRICT

Disposable Household Income per capita in the districts of Barcelona, 2016 (Index. 100 average for Barcelona)

55 182

Source: Technical Programming Office at Barcelona City Council

FOREIGN-RESIDENT POPULATION BY DISTRICT

Foreign population in the districts of Barcelona, 2018

(% of total population)

12% 46%

Source: Produced by the Department of Studies at the Manager’s Office for Economic Policy and Local Development, based on data from the Department of Statistics at Barcelona City Council.

POPULATION AT RISK OF POVERTY

Population at risk of poverty or social exclusion, 2017

COUNTRY REGION (PRINCIPAL CITY) AROPE RATE (%)

Czech Republic Prague (Prague) 9.4

Finland Helsinki-Uusimaa (Helsinki) 11.8

Slovakia Bratislavsk_ kraj (Bratislava)* 13.8

Sweden Stockholm (Stockholm) 14.4

Poland Centralny region (Warsaw) 15,5

Norway Oslo og Akershus (Oslo) 16.1

Germany Baviera (Munich) 16.2

Netherlands Netherlands - West (Amsterdam) 18,0

Denmark Hovedstaden (Copenhagen) 18.4

Spain Catalonia (Barcelona) 19.4

Italy Lombardy (Milan)* 19.7

Switzerland Mittelland space (Bern)* 20.6

Spain Community of Madrid (Madrid) 20.6

Ireland Ireland - south and east (Dublin)* 22.7

EU28 average* 23.5

Germany Berlin (Berlin)* 24.8

Romania Bucuresti - Ilfov (Bucharest) 25.1

Austria Vienna (Vienna)* 26.0

Spain 26.6

Italy Lazio (Rome) 28,9

Bulgaria Bulgaria - south-west (Sofia) 29.3

Greece Attica (Athens) 31.1

* Data from 2016

Note: The ‘At Risk of Poverty or Social Exclusion’ rate (AROPE) indicates the percentage of the population that is, at a minimum, in one of the following circumstances: at risk of poverty, severe material deprivation or living in households with very low labour intensity.

Source: Eurostat

COMPACT CITY WITH SOCIAL COHESION

Ciutat Vella

86.9

Horta-Guinardó

79.2

Les Corts

136.0

Sants-Montjuïc

79.1

Eixample

119.3

Sarrià-Sant Gervasi

182.4

Gràcia

105.4

Sant Martí

87.1

Sant Andreu

74.5

Nou Barris

55.0

Ciutat Vella

46.3%

Horta-Guinardó

13.4%

Les Corts

12.6%

Sants-Montjuïc

20.3%

Eixample

21.1%

Sarrià-Sant Gervasi

12.4%

Gràcia

17.0%

Sant Martí

17.4%

Sant Andreu

12.6%

Nou Barris

SAFE CITY

Safety in cities in the world, 2017

POSITION CITY INDEX 100

1 Tokyo 89.80

2 Singapore 89.64

3 Osaka 88.87

4 Toronto 87.36

5 Melbourne 87.30

6 Amsterdam 87.26

7 Sydney 86.74

8 Stockholm 86.72

9 Hong Kong 86.22

10 Zurich 85.20

11 Frankfurt 84.86

12 Madrid 83.88

13 Barcelona 83.71

14 Seoul 83.61

15 San Francisco 83.55

16 Wellington 83.18

17 Brussels 83.01

18 Los Angeles 82.26

19 Chicago 82.21

20 London 82.10

21 New York 81.01

22 Taipei 80.70

23 Washington DC 80.37

24 Paris 79.71

25 Milan 79.30

Source: The Safe Cities Index 2017. The Economist Intelligence Unit

Position of Barcelona in urban safety categories,

2017

0

5

10

15

20

25

30

Digital

safety Health safety Infrastructure safety Personal safety Overall urban safety

Source: The Safe Cities Index 2017. The Economist Intelligence Unit

21

16

3

17

13

Sustainable mobility representes

of inner-city journeys in Barcelona