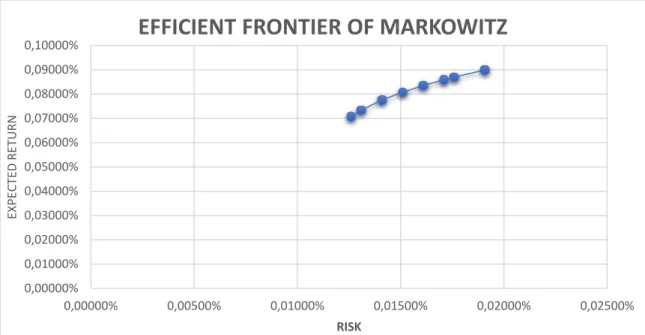

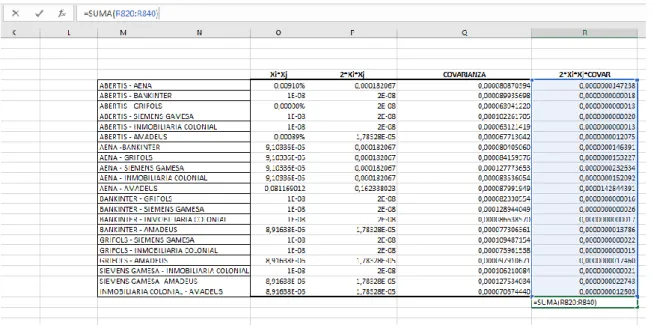

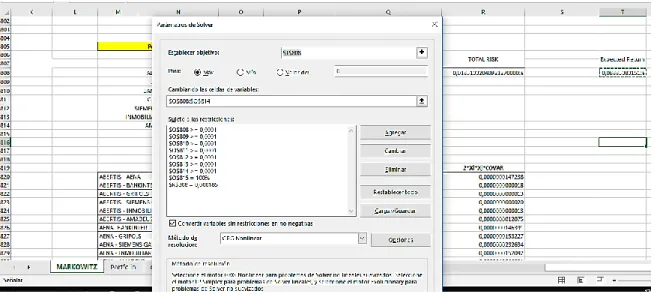

Analysis of investment in financial markets: Markowitz against Value at Risk historical approach

Texto completo

Figure

Documento similar

The Dwellers in the Garden of Allah 109... The Dwellers in the Garden of Allah

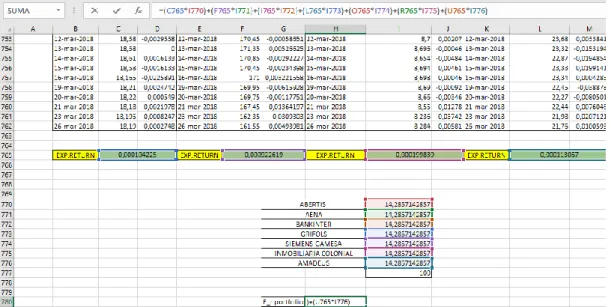

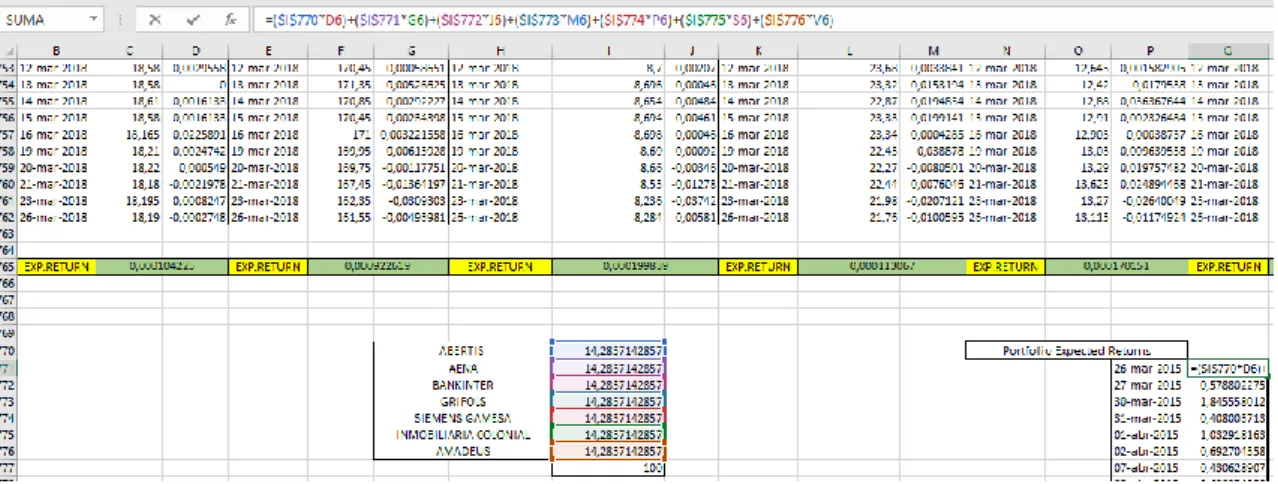

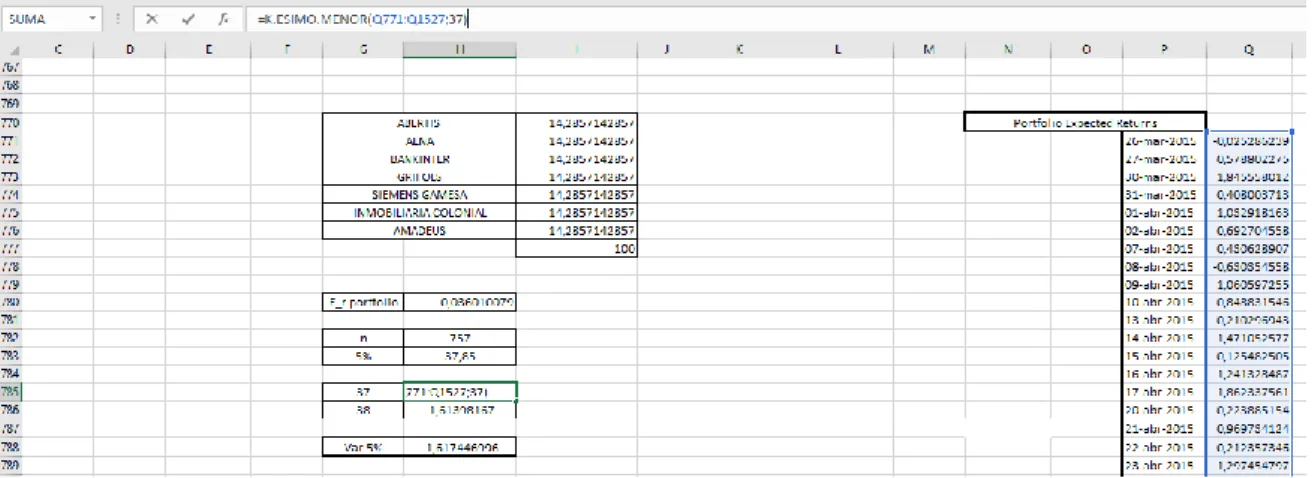

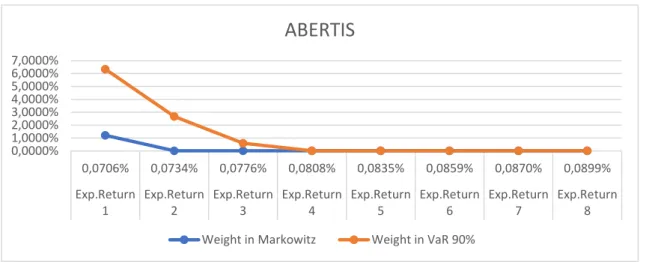

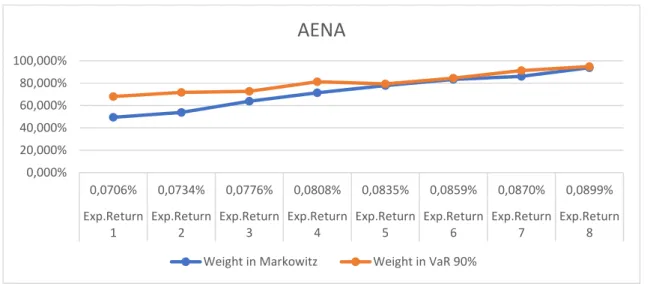

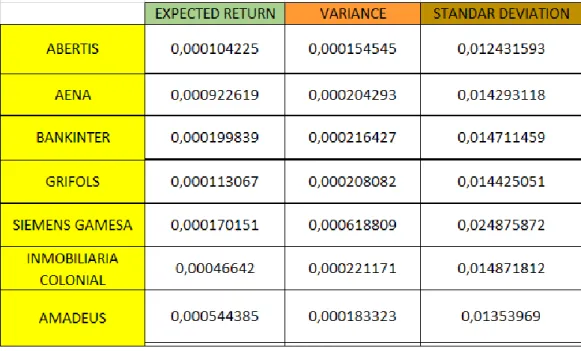

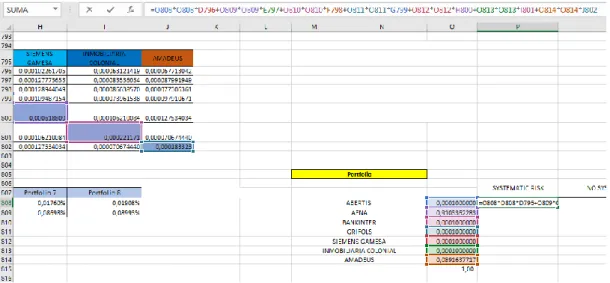

In particular, in order to obtain portfolios that are comparable with the ones obtained in the previous stage (which are optimal in the Markowitz’s (1952) sense)

teriza por dos factores, que vienen a determinar la especial responsabilidad que incumbe al Tribunal de Justicia en esta materia: de un lado, la inexistencia, en el

No obstante, como esta enfermedad afecta a cada persona de manera diferente, no todas las opciones de cuidado y tratamiento pueden ser apropiadas para cada individuo.. La forma

The analysis of the first risk category (structural features of the financial sector) shows that four out of the ten indicators, namely, banking sector size, bank lending

We provide evidence suggesting that the assumption on the probability distribution for return innovations is more influential for Value at Risk (VaR) performance than the conditional

Method: This article aims to bring some order to the polysemy and synonymy of the terms that are often used in the production of graphic representations and to

The historical performance of the 8 simulated portfolios of a theoretical investor that pays VIX future roll-over costs and has no stock trading fees.. Source: Own elaboration