Discussion on the valuation of biological assets: fair value vs historical cost

Texto completo

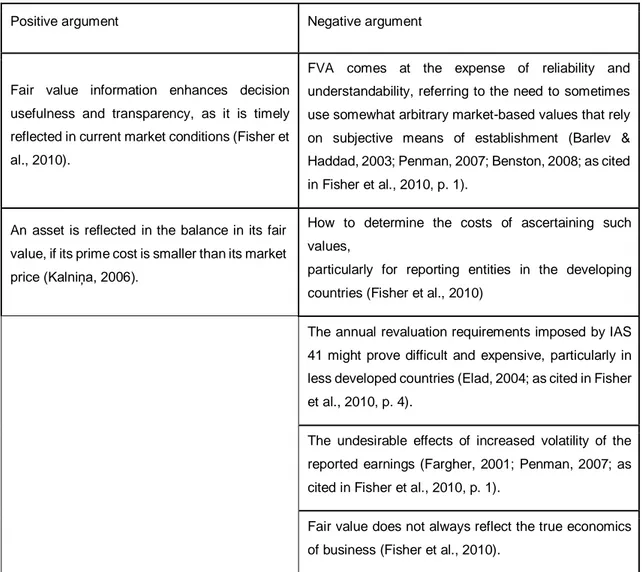

Figure

Documento similar

When the market portfolio is not nearly efficient,

No obstante, como esta enfermedad afecta a cada persona de manera diferente, no todas las opciones de cuidado y tratamiento pueden ser apropiadas para cada individuo.. La forma

The primary purpose of the paper is to define targeting as an aid in estimating matrices associated with large numbers of financial assets, discuss the use of targeting in estimating

Note that an equal sharing of the total cost may imply that some of the agents can be charged a cost that is greater than their direct cost to the source, c ii , and, in this

The present methodology has remarkable advantages: 1) it allows to conduct analysis with up to five assets together; 2) it allows to know the shares of the assets for any

teriza por dos factores, que vienen a determinar la especial responsabilidad que incumbe al Tribunal de Justicia en esta materia: de un lado, la inexistencia, en el

Different proxies for growth options ratio to the firm’s total value (GOR) (either MBAR (the market to book assets ratio), Q (Tobin’s Q), or RDsales (the ratio of R&D expenses

As a result, the study used firm size, profitability, liquidity, and assets structure as main factors that may determine the capital structure of SMEs in Algeria, in line with