Informality and macroeconomic volatility : do credit constraints matter?

Texto completo

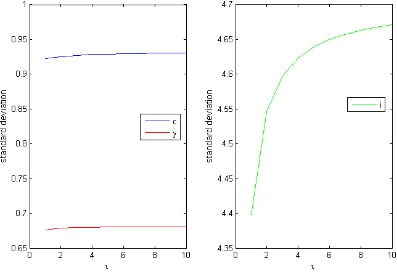

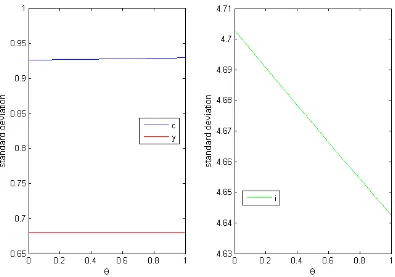

Figure

Documento similar

As shown in Figure 4 in the case of the 385 nm wavelength, the results provided by the LED reach deviations in the range of 14–20% with respect to the values obtained by means of

The increase in dry weight (Figure 1A) and dry matter (Figure 2A) in lettuce plants exposed to long photoperiods is consistent with the hypothesis that longer

It is against this backdrop that the study is enthralled in investigating the financial factors (access to credit, financial literacy and tax) that affect SMEs performance using

If the share of own contribution in household income has a positive effect on own private consumption relative to other members, it is interpreted as evidence against the

The expansionary monetary policy measures have had a negative impact on net interest margins both via the reduction in interest rates and –less powerfully- the flattening of the

Jointly estimate this entry game with several outcome equations (fees/rates, credit limits) for bank accounts, credit cards and lines of credit. Use simulation methods to

In our sample, 2890 deals were issued by less reputable underwriters (i.e. a weighted syndication underwriting reputation share below the share of the 7 th largest underwriter

The Dwellers in the Garden of Allah 109... The Dwellers in the Garden of Allah