Art – Financial development, the structure of capital markets and the global digital divide – Yartey – 2008

Texto completo

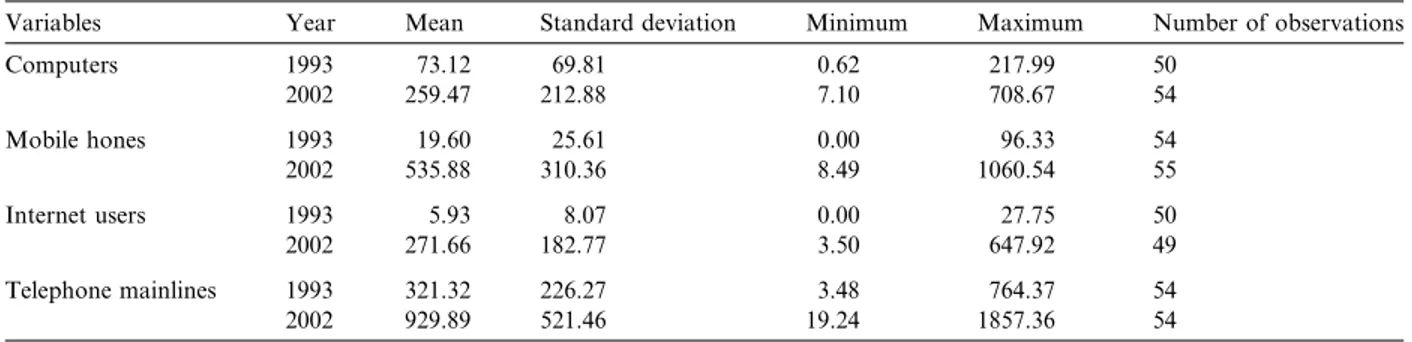

Figure

Documento similar

(Eds.), New Development in the Analysis of Market Structure. Gender, Structural Factors, and Credit terms Between Canadian Small Businesses and Financial

The latter is a modeling language intended for model-driven development of component- based software systems and for the early evaluation of non-functional properties such as

That is, estimating market power with a composed error model requires capturing not only the appropriate distribution for the conduct random term but also most of the variables

The PLS-DA model was built using three latent variables and the top- 26 ranked variables based on the model development subset with data obtained from the metabolomic analysis of

Key words: volatility dependence, Mexican Stock Exchange, World Capital Market, multivariate GARCH , copula analysis.. JEL Classification: C58, F30, F37, F65,

Before the evaluation, a development set consisting of the NIST 2004 SRE database was selected. Trials performed using this development set follow the NIST 2004 SRE protocol. The

Financial decision-making should be based on the level of economic development, guided by the goal of macroeconomic development, and ensure the realization of

The investment development path (IDP) was developed as a framework to understand the dynamic relationship between foreign direct investment (FDI) and the level of