5

( )

*

+,,-( )

*

.#/'01# 2' ' 3

3.'01#.

0#%#43 1!

+,,-7

#1! 2' 0' 1!035%

666666666666666666666666666666 666666666666666666666666666666 666666666666666666666666666666 666666666666666666666666666666 666666666666666666666666666666

666666666666666666666666666666 3.4! 7.!2#

666666666666666666666666666666 3.4! 7.!2#

8

43 !97'$# 7$3#: 07/# '.;3$ .'1'%2# ;#.8!.<

43 !2.' : 43 ='.4!%# / 43 1>! #. 7 ! #/# 3%0#%2303#%!$<

9

B,

B+

+,

+B

++

B< +C

1 & % :& 4 7 & A

C

" "% 7 %" & " & % & "

1 K

( " # "& 1 +

A C ;" A

A ( " # "& % & " 1 ;" A

, ;"3 A

, ( " # "& ;"3 A,

3% & A

10

( " % & &" 3% :& " A+

+< D,

! "% :& & # & 1 &"&% 0" ,

& # & 1 &"&% 0" % & 1 & % ( " ,

& "( *"% :& & # & 1 &"&% 0" % & 1 &

% ( " ,,

& "( *"% :& % ( " 3 % . & %"#( ,

& "( *"% :& " % ( " 1 . 1 % 0 ,

A & "( *"% :& " % ( " "% 0 3" 0 &

# & " < "&. " ,K

' % 1 % & # %" #( "& ,+

0" "& " *" ,+

C 3 "* ,5

C # "& 3 "*

A C " 3 "*

, 3 "% & " 3 "* % #3 # & 1 &"&% ( !> A

A '" % 3"&

C<

EF

A "( "% :& +

A & 4 "

-D< GC

, ! " L : %" -A

-11

E<

GG

3% :& ( " % & C ;" -K

A 3% :& ( " % & ' CM -+

FB

FC

12

C " $ 0 % :& " 1 #" 1 &"&% "% :&

C " $ ' % :& % ( " % " & 17 % 5

C " A$ ' % :& % ( " % " " 1 A

C " ,$ G( & 1 % % #3 " &" 3% :& ' A+

13

& < $ &% "

K-& < $ " " 3 &" &% " "

& < A$ " "&% & " 0 % K N +

& < ,$ % &" " % " " +

-& < $ % &" (". " " + K

& < -$ % &" % & % ( " 1 ;" " 5 7" +

& < K$ % &" % & % ( " 1 ;" " A 7" 5

& < +$ % &" % & % ( " ' C & N . & +

14

L" " @"% # & &" 9%" " " %" #3 & "( 6 & #( "

% " &" "3 % "% :& 3 1 & " : " " )&

#9 %" & " (" *"% :& " % & #7" 4 " & % :& & # %"

& &"% &" 3" : " & 9 # & " " %"#( 1 "& % 6

" " " %"#( # &" " ( %"# & 3 " 1 *" # %"

& " % & % & 4 % & &" % & #7" & &"% &" # 4 %"#( "&

" : & 1 %" 0"# & % #3 "# & " " " %"#( 3 G : "

6 3" : &" & &% " 73 %"# & " % " H 0" "% :& 3 #"& & I " &"

"& 0 " " H & &% " %" % & # 0 # & & 3 % (

0" "% :& 4 0" "% :&I @ %@ #3 %: "& 39 " 3" " %

<3 " % #( "& 6 3 "(" % ( # 3 6 " # &

( 0 " # " 6 # & *"(" 3" 6 @"%7"& % & 3 "

<3 "% & 6 " *"("& 1 &:# & %"#( " 6 3 # 4"

& < " & 1 & 1 %" 6 " # & " % #( "&" " #

<3 " " " 0" "% & # %" & &"% &" 4 3 "& . " " &"

#"4 0 " " # % & % &% " @ %@ " #3 "

&0 % " " &" " 1 #" & # %" < & " % "

#"& " &9 %" 3 # %" 1 %" % # #3 " " <3 " "

( & "% #( " " " *" " % ( " & % " " 3" " 3 "

<3 % :& " %"#( " "% 3 # % & &" " " "% "

% " 6 " &% " # &" %" "% *" " 3 " :&

3" " 6 %" " & % 3 " % & " & 3 3 " 4 "& 1 "

" & # %" % # 6 & 1 %" " 0 " " " " "

%"#(

3 & "(". " @"% &" "3 < #"% :& 3 "% %" " 3 &% 3"

& # & 1 &"&% 0" 6 @"& % # & % "

"( *" # %" 17 % " " 3 "* 4 6 @ 4 & " 3 &

15

% " #3 " % " % 4" &" " *" (" " & " <3 "% :&

"& 1 #"% :& 4G 3 %% :& ( & & 3 & % &" #

0" "% :& %@ & # & & "3 %" % # & <3 # & <=

3 " 6 3 @"( % & # %" 0" 1 % &

16

L 4 & 7" % # % & &"% &" &" "& 3% :& 3" " " # & " "

& "( " & % "& 3" " " " % & % & 3 % 4 <3"&

# %" % # 3" " % #3 " & # & % " 3" " " 3 %% :& "

# & % & 3"7 " "3 " " # %" & &"% &" @"

3 ( & "& #"& " "% " " " #" 1 &"&% 3

@" 0 & "& & %"#( " " & " 1 #" 1 &"&% "% :& 3" "&

" 1 &"&% "% :& & % " % &1 #" " 3 " ("&%" % # % " " " 1 &"&% "% :&

% " % #3 " 3 # %" %"3 " % & #? 3 3% &

&0 :& &6 " " " 6 " " #"4 7" " 3 &"

" # *" % & % " " # & "& 6 & # 4 0" "( 4 6 " %"& "

& 6 6 # 4 " " " % & #7" & ( & " # 4 ( &"

@ "# & " % # # %" 0" 6 3 # & # &

4 " &% #( " #3 6 # . "& " & "( " & 3 % 3" & 3

3 % %"#( & " " " & 9 & " &1 "% :& & " # & "

[image:12.612.174.514.497.676.2]6 % # ( & "( # & . %" & ( # & " 3 % "% :&

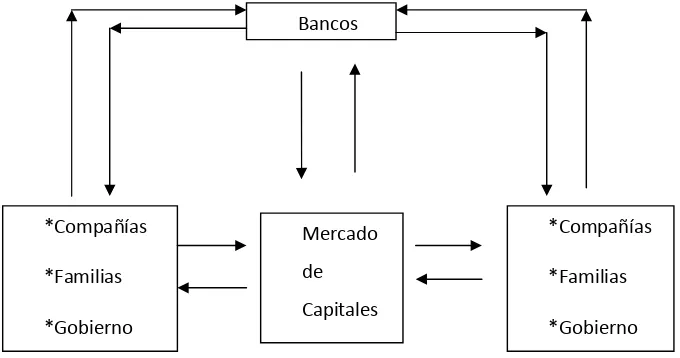

Figura 1: Evolución de las formas de financiación.

Fuente: Elaboración Propia.

Bancos

Mercado

de

Capitales

*Compañías

*Familias

*Gobierno *Compañías

*Familias

17

<3 " #3 " 3 &" 4 & " % & " & : "

&0 & " 0 & "1 % " 3 0" "% & & " " " %"#(

<3 " 0 & 3 . %" % "& (". " " " %"#( 3

% ( & # & 3 3 0 & " #3 " 3 . %" & % "&

" # & " " " %"#( 3 ( & 3" " # 3 3 #3 "% :&

& : " "1 % " & % "& @"4" 0" "% :& 3

3" 0 &% # & " 4 &0 & " 3 . %" & % "& @"4"

0" "% :& 3 &0 & 0 & # & "

& " " " " "& 3 & " 6 ( # 3 "& " & &$ O

& #3 " 1 &"&% "# & 3 3" " 3" " " # 0 " "

%"#( " " & " " P 4 O :# 3 3 1 & "

&" 0" "% :& & " " " %"#( P #3 " 3 3

# 0 # & % & % ( " &" " % & & # & 1 &"&% "

% ( " / &" 3 "% :& 3 3 " 3" " % 2 '" " &

#3 " " % ( " &" " 3 0 & # # & % " 7 % #

& 1 . & #" 3 "% :& & 4 & "

& " # #" # & " H G : " G : " I 4 3 # # # & 6

& 1 %" 6 & & % " @"% % &0 & & # & " 3" " % (

1 . %"." 3 6 #3 " ( & 1 %" # # & &

6 " 3 % & & "& 1 . %"." 3" " " " # & % (

" 1 #" % ( " &" " " " "09 " 3 ( " #"& & &

(" "&% "% 0 4 3" 0 6 % #3 & & & 7 %" 3 . #3

<3 " 6 % & " &" " & : " H3" 0 I 3 3 "* 4 # &

6 0" & " &" % & " 3 % ( " & : " H"% 0 I 3 " " "

#"& " " & " & : " @ 4 3" " 3" " & &" 1 %@" 1 " " "

% & " & 1 % & " % & % 3" " % ( & % "

%"3 " &0 :& 4 & % %"#( " # # #

1

18

#3 " 3 &0 & & 3 "1 1 & & : " H"% 0 I # & "

% #3 & ( "% & H3" 0 I & & &" % & "

% #3 & "% :& 1 % &" 1 #" " # & "% :& 4 % & 4

& : "

'" " " " % ( " &" " " 1 #" % ( " & 0" 6

& & # & % 4 3 % 3 & 0" 3 % "% 0 A

0" & & # & 1 &"&% # 4 #3 "& & " :&

4" 6 3 # & % & " 9 1 #" # 3 % " & "

#3 " " 3 & " "% " 1 #" % & & & 1 & "

< & # %@" % " &" # " 6 " " &" 6 "3 & "&

@"% " " 3 % "% :& " 6 0"& " " % " &0 & " 6

"& "( % &" & "( " & 3 % 3" 3 " 0" "% & "

0 " & #( " 3" % " # & "#" " " &% :& " 3 :& 3 & :&

" &% " 6 # & " # & " *" "&% " ! 3?( %" "

3 " # %" & "% :& % & 3 &: % " " " %"#( &

" " "& & . K 4 1 ( + " 1 &% " &

< # " # " @" & 3 # Q K, <% 3 3 "

3% & 0 " " 6 % & &?" (" "& "&% " ! 3?( %" 9

/ ( :2 " " " %"#( 3 "% " # & & #( " 9 # & 3

%"#( 3 " 1 " 4 #"& " : " & # %" 4 &

4" " " " &" ("& " %"#( " " 6 % & 7" & 7# "( % 3

" " " % &:# %" & % " ."(" 1 % " " " "

%"#( ( " " / ( "% :&2 # %" 3" " % " 6 " &

Consiste en que los residentes en el país puedan constituir libremente depósitos en cuentas corrientes en el exterior con divisas adquiridas en el mercado cambiario o que no deban ser canalizadas a través de este mismo mercado, es decir que provengan de operaciones de comercio exterior.

3

HULL, John. Introducción a los mercados de futuros y opciones. 4º edición. Madrid:Prentice Hall 2002, p. 525.

4

19

% &:# % % " <3 % :& " 1 % "% & & " " " & 9 "

" " %"#( H %" 4 < & I 4 % & & " "( "# & 0 &

& # & 0" & " 3" " 3

.'A' =3 1#.3! 2' $# 2'.3A!2#

# %" % ( " 1 &"&% " " "09 0" 0 #"4

#3 % # 3 " " " % % & 0 " " " # & " 4 " " "

& 9 & 3"7 & " *" @"% % %" A " " @ "

#" %" & # %" 1 4 3% & 1 &"&%

1 &" F F & " % " @ %" % & " % & 1 &"&%

# #3 "& & 6 " 3 % 0" 1 # %"

#3 *: % & " % " & " & % " " " 3 %

% %@" & " 9%" " %@ & " "3 < #" "# & * " 3 9

% "% :& & " )& % & " 1 4 3% &

1 &"&% "& " 3" % & 49& " " # & # %"

0" & 3"7 % # L "& " & 5K+ ! & )& & 5K+ C "&% " &

5+ *" & 5++ #"& " & 55 " " & 55A

" # %" 0" & 3"7 # & : 1

3 ( 3 9 " 9%" " %@ & " % "& " 3 &% 3" % & #7"

& " & & & % % 3 0 "( *"% :& #"% % &:# %" % % # & 4

%"#( & % &" % " #3 : # %" 1 &"&% #9 %

( & : #"4 "3 " " &0 & " < & 4 1"% : # &

&" "% :& 1"0 "( " %@" 3 "% & #3 *: & >9< % " 3"

5K+ #3 *"& " % *" % & " " 1 ( 3 %"#(

3 G : " & 55+ & % &" *" > < H> %" > < %"&

0" I & " & 5K+ % " " ( " " '" H E ' I 4 &

5+- & % " 3 "% & " " > %"& 4 C H >RCI 4 & & &"

20

& " "% " " & < & 1 %" 4 & "( & % 6 "& " &

3 # %" & 3 # H# %" "& " *" I & % "&

% & " "& " *" & & #" "& "%% &" % #3" & % &"

% & "% 0 1 &"&% & " ( " 8 # & " 6 & & "

3 "% & " *"& % "# & & " 3" 1 ."& % & % &

1 &% " & %" " "& "%% :&8 6 % & % % # # %"

# " H 0 @ % & I < "(

'.3A!2# ' 1!%2!.3H!2# '% #$ !

& # %" "& *" % #3 3 , ( " " # &

"& " & # +- # & % & " & K ?& % 1 "

C & 4 " ( " 0" # "& # & # "

3 &?# % & " & % " 1 & & K @ %" > %"&

<%@"& H > I % & #" + , # & % & " "& " S "

<%@"& HS!FI % & # K 5 # & % & " "& " 4 <

% & # +55 # & % & " "& " - % & " % & #"4

&?# "& "%% & & # & 1 & & # # " " 3% &

( 7& % S ' HS " #3 %J ' % & < % & # -,

# & % & " "& " . 3 1 : "

> % & - # & % & " "& " K

& #9 %" " &" " ( " % & #"4 0 # & 3 "% :& % & "

> %" > < %"& 0" H> < I % "& , % & # &

5

Burghardt Galen. Volume surges again: Global futures and options trading rises 28% in 2007. Future Industry Magazine. March / April 2008. [En línea] Disponible en: http://www.futuresindustry.org/fi-magazine-home.asp?a=1242.

6

Ibid.

21

% & " "& " " " + " " % "% :& % & > CC H> %" 3"

C C &"&% I 4 " % "% :& & #" C #"

> %" & 1 & % "0 3" " " "& *" " 6 * 6 3 % &:

# & " # & " & 0 # & 3 " " > %" 7" 4 C

" H >RCI % & +A # & % & " & ,5 4 > %" "

9 # & & H> I % & +, # & % & " & ,

"%" " 3 % "% :& " % # &* FF 4 3 1 &

3 % " 7% "

'.3A!2#

& 6 3 % " " # %" " % #( K ?& "&J 1

& &" &" # & H I ( 0 & " 0" )

5- , ( & % & & % % # & #" T &

0 # & % & " 0 & # %" " 3 ;"3 ( " "

& 9 % & 5T # & & #(" % % # & # #3 "&

@" 9 1" ;"3 H I & # & 6 3 # & " &"

3" "& 1 % 9 & "% 0 " &" % & "3" &

& % " 1 % " " 0 & " # # ?& & K "

% % : & K 5T 3 % & % 3 & &% " % & "

0 & % & " 0" # 76 & ;"3

3 % & " 1 ;" 4 " 3% &

8

Conferencia de las naciones unidas sobre comercio y desarrollo (Unctad). Situación general de las bolsas mundiales de productos básicos. Enero de 2006. [En línea] Disponible en: http://www.unctad.org/sp/docs/ditccom20058_sp.pdf

9 Ibid.

10 Ibid.

11 Bank for International Settlements. Semiannual OTC derivatives statistics at end December 2007. Table 19: Amounts outstanding of OTC derivatives by risk category and instrument. [En línea]

22

' & # 4 ("." " 3" % 3"% :& #9 %" " &" & # %"

(" 0" "& & " " %"#( % # & " " & 9 "

% & ( % :& &1 " T 3" " # %" & >9< % 3"7 6

# %"& " & % " & % & & & % & & # & ) , &

"

'.0!2# 2' '.3A!2# '% #$#493!<

" # %" 0" & #( " # " "

3 "% & & #"4 " "# & & " " E" #( "

: "& "& 3 "% & % #3 # & 1 &"&% " 3 "* H ' CI (

!> 6 & % & " "& " *" " 1 3 #( 3 &

" " *" & 3 "% & 3 # ' & A

3" " 3 # 3 #( " " E" #( " H E I "&*:

" # %" & 0 # %" % & " *" 0" (" " & &

0 & % "% :& 3 3 % &" 3 U= >F " E % &0 :

" #"& " & % 3"7 " & "#9 %" " 4 >9< % &

"( &" 3 " "1 #" & % "% :& & # & 0"

# %" 0" "& " *" #( "& " : % & 3 % $

& % & " 1 ( H 7 " 3?( %" ( & I

4 ( 3 %"#( & #(" 3 " & 0 3 % % #

& 0" ( D& % "3 " *"% :& " " 4 "#( 9& ( "

! 6 " & 0" " " 1 &% " # %" & ("&%" &

0" "& " *" % & "3" & < & ( " 6

" % #" " % #3 & "% :& H ! & #( "I & 3 & &

12

Bank for International Settlements. Triennial Central Bank SurveyDecember 2007.Foreign exchange andderivatives market activityin 2007. [En línea] Disponible en: http://www.bis.org/publ/rpfxf07t.pdf

13 Bolsa de Valores de Colombia. Resumen mensual operativo general. Septiembre de 2008. [En línea] Disponible

23

&0 & " 6 " % & &" & % "% :& " "& % #3 # & "

% & % & % & " 3" " "#(" 3" # "& &" " % " "

" # & "% :& " "& 7" 4 & ? #" & "&% " 3 3

%"3 " " 3 &% 3" 0 & "." 0" "& " *" 1 & "

6 ( " " "& " *"% :& # 17% ". " 3 % " "

& % " 3 %71 %" %" " &0 & " & #(" ( & 1 % &

9 # & " " 6 * 4 3 1 & " # %" 4 " # &"% :&

% & "3" 3 "& "#3 "# & " 0 & "."

#.47$!035% 2'$ .#9$'4!

"(". % & " & " % "& 1 %"% :& % & (" & "

<3 % :& %"#( " " & %" ( " % #3" 7" % #( "&"

0 % #3 " %" " " " 1"( %"% :& % # % " *"% :&

& " "% :& 6 3 "& 3 0 %" % & " #" %" % & & &

" 3 & &% " %" (" " & " <3 % :& "

%"#( " 6 & " % #3" 7" 3 6 <3 " # - T

3 %% :& # & " 6 #" " 3 #" & & " % #3 & & #3 "

"#( 9& "(". 0" " &" 1 #" % ( " < & & # %"

#( "& 6 " 3 & & 3" " " #3 " & & & % & "

% " 1 &"&% " & ( %" # . " #3 1 &"&% "

24

98'13A# &'%'.!$

&" *" 4 0" " " 1 %"% " " % ( " % & " %"#( "

# "& & # & 1 &"&% 0" 1 % & #( " 4

#3 # & "% :& 3" " &" #3 " % "

98'13A# ' '0>;30#

% ( " % " 4 1 &% &"# & > %" 0"

! " *" & " &: % & 0 "% " " *"% :& > %"

0" & #( "

% " 3 ( #" 4 # "% & 6 3 "& 3 & " & "

*"% :& & # & 1 &"&% 0"

> " %:# 3 # . " #3 1 &"&% " #3 "

*"& & # & 1 &"&% 0" & & & % & "

%"#( " & " #3 " 0 %

0" " " 3 & &% " &" % ( " # "& "& %"

"& 1 %" # %" " 6 <3 & 7" " #3 "

0 % " *" & # & 1 &"&% 0" & "

25

#9 6 *" "& 3" " " " &0 "% :& &

% " " 0 4 % "& " 0

" " 0 $ > "& " % & " " #3 " % & " (

" 7% 0 " 3 % " *" " &0 "% & (

# %" 0" "& " & 0 &"% &" % # & &"% &" (

" " # & "% :& # %" 4 *"% :& 0" 3" "

% & " "

"& " 0 $ &1 #"% :& 1 &"&% " " #3 " &1 #"% :&

# %" 0" &% " "& 1 &"&%

"( "& " 6 " &6 " ( ( "17" 3 4 % < & "

& & % # # &0 "% :& #" #3 "&% " ( " 6 "

&1 #"% :& # %" 0" % & 4 "& 3" "

3 " & " 6 1"% " & "& # " 3 % (? 6 " 4

26

( " " % % & (" *"% :& 3" % 3"& & # %"

& &"% &" & %" " 0 * # <3 " %"#( "

3 4 % 3 & "&" *" 4 0" " " 1 %"% " " % ( " % & "

%"#( " # "& & # & 1 &"&% 0" 1 % & #( "

4 #3 # & "% :& 3" " &" #3 " % " & %"

0 %

#3 *" % & " @ " 0" 7 & %" "% 7 %" 4

"3 %"( " % # & # & % ( " & &?" % & " %" "% 7 %"

3 &% 3" "% :& 4 % & "( *"% :& 0" % & 1 &

% ( " " 3 # %" #( "& " 7 % # &" ( 0

<3 %"% :& 1 &% &"# & %" " & 4 3" % 3"&

% & " "( "% :& 4 "& &" &% " " *" " "

#3 " % " % #( "& % & 1 & " *" & " & % (

" *"% :& 0" 1 &"&% % & 1 & % ( "

& &?" % & &" ( 0 % 3% :& " #3 " 4 & "& 3 1

%"#( " % " #" % # (" 3" " " *" & <3 # & <

3 % ( " % & 0" 1 &"&% 1 % & # %"

% #( "& "& ( % #

" " " & " <3 # & <=3 # "& % 4

( & 1 % " % ( " % & 0" 1 &"&% 1 &" # & 3 & "&

27

B<

B<B ';3%3035% / #.>&'%'

0" 1 &"&% & & # & 6 @"& " " &

" " 1 &"&*" 3" " " # % ( " " 0" "% & &

3 % & # & #"& & #( 3 6 0" 0" &

"% 0 (4"% & 6 " " 0 * # &" 3 " 0" "( '

. #3 &" 3% :& ( "%% & " #3 " > % 1 & 0"

3 6 0" 3 & 3 % " "%% :& " 1 #" 3 #

&% & " 3% & 1 & % " "% 0 (4"% & 6 &$ "

"%% & 7& % ( ( & " # & " 4 " # %"&%7"

/% ## 2 & 0" & % & 3 @"

0 & " "& "& " ? #" 9%" " & " 1 &"&*"

& %" /1 ;" 2 3 # % & " 0 & & C "&% " "

1 " &" 6 "& *"("& % & @"#3" & & F

4 F E " 1 " " "7"& " # %" 6 "& "("& # %"&%7" 4 "

%"#( " 1 H6 @"%7"& " 0 % & I " " " %"& " # & "

< & & " " > " & " " # %" 3 "("& "

%"& " 4 3 % " % #3 " 4 0 & & " % %@" 0 & "

' 3" 3 # %" # %" 1 " "& FE &

"3:& & & % & " & % # 3 " " " & % "

" % 4 % # % "& " 93 %" 6 3 % (7"& " & "

3 3 " 4 % &0 :& & 1 #" 1 "%% :& " % %@"8

3 " & " "("& . " " " "% & % 0 %"#(

% # % 4 " 3 ( " &" " '" " " "0" " % " " & ( *"

"3 & " & % "(" & & 3 & ( & # # & C " 7 % #

& # %" " * @ * & % " &0 " 3 % ( "& "

( " 3 % " & & 6 "(" 3 & ( 3" " % ( " & % "

28

% & " " * 3 " "*:& 3 " % " #3 *" & " & % "

3"3 % # &" # & " #

/ & " )& @"% " 5,+ 1 & : " ( " % # % @ %"

3" " " " " "&. 4 % # % "& " & # # " 4 # " "

% # % " *"% :& 3 % " 7% " "& " * & & 9 # &

%" " 4 %"& " "& & 6 6 7" # %" " " 1 2,

& " 1 &"&*" % & #3 & " " # " "& 3" "

&"% & # %" 1 0" V J 4 @ %" 4 . & % &

# %" 1 #" " 3 #" & 6 &% 4 & % " "

%" & # " 3 : % & " "% " " & % "& " 7 1

"% 0 (4"% & % # 1 . #"7* % (" " 3 " " ( &

7& % ( &

# 4 1 & & " 3% & 8 4" & -++ " *"("& &

W# "# 3 "& "%% & " "09 &" ( " 3 % " *" "

" 3 "% & "("& " 3 & " " & & 0 % #3 " 0 &

% "% 0 " &" 1 %@" # &" " @"% " 1 4 " & 3 % 3 0 "# &

3"% " 3 " % & "3" & " & % " "# & ( " " % ( &

%" 6 3 % # %" 7" " <3 "% :& % & " &

1 " 1"0 "( & % #3" "% :& " 3 % 3"% " & % & " H# %"

% #3 "(" # (" " 0 & 7"I / 3 &% 3 3 & & "

)& & 3 #3 " "& *: 6 "#"(" " /' "& "

J "& " % " &2 " % " &7" % # 1 & % & "% " "

% #3 " 4 0 & 3" " @"% " "& "%% & & %" 6 &

&% & " " % & "3" 3" " " % #3 " 0 & " " " % "% :& &%" "("

14

HULL, John. Introducción a los mercados de futuros y opciones. 4º edición. Madrid: Prentice Hall 2002, p. 8.

15

29

" # " 3 % :& 3 " " & 3 % "* &"( 3" " "#(" 3" 2

-( %"# & 6 @ 4 & 7" % & % % # 3 "% & H 0 @

% & I 6 " # & ("&% ( " 4 & " 1 &"&% " "

# & " " % "% :& H " ' "& " J "& " % " &I &7"

1 % &% " $ & 3 # " & "&% " & < 7" & # %" % & "

% " #3 %" 6 % #3 " &" 3% :& & &7" " 3 ( "

0 & " " 3 &" "& " <3 "% :& H "& 3 &"

& "& 1 ( I 4 & & " & "&% " & @"(7" 1 #" " "& *" 6

1 % 0"# & 6 & # 7" " 3% :& 1 " % #3 " %"(" # & 6

% & % @ 4 % # % & "3"

& % "& " ;"3 @ " # 4 % & % #3" " " % & "

0" " &6 & 1 & & &" % #( &"% :& # &" 1 ;"

& 3" % & "% " 6 3"% "& & & % " "& " *" &"

%"& " & 3 % # &" " & 3 % 3"% " & % #?& "%

3" " %" " #" " 3 #" *"% :& & % : & 5+ 4

& &% @" % % " " " % & "3 %"( " " %" 3 %

1 &"&% 3 3 % " # & @"% " " " " & 9 4 " 0 "

B<+ 717.#

& "0"&*" & #" 4 3" " % #3 & & 1 %" & # %"

1 & % " & & % & " " < &% " # %" 17 %

6 3 & & & % # (4"% & # %" 1 )&

# %" 17 % "6 & % " "& " % " 6 %"& " & ( & " &

3 % # &" 3 " ( & "%% :& " 1 " 4 " #"& " 3

3 "% & % #3 " 4 0 & " 3 & " & & "& " *" " 8 &

3 % 1 %" " % #3 " & " & ( & & # %@ # & 3 %

3 & ( & & " 8 3 % & " @"4 # %" 4 %" " 3" "

)&" ( " " * 3 " 6 " 1 & 3 %

16

30

3 & & " "&% " # %" " % 0 " %" " 4

" 1 % % 8 @"% 6 " &6 @"( " * 9 & "

& % " "# & # # ( & 6 #3 %" 6 & " @ # 9&

'" " & & & % & " 1 ( % 3 *" & . #3 6

% " " &"% # & 3 # %" "# 6 &

" % #( " & 3 % & & 4 % % %@" & . &

" % & &% #( "% %" 3 % 6 0" " % ( 3 3 %

# 3 9 3 & " 6 @"4 %" * 3 % & ( &

3 % & # %" 4 % 3 & " & " # & & " "&"&% "

3 " " 8 3 " & " ( = 1 " 3 % # 4

3 ("( # & 3 % 4 "&"&% " & # & " 3 " "

" 1 #" " % 0 &0 % " & " 0" "% & &

3 % ' " " % & "3" 3 0 3 & 0 "

& % # % "& 6 & & " "& 4 % &0 & & & # #

3 % 3" " 0 & " % & '" " % # % "& % &0 & & 6

< " ( =3 %% :& 3 % 3? &% & " # # ( & " 3 %

# (". ' % "& @"4 %" * % # % "& ( 3" " # 3

# # 3 % % " 6 % # " 3 % :& "#( % & " " 3 7"&

" " & "% & & H &% 0 "& I 3" " & % " & 3 %

3 % 3" " . & " "09 & % & " 1 " #"& " "#("

3" 3 & # & # *" " 0" "% & & 3 % 4 "% " &

6 3 # " & & & H I 1 . " 1 &" % & "

# %" 1 % & " *"& " 3 "% & " 1 #" 6

3 % 0 0 @ # 9& 4 " %"& " "& " " 3 % & " &

3 # &" " 8 % ?& % 1"% 6 3 0" " 3 %

% & " 6 "% " & % #3 " 4 0 & # # 3

6 & # %" 1 & & % "& & % " "# & "

< &% " 17 %" & 3 % H" &6 & " & %" 3 % I

31

& 7 % & " 1 & 3 &% 3" # & @ "# & " % ( "

" &6 "#( 9& "& % & 1 & 3 % " 0

)& % & " 1 & "% % & "% " %" % ( " 3" "

% #3 " 0 & &" %"& " 3 %71 %" & "% 0 & & # # &

# &" & 1 4 " & 3 % "% " 3 "#(" 3" & 3

% & " ( & "& " *" 8 6 % 6 &" %" " 4

%" "% 7 %" 3 % 1 %" # # #3 < & & # " 6 "

% #" " % #3 & "% :& " % " 3 " " %"& " "% 0 (4"% & "

"& " " 7 % # " 1 %@" & " @"% 6 3

% & " " 1 % # & & % "( % & " 3 # & " "& 1 &% "

" & 6 & 4 & 6 H% ( "I " " & 6 &

& 4 6 " # H 3 % " I

B<+<B !.!01'.> 130! &'%'.!$' 2' 7% 0#%1.!1# 2' ;717.# <

& & % & " 1 & & % " & & % & " & " 3 % $

"% 0 (4"% & 3 & ( & 3 % 3 "#( 9&

3 &" # & " & 7& % ( &" "%% :& & ( & % &

%" 6 "% 0 " & % ## 4 ( 3 % 1 %"

%" " 4 # %" "% 7 %" 6 1 &% & ( &

"1 &

"#" % & " 3 " " %"& " ( & 6 & "

" 1 &" *" %" " % & "

" & " )& % & " 1 3 " & " & "

3" " "% 0 (4"% & #3 "& 3 % "& 3

& " 3" " %" % ## 3 & " 3"7

32

6 @"4 6 & & % & " % "& 3 " " 1 %@"

%" % " % & "

0 &% # & #3 " & " "% 0 0" 7" % & " &

% & " 4 3 & %" " % #" " % #3 & "% :& # %"

1 & % # &"% # & 4 0 &% # & 6

# &"& " 0 " "% :& %" " % & "

# 3 % :& & &?# # < # % & " 6 & " &

3 " 6 " # "% :& % : % & 1 & 0 " 6 &"

3 &" & " 3 ( # %" 4 "1 % #"& "

# & 3 7 %" 3 % ( %"# & &" " 6 3 # " (

"%% :& " 1 " 4 " #"& " & # %"

B<+<+ ! 0#9'.17.! 2'$ .3' &# 4'23!%1' ;717.#

< & %" 3 %71 % &% #( 6 "& & "

3 % & % & " " % ( " & & # %" 1 ' & "

"6 " 3 &" 6 & 3 "% 0 (4"% & 4 6 " " & &

1 H% #3 " " 1 I " " " &% #( "& & " # & & 3 % 8

" 3 &" % 6 /% " 17 % 2 & %" & 7" 6 % #3 "

% & " % #" &" 3 % :& / " " " 1 2 ( "% 0

(4"% & 3" " % ( ' " "6 " 3 &" 6 & &

"% 0 (4"% & 4 6 0 & " 1 % 6 / " 17 % 2

" 3 &" & 6 & 1 3 % %" " ' &

6 /% " 1 28 0 & % & " " 1 3" " # &" " &% #(

33

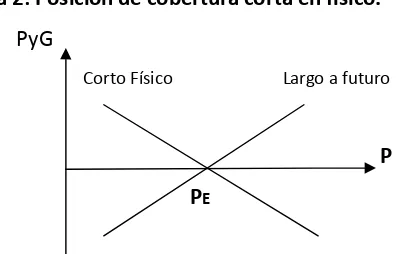

Figura 2: Posición de cobertura corta en físico.

PyG

Corto Físico Largo a futuro

P

PE

Fuente: HULL, John. Introducción a los mercados de futuros y opciones. 4º edición. Madrid: Prentice Hall. 2002

" 1 " # " " 3 % :& &" % #3" 7" H@ I 6 " % " &

17 % & & # # & & % " % & & "% 0 4 % 6

3 % "% 0 " # & " 1 #" "% " # %" 1 4

" " & 3 % 3" " " % #3 " "% 0 & 1 & #"4 "

3 % "% 0 #"4 & " 39 " H % #3 "% :&I 4

& #" (". 3 % #"4 ( & 1 % 3 1

& % " # %" 1 1 % & " 3 ( " #" " 3 % :&

% & " " " # & &" 3 % :& " " " 1 " 1 #" 6

0" "% :& 3 % & 1 "&

: 6 3 1 #"& % & 3 % " 3 0 "% 0 4

" 39 " 4 "&"&% " H'4 I " % #3" 7" 6 % (

H@ I8 3 % 1 % 0 % #3 " 3 & " & 1 % 3 "

& %% :& "#( 3 1 H' I " 1 #" % ( " @"

" " & 3 % 3" " &" 1 %@" # &" " " "09 & % & "

1

& "# & &" #3 " 6 3 % & "% 0 H " " 17 %"# & I 4

& " &% #( 6 3 % (". #" &" 3 % :& % " " 1

34

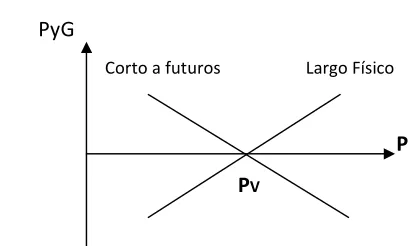

Figura 3: Posición de cobertura corta a futuro.

PyG

Corto a futuros Largo Físico

P

PV

Fuente: HULL, John. Introducción a los mercados de futuros y opciones. 4º edición. Madrid: Prentice Hall. 2002

& %" 3 % 1 % 0 0 & " 3 & " 3 3 & H'0I

6 # " " & %% :& "#( 3 1

B<C #.I!.2 <

)& % & " 1 ;" /" 3 "* 2 " ( "% :& % & "% " % #3 "

0 & &" %"& " & "% 0 3 % 1 % " & 3 % 3 % 3 % 1 % " &

3 % # &" 4 " &" 1 %@" # &" " % & " %" %

3 0" 4 3 & " & &0 % " & # %" % & " *" & "#3 % &"

% #" " % #3 & "% :& 6 "( *%" &" % & " #" & 6 6

" "# & " 3 % :& 3" % 3"& & % & " 8 " 7 6

"# & " % & 3" " ? # 7" #" "% :& & " #"4 7"

%" " & " 17 %" "% 0 &0 % " & % & " & " *"

9 # & % & " & @ %@ /" " # "2 & & 6 "#(" 3"

"% "& " 1 %@" %" " 3 % 4 1 #" & " # #

# & % & " 1 ;" & "% ( " " & & &" "

3" " # " 3 % :& " " "% " % #3 " & ( & 3 %71 % " &"

1 %@" # &" " 4 " & 3 % # &" # # # % & "3"

35

" # # 3 % % 6 "& " 1 %@" & " % # 3 % &

3"% " % #?& "% ( " 6 & "(". & &1 %"# "

%"#( " @"( " # 1 ;" ( 0 "

1 ;" 3 & 3"% " 0 4 & & 0 4 H CI ?& 1 #"

6 "% :& 4 3" 4 "% % & " & % " #3 "

" #"& " & " 3 "% :& 0 4 : " 3"% " 4" " % #3 "

0 & " & & " 3 #3 " <3 " " & "

1 &"&% " ?& " %" 3" 3 % 0 9 @" & 3

#"& " & #" 4 " 3 "% :& " . " " #3 E & %" 6

" " 1 %@" % #3 # & 1 ;" 0 4 " " " 3"% " " 9 3 &% #"

3 # % #3 " : " 7" "& " & " 1 &"&% "

#3 E &" 3 6 % & " 6 @"4 &" 0 & " : "

& %" " 3 "% :& C " 6 "% :& 1 % " % & " & 7& %

H !>I 7" 0 &% # & 1 ;" & % 4 %" : " 0"

& 3 3 % " 1 &% " & " " " 3"% " " 4 7& % 0 &

3" " " 1 %@" 0 &% # & 1 ;" " % & "3" 6 & " " 1 &% "

& % & " " 3 6 0" & @"4 : " 4 & @"4 % (

E

B<C<B< #9'.17.! 4'23!%1' 0#%1.!1# #.I!.2

3 % % ( " %"#( " " " "09 1 ;" & %" &"

#3 " % " <3 " " %"#( " % & & " " &

3 % " 0 " & 1 % & &" % & "3" 6 " & 0"

1 . & & %" " #3 " 3 " % # % #3 " % # 0 &

?& 6 " % #3 " 0 " H #3 " I 0 & 0 " H <3 " I &

1 " #3 " " " & % & " 1 ;" % & &" & " 1 &"&% "

6 & # &" 3 %"#( . % % 4 " 1 &" % & " " *"

36

0 &% # & 1 ;" H & %" & CI " & " " 0 "

H & %" & 0 4 1 ;" I

% ( # & % & 3 % & " 3 " 1 #" # " 6

% & 1 4" 6 &" " 3" &% & " % " 17 %"# & 4 "

" " " " 7 6 3 1 "& "& " %" % ( "

% & 1 ' " " # 0" < & &" 1 &% "

&% " $

C ;"

% ( " " 4 3 0"

"& " *"

& % "( & ( "

< % & "3"

)&" " 1 %@" & "

& " #"4 7" %" @"4 & " "% 0

C

% & & # %" 1 & H% #" " % #3 & "% :&I

& " "& " *"

& & % "( & ( "

@"4 % & "3"

!"& 7" # &" 3" " " % #3 " "% 0

" #"4 7" % & " % "& "& #" "% :&

B<D I!

)& ;"3 &" 3 # " & %"&. " ?& ( & ( "% :& 3 %71 %

;"3 & "% 3 0" & 3" 3" " & %"#( " 1 . %"."

37

&6 #" "(". " " % ( " & 0 " 0" " 3 &"

& & & 9%& % & ;"3 % " : " 3" & %"#(

1 . " " & 9 & % & "3"

3 # % #?& ;"3 & # &" /' " & E"& " & = " ;"32

& %"#( " " & 9 & % " &" " % & "3" H I

% #3 # " 3" " " " " 3" H I 1 . 1 % 0 " " & 9 "

&" " " 1 ." 3 # &" " ( & 0" 3 &% 3" & # &" "& &

3 #3 " 1 #" H I 3" " &" " " & 9 1 ." ( &

0" & # &" " H I8 " 1 #" H I % #3 # " 3" " " H I 1 .

1 % 0 " " & 9 3 " &" " " & 9 0" "( # &" "

H% # " !I ( # # 0" & # &" "& # # 3

#3 " "*:& 1 & 3 " % " 3" 0"& " %"( 3

% & " " < &% " 0 & "." % #3" " 0" " " " # & "% &

# %" " &" % #3" 7" % &0 & & " " &" " "

& 9 1 ." 4 " " " &" " " & 9 0" "( ( & & 3 9 "#

& & 6 " %" " % #3" 7" % &0 & " ( %" & # %" &"

0 & "." % #3" " 0" 7 & ;"3 "4 " " "& 1 #" " " "

& 9 1 "& " 1 ." 4 0 % 0 " & & & @"% "& 1 &% " %"3 "

3 &% 3" & " ( "% :& & 9

' 3" & ;"3 0 " & "% & 3" & 6

&" @"% 3" & &" # & " 4 " " @"% 3" & " # & " 1 &

& 1 %@" 1 " "% " " @" " " " 0 &% # & "% &

3 &% 3 ;"3 0 " & # 4 # " " ;"3 3 & 9

4 " # & % #( &"& % & " 3 &% 3" 1 &% " & "

# " " ;"3 & " & $

3" & @"% & & # & " 1 &

L"4 & & %"#( 3 &% 3" & " # & " & % 4 " 1 &"

"%

3" 3 : % 6 @"% & " 3" 3 & (" " & " " 1 ."

38

1 % " " " %"#( 0 " 6 *%"& %

1 &"&% "% :& & &" # & " < "&. " 6 "2 K E" " 3 &" "% " " 6

& ;"3 0 " & " # #" "& "%% :& 6 & ;"3 %"#(

0 " ? # &% 4 & " % #3 " 4 0 & " # "& " &" 0 "

% & " " 3" " 1 %@" % &% " ;"3 0 " 3 & & &

%" & " 3" 6 % ( " & " 3 "* 0 &% # &

B<D<B #9'.17.! 2'$ .3' &# 0!493!.3# 4'23!%1' I!

3 & "# & ;"3 0 " & 0 % > > & % " &

3 9 "# & 3 " " 3 "* 3" " 1 &"&% " 0" 3 4 % 3 &

# %" "% " " " " & 9 & # 4 " " & #(" 3

% & : " " " 3 "* " " " & 9 # 4 1"0 "( '

" 0 % 6 & 1 3 &% " & # %" #( "& 3

3 3 9 "# & 3 " " 3 "* " " " # 4 ("." 3 & % "

: " 3" " 3" 3 0 & < " % :& 3" " "

& % " 1 &"&% "% :& " " 3 "* & # & " < "&. " "#("

"& *"% & " *" & ;"3 0 " 0 % 3 & 3 9 "#

& 3 > & : " % & & "% :& "#(" % #3" 7" & %"#( "&

3 &% 3" 4 3" & 0 &% # & ;"3 "

%"& " 3 &% 3" 0 0 & " & %"#( "

" 6 0 % 3" " &" " " #" ("." 3 /3 9 "# 2 &

: " 6 @"( 7" 3" " & # %" %"#( " 4 " > 3" "

# # 6 % & 3 #(" "& *"% & ( & 1 % "&

3 % 0" 3 % & 0 & ". " & # %" 1 &

> 4 0 % 3 7"& @"( # 3"3 % # % " & # &

" " &" " " 1 ." 4 @"( % &0 %"3 " O' 6 9 & &%

& ;"3 0 " P & 1 #" # &% " & ;"3 0 " &

39

1 % &" "& "%% :& # %" % & " % #( &" " % & &"

"& "%% & " 3 "* # %" 0 "

& % ;"3 > 4 0 % 3 & 3 " " %"& " 6 0" &

0 " & %"#( "& " %"& " 3 &% 3" # & " < "&. " "

&" " " %"#( "% " " 3 %"#( & #" # & % & "

3 " 3 ( " 6 %"& " & % &" # & " < "&. "

3 7"& @"( & %"#( " & < &" & " " 0 " &

& %"#( "& 3" & ( " %"& " 3 &% 3" " &"

" " 3 % 0" "% " " " % # &* ;"3 ! % ( : " >

% #3 & " 3" & 6 @"% 0 % 3 3 9 "# &

3 4 1 #" # " 3 6 % ( > % #3 & "& &

6 3" " & : "

0 &% # & ;"3 0 % > 0 0 & " & %"#( " "

%"& " 3 &% 3" " " " " %"#( &" 1 % & ;"3

0 " 6 0 % % &0 3 9 "# & 3 " & & : " "

&" " " # ("." " # & & %" & 3 9 "# & 3 >

B<E 03#%'

)&" 3% :& & 1 &"&*" & & % # & % & " " 1 6 % &% "

& %@ #" & " ( "% :& " % #3 " H 3% :& " I " 0 &

H 3% :& ' I &" %"& " &" "% 0 (4"% & # &" " & 3 %

3 0 "# & 3"% " "#" 3 % . % % / J 3 % 2 & &"

1 %@" # &" " # & #( & %" " 3% :& & %" %

( " 3" " 6 & " % #3 " & (" & "& 0 &

3 & "( " 3% :& ( 3 & " 3 " & % & "

#"& " ( " " & "#( %" " 3 &" 6 0 & &" 3% :&

. " " " % :& % #3 " 4" 6 ?& % &0 & &% " #

3 . % " 3% :& & % #3 % & " "% % &

40

3 % / 3 2 9 3 &% #" 3 % 3"% " . % % " 0 &% # &

% & " 8 1 #" "& " % #3 " &" 3% :& 3 ( & 1 % "

3 % / 3 2 3 (". 3 % . % % " 0 &% # &

% & " " 1 &% " & 3 % . % % 4 3 % "% 0

(4"% & 1 " " % # &"% :& % & " # &" 0"

& 7& % " 3% :& & &" 3% :& %" % "& 3 % 1

(4"% & 3 &% #" 3 % . % % " # #" " 1 &% "

0" & 7& %

'" " % #3 " &" 3% :& & % " 3" " &" 3 #" " % " 3 & " &"

# & "% :& " 0 & " # #" 3 % #3 # " 6

% #3 " 0 & & "% 0 (4"% & " 3 #" 3 % " 3% :&

0" " 3 #" " 3 0" & 7& % " 3% :& H6 "

1 &% " & 3 % . % % " 3% :& 4 3 % (4"% & &

# %" 1 " 7" " <3 "% :& % & " I #3 6 1" "

3" " " <3 "% :& " 3% :& " # #" 1 " 4 #"& " " 3% & "

0 " " 3 % "% 0 (4"% & & % & " 1 4 " " "

& 9 % 3 "*

&% " # & < & % " 3% & 8 " 3% & 3 " 6

. % & & " 1 %@" 0 &% # & % 3 & . % " 3% :&

7" #" "% :& 3 3% & & " "# %"&" 6

3 & . % " 7" " 6 % :& @" " " 1 %@"

#" "% :& "& " 3 ( " . % " 3% :& 0 & " " # %"

#3 # & & . % " ' " "*:& #37 %"# & " 3% :& "# %"&"

# " " 3 % "& 1 % # 1 < ( " 3 "% :&

# & 3 &% 3" " 3% & $

E & # $ 6 & % #3 # H & " ( "% :&I "

41

% #3 " $ "6 6 ( & %@ " % #3 " 0 & &

"% 0 (4"% &

3 % . % % J 3 % $ 3 % 3 " & % & "

" % " & 6 # 0 & % & "

" 3 #"$ % 6 & 6 3" " % #3 " & % & "

3% & 3" " " "& *" & 3 % & 1 4 6 % ( 3

0 & # % & "

"% 0 (4"% & $ "% 0 ( & 6 3 " & % & "

"& &" 3% :& " 1"0 "( . % % % "& 3 %

. % % # & 6 3 % "% " (4"% & & %" " %" 4

#"4 6 3 % "% " (4"% & & %" " 3 % 6

/ & @ > & 42 H & & I 3 1"0 "( . % " )&" 3% :&

" /" @ > & 42 H" & I % "& 3 % . % % " " 3 %

(4"% & % &" # & &" 3% :& / 1 @ > & 42 H1 "

& I % "& " . % " 3 & " 3 "

& & " & # %" 3% & &0 % " # # " & 4

%" "% 7 %" & # %" 1 " 1 &% " # & "( % &

# %" 1 6 " 3% & & 3 "% & 6 &0 % "& &

# " " 3 " # #" % " " % #3 " " 3% :&

. % " & 3 " # # #3 & " 3 & " & &"

"&"&% " # " "

B<E<B #9'.17.! 0#% 7%! # 035% 71BJ

3 & "# 6 0 % 6 " % ( & " %"7 " 3 %

: " & 1 " 6 &% & " " & : " ' # "

% #3 " &" 3% :& 3 3 % ( 1 #" # " 6 % &

42

1 7 " #3 " " 6 %@ # & " ( "% :& 0 & &

% & " ( : " " & 3 % . % % 3"% " " 3% :& / & @

> & 42 " #3 " 3 . % " & "& "&"&% " 3 & "# 6

J Q " 3 #" % : Q 4 3 % & 1 @ 4 Q+ ".

3 " #3 " "&" Q 6 " 1 &% " & 3 % &

1 4 3 % . % % # & Q 6 3" " & 3 " 3 #"8

6 & ." % & &" "&"&% " Q 3" " #3 " 3 %" " % & "

6 @"4" % #3 " " 3% :& &% & " /" @ > & 42

& 1 & " " #3 " . % " 3% :& & & & & % & " 6

3 % & 1 9 " Q (0 "# & " #3 " 3 Q 6 % :

" 3% :& ' ? # 3 % # %" ( 3" " 3 % . % %

# . & . % " 3% :& 4 "# & &% & " 39 " 0"

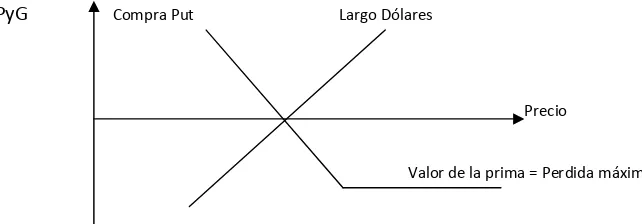

[image:38.612.168.489.415.527.2]" 3 #" HE 1 " AI

Figura 4: Costo/Beneficio compra de una opción Put.

PyG Compra Put Largo Dólares

Precio

Valor de la prima = Perdida máxima

Fuente: ROGERS Keith, Curso de Derivados. Reuters Financial Training Series. 2003.

B<E<+ #9'.17.! 0#% 7%! # 035% !$$

B-3 % % & &" 3% :& %" "& " %" "& 3 . #3

0 % 6 : " 3" " % #3 " & # 3" " 3 %

3 % 0 4 6 " " & 3 % 3" " : " H3 %

19

43

6 3 % : " (" & 1 I 4" 6 &% & " % " & : "

0 % 3 % ( " "09 &" 3% :& %" " " 6

%@ # & " ( "% :& % #3 " : " " & 3 % . % %

3"% " & % & " % & &" 3 #" # &" " " 3% :& / & @

> & 42 " % "& 3 % . % % &% & " 3 (". 3 %

"% " # %" 1 " #3 " " . % " & 0" & 7& %

1"0 "( 8 " 3% :& /" @ > & 42 & 1 & . % " & 8

& 0 " 3% :& &% & " /" @ > & 42 & . % " 3% :& &%

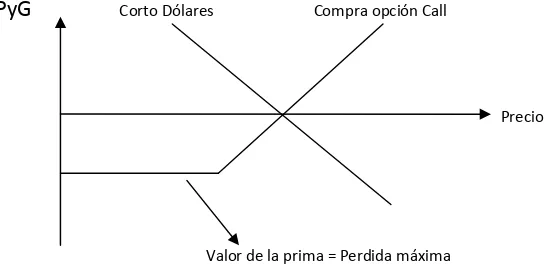

[image:39.612.196.471.344.476.2]?& %"# & & " 39 " 0" " 3 #" HE 1 " ,I

Figura 5: Costo/Beneficio compra de una opción Call.

PyG Corto Dólares Compra opción Call

Precio

Valor de la prima = Perdida máxima

Fuente: ROGERS Keith, Curso de Derivados. Reuters Financial Training Series. 2003.

C &" # & %"( "& " 6 % & " 3% & "#( 9& 3 &

& % " 3 1 " " ( " H < "( I #"& " 3 0" " & # %"

44

+<

+<B '&7$!035% 2' % 1.74'%1# 3%!%03'.# '.3A!2#

% & " 3" %"37 "3 %" 3" " & # & 1 &"&%

0" 6 " % & " & " # " " 0 "&% " "

3 & & &% " C &"&% " #( " % &1 # " % & "( %

&$

" % :& , 55 " " " & " " 3 & & &% "

E"

%"3 FE " % % " ( %" % & "( 4 1 &"&% " H% % "

< &" 55 I ( & # & 1 &"&% 0" 4

3 % % " " 3 & & &% " 1 &"&% " #( "

" % % " ,+ + 6 # 1 %" %"3 FE " % % "

( %" % & "(

% K5- 3 % " "# & "& " 3 "% & % &

& # & 1 &"&% 0" 4 3 % % " "& &

# %" # " % # & #" & % "% :& 0"

" *" " 3 " & " # " " & 3 %% :& 4 0 "&% " "

3 & & &% " C &"&% " #( "

% K5K + 3 % " " 3" " 1 % ( "

9 # & " #" " ! & " & "3" 4 " &"

3 "% & ( 0"

" % " ! "# & " " < &" =+A + 3" "

/3 % # & "3 %"( " 3 "% & %"#( 2 "&% "

! 3?( %"

" % " ! "# & " " < &" >= A5 + 3" " /3 % :&

3 3 " 3 % :& 3 3 " % & " 4 3 % :& ( " "3" "&%"# &

& # " # %" %"#( " 2 "&% " ! 3?( %"

" % " ! "# & " " < &" >= ,, + 3" "

45

! "# & & " # %" 0" " ( " 0"

#( "

# 1 & "(". & 3 1 & *" & " "% :& 0"

& & 3 " & 3 % %" % # @ "# & " % ( " " 3"

%"37 " " "# & " 3" " "% :& % &% & & " & # &

1 &"&% 0" % & 1 & % ( " '" " 1 % % & % "

3 # % " 1 %" & 9 # & $

' % :& 3 #" " H3" " % ( "I$ & & % # " " <3 % :&

" & # &" & " " 3 $ )& "% 0 3" 0 &" 3 % :&

& "% 0 & 3" 0 & % #3 # & 1 # "?& & % & %

& (" "&% 3" " % #3 " 0 & & "% 0 " & 3 % 1 . &"

% & & &% " " "# & 3 ("( & 3 "1 "% 0 3" 0

% #3 # & 1 # #3 6 & "& %" "% 7 %"

# " & "% 0 3" 0 & # & " < "&. "

' % . & %"#( & & # & 1 &"&% 0"

& 3 % % " $ 0" 3 % . & %"#( "6 9

3 % " & % #3 " 4 & 0 & & 3 " "& "

% 3 & & & # & 1 &"&% 0" 3 %

% " "% % & " %" "% 7 %" 3" % "

& # & 3 % 4 & " % & % & 3 0" % & &

# %" & " 1 %@" & % "% :&

& # & 1 &"&% 0" 3 & & % " ?& 3 # "

3 % 0 9 # & " "3 %"( " %" " 3 & " 0 " " 3 " &"

" & 1 &" " $ I ( " " 3 % & I

3 % "% :& ( %"& ( & "&"&% " : AI ! " *"% :& " ( ". &

46

+<B<B % 1.74'%1# ;3%!%03'.# '.3A!2# 0#% ;3%' 2' #9'.17.!

& # & 1 &"&% 0" 6 & % & % & 1 & % ( "

( & 6 " % " "# & & 1 %" # # & # #

% ( "% :& 4 " % " "# & % # & " '" " 1 %

"% % & 3 1 <3 % :& " 6 % ( % & % &

3 % ( " % & & # & 1 &"&% 0" " "( $ I

( " 3 % . & %"#( I ( " 1 . 1 % 0 4 AI

( " "% 0 3" 0 & # & " < "&. " '" " ( & &

& % & " & % $

" % ( " 3 % . & %"#( $ ( & " <3 % :& " "

0" "% :& & 3 % . & %"#( &" 3 % :& 3 #" "

#3 4 % "& %@" 0" "% :& " " ( ( " & # &

3" % " 4 "1 % & 3 "& "1 % " " " "

& " 0 " "

" % ( " 1 . 1 % 0 $ ( & " <3 % :& " " 0" "% :&

& 1 . 1 % 0 &" 3 % :& 3 #" " #3 4 % "&

%@" 0" "( " " " ( ( " & # & 3" % " 4

"1 % & 3 "& "1 % " " " " & " 0 " "

" % ( " "% 0 3" 0 & # & " < "&. "$ ( &

<% 0"# & 3 %"#( & # &" 0"

"% 0 3" 0 6 @" & & # &" & <" & # & "

1 & " 3 % #( "&

" 3" " 6 & & % # 3 % & 3 #" " 3" " % ( "

& 3 %71 % ( & % #3 & % $

( & 1 #" 3" "#" X ( "&%" M H % " < &"

47

% 9 ("&% 4 " ( "% & 1 &"&% " 4 7

&0 :& & % % "% :& H( & %9 " % I 3 & % (

" # & 3 & # &" #3 3 % & ". 1 .

1 % 0 3 % . & %"#( #3 6 3 " #

" 1 % 0 " " % ( "

% 9 ("&% 4 " ( "% & 1 &"&% " 4 3" 0 &

7 &0 :& & % % "% :& 3 & &" % # 3 % &

3 #" " & " % ( " 3 % . & %"#( "# &

3 3 "* "& % " "% & 3 " 3 &

% & "% " # & 0"

"% 0 4 ( "% & & 1 &"&% " % & <% 3% :& 3 %

( & "& "( & #" & % "% :& : 3 &

&" % # 3 % & 3 #" " 3" " 1 % % (

3 %"#(

)& 3 "1 "% 0 3" 0 3 % ( % # "

#3 4 % "& "% 0 & 0 " 3" 0 & 0 "

3 "1 & "& & % #?& " <3 % :& " # #

)& % #3 # & 1 # " 6 " #3 " : 3 3 % :&

3 #" " 3" " 1 % &" % ( " 3 %"#(

7 " % " 1 %" @" " 0 &% # & 8 " 7 % # "

&0 & %"3 " & & " 1 " ( &" " 0 &% " "

3 & % & " % # 3 % :& 3 #" " 3" " % ( " % &

& # & 1 &"&% 0" "# & % "& ( 6 % (

48

& & & ?& %" & & # & 1 &"&% 0" 3 &

&" % # & # & % ( "$

" 3% & # " 0 & " " 0 6 & & 3" " % (

3% & % #3 " " &% " 6 @" & #3 7% " & 3 %

% "

" " " % & & # & 1 &"&% 0" 6 % #( & &

3% & # " 0 & " 4 % #3 " " ( & # #

(4"% & % "& & 6 " . " % #( &"% :& & 9

# "

+<B<+ #%1!93$3H!035% 2' % 1.74'%1# 3%!%03'.# '.3A!2# 0#% 3%' 2'

#9'.17.!

" % & "( *"% :& & # & 1 &"&% 0" % & 1 &

% ( " 3 & 3 3 %71 % % ( " 6 " " % #

<3 %" " % & & "% :& & & 3 & &% " " 0" "% :& "% # " "

3 % . & %"#( & & # & 1 &"&% 0" % & 1 &

% ( " 3 0" H " I & " 0" H39 "I "6 " 3" "

0" "% :& 6 " "# & & " " & "

3 % 0" (% & " & & & # & 1 &"&%

0" (" " ?& " &" " "% # " " &"

39 " "% # " " 0 * "6 " 3" " 0" "% :& "% # " "

3 % . & %"#( 6 (" " " " " "# & & " % & "

3" # & " @"( " " 3" " 1 % ( % & "( *" & 9 " % & &

3 0 & " 0 ?& % 3 & "

+<B<+<B #%1!93$3H!035% 2' $! 0#9'.17.! 2'$ .'03# 87 1# 2' 3%1'.0!493#

" % ( " 3 % . & %"#( ( & " "

49

& # & 1 &"&% 0" % & 1 & % ( "$ " " "

" "&"&% " 39 " 6 ." " 0" " & # & 1 &"&%

0" % & 1 & % ( " 3 % . & %"#( (

% & % &# " "# & & " " *"& "

% 3 & & % & " ') 3" " & # & % & 1 &

% ( "

' % & 3 #" " $ " " " " "&"&% " 39 " " ( ( "

% ( ( % & % & 0" & ( " 3 % :&

3 #" " " 1 #" 6 9 " @" " 3 % . & %"#(

0" "% & & & % # % & "3" " " (% & " 3 & &

" " &% " " &" 3 % :& 3 #" "

% ( " 6 0" " %

"& &" & " 0 " " % (" & % #3 # & 1 # 3" " " 6 &

"% 0 " # & 3" 0 6 " &" 3 % :& 3 #" " & &"

% ( " 3 % . & %"#( 0" & % " & ( "% 0

3" 0 6 % #3 # & % #3 # & 1 # ( ". "

3" " &% " 0" "% :& "% # " " & 3 % . & %"#( %@

% #3 # 6 " " ( ( " % ( 6 @"4" % & % &

(" "&%

+<B<+<+ #%1!93$3H!035% 2' $! 0#9'.17.! 2' ;$78# 2' ';'013A#

" % ( " 1 . 1 % 0 ( & % & "( *" " & 1 #"$

& # & 1 &"&% 0" % & 1 & % ( "$ " "&"&% "

39 " "% # " " & # & 1 &"&% 0" % & 1 &

% ( " 1 . 1 % 0 ( % & % % "# & & "

% & " 3" # & " / "&"&% " 39 " "% # " " & " *" " &

& # & 1 &"&% 0" % & 1 & % ( " = ( "