Monterrey, Nuevo León a

Lic. Arturo Azuara Flores:

Director de Asesoría Legal del Sistema

Por medio de la presente hago constar que soy autor y titular de la obra titulada

en los sucesivo LA OBRA, en virtud de lo cual autorizo a el Instituto Tecnológico y de Estudios Superiores de Monterrey (EL INSTITUTO) para que efectúe la divulgación, publicación, comunicación pública, distribución y reproducción, así como la digitalización de la misma, con fines académicos o propios al objeto de EL INSTITUTO.

El Instituto se compromete a respetar en todo momento mi autoría y a otorgarme el crédito correspondiente en todas las actividades mencionadas anteriormente de la obra.

Methodology for Cluster Initiatives Analysis-Edición Única

Title Methodology for Cluster Initiatives Analysis-Edición Única

Authors Luis Mejía Sánchez

Affiliation ITESM-Campus Monterrey

Issue Date 2006-07-01

Item type Tesis

Rights Open Access

Downloaded 19-Jan-2017 10:53:37

INSTITUTO TECNOLÓGICO Y DE ESTUDIOS SUPERIORES DE MONTERREY

CAMPUS MONTERREY

DIVISIÓN DE INGENIERÍA Y ARQUITECTURA PROGRAMA DE GRADUADOS EN INGENIERÍA

METHODOLOGY FOR CLUSTER INITIATIVES ANALYSIS

TESIS

PRESENTADA COMO REQUISITO PARCIAL PARA OBTENER EL GRADO ACADÉMICO DE:

MAESTRO EN CIENCAS

CON ESPECIALIDAD EN SISTEMAS DE CALIDAD Y PRODUCTIVIDAD

POR:

LUIS MEJÍA SÁNCHEZ

INSTITUTO TECNOLÓGICO Y DE ESTUDIOS SUPERIORES DE MONTERREY

CAMPUS MONTERREY

DIVISIÓN DE INGENIERÍA Y ARQUITECTURA

PROGRAMA DE GRADUADOS EN INGENIERÍA

Los miembros del comité de tesis recomendamos que el presente proyecto de tesis presentado por el Ing. Luis Mejía Sánchez sea aceptado como requisito parcial para obtener el grado académico de:

Maestro en Ciencias con Especialidad en Sistemas de Calidad y Productividad

Comité de Tesis:

Dr. Neale Ricardo Smith Cornejo

Asesor

Dr. Dagoberto Garza Núñez Sinodal

M.C. Jacobo Tijerina Aguilera Sinodal

AGRADECIMIENTOS

A Dios…

por todo lo que me ha brindado y

darme la oportunidad de realizar mis metas.

A mi toda mi familia… a mis papás y a mi hermano, a mis padrinos,

por los consejos y formación que me han brindado y por el apoyo incondicional proporcionado.

A ti Erika…

por tu amor, ayuda y apoyo.

Al Ingeniero Jacabo Tijerina Aguilera…

por brindarme todo el apoyo cuando mas lo necesite, y por el conocimiento, tanto profesional como personal, que compartió conmigo.

A los profesores: Dr. Neale Smith, Dr. Dagoberto Garza, Dr. René Villalobos, y al Ing. Gerardo Treviño

por los consejos y asesorías para formalizar la presente.

A mis amigos, amigas, compañeros, y compañeras…

que estuvieron presentes en la realización de la investigación.

A todos aquellos…

TABLE OF CONTENTS

1

11... Chapter 1. Introduction

1

11...111... Abstract 3

1

11...222... Definition of the problem 4

1

11...333... Problem description 5

1

11...444... Problem Statement 6

1

11...555... Scope of Investigation 6

2

22... Chapter 2. Literature Review

2

22...111... Clusters 7

2

22...222... Cluster initiative 12

2

22...333... Background of previous work 15

2

22...444... Direct and Indirect application of previous work 18

3

33... Chapter 3. Methodology

3

33...111... Methodology framework 24

3

33...222... Description of the Methodology 24 3

33...222...111... Identify

3

33...222...222... Set Drivers

3

33...222...333... Pool and Compare

3

33...222...444... Recommend

4

44... Chapter 4. Analysis

4

4

44...333... Set Drivers 55

4

44...333...111... Location Quotient (LQ)

4

44...333...222... Competitiveness measures

4

44...333...333... Centrality measures

4

44...333...444... Export-orientation measures

4

44...444... Pool and Compare 60

4

44...444...111... Benchmarking

4

44...444...222... Comparison Matrix

4

44...555... Recommend 74

4

44...555...111... Specific Recommendations

4

44...555...222... General Recommendations

4

44...555...333... Final Recommendation

5

55... Chapter 5. Conclusion

5

55...111... Conclusions 81

5

55...222... Further Work 85

5

55...333... Bibliography 86

5

55...444... References 87

6

66... Appendix

6

66...111... Statistics of the Aerospace Industry 91

6

66...222... Statistics of Queretaro 94

6

Methodology for Cluster Initiatives Analysis Chapter 1. Introduction

1

11... Chapter 1 Introduction

1

11...111... Abstract

Nowadays the globalization and the growing of industries and the development of new technologies are making the world smaller, in Thomas L. Friedman words: “The World Is Flat”. The dynamics of the continuous improvement make the competition harder and closer, where details are important and the new strategies and new decisions must be applied.

Some of these strategies and decisions are the reductions of costs and the implementation of new models of the supply chain. These guide us to the searching of new suppliers and obviously to expansion of the industries.

And these changes are valid for all industries, including the aerospace industry. In this case, to reduce costs, aerospace original equipment manufacturers have increased their outsourcing to suppliers of subassemblies (such as engines, structures, landing gear and avionics) and concentrating on their core competencies of design, assembling and marketing aircraft. At the same time, they made efforts to reduce, reorganize and rationalize their supply base [Bozdogan et al. 1998].

Methodology for Cluster Initiatives Analysis Chapter 1. Introduction

defined it, is a “several formally independent firms and organizations located together that do similar things or contribute to the production of similar products”. And a cluster is a trigger for the economy development and the Industry growth. A reason for make an analysis of cluster in the city and reach a gain-gain relationship for both parts (Industry and Region) and lead us to best results.

1

11...222... Definition of the Problem

The objective is to apply a methodology for evaluating the appropriateness of a region for hosting a specific cluster. The reason is because when a specific region has been immersed in a process of growth and receiving new foreign investment for a specific industry the need or the chance to develop an industrial cluster is eminent. And one of the most important factors, the employment, suffers modifications to achieve the objective of clustering.

The definition of the problem and its respective literature review on previous work give the introduction material for the methodology creation. The research will first focus on an introduction to a target industry (aerospace industry), and how a target area or region has grown over the past decades. Shown the statistical data obtained for the specific region and the potential cluster initiative for the specific industry.

Methodology for Cluster Initiatives Analysis Chapter 1. Introduction

1

11...333... Problem Description

The methodology to develop will look and establish the competitive advantages of target region (focus on central Mexico), highlighted the assets of the region and the target industry (aerospace industry) growth, also the network target industry (aerospace industry) formed in the surroundings. Furthermore, remarking and investigating the requirements for the target industry (aerospace industry) to develop an industrial cluster.

The methodology to develop matches the assets (capacities and resources) with the requirements given as a result a bunch of helpful recommendation for the target region. It would respond to the question: What a supplier in target region offers and what should it develop to satisfy the demand of the target Industry and its supply Chain? Also the final objective is giving the necessary element for make the decision to implement the cluster initiative.

The methodology to follow and the analysis that should be performed is based on the already existent methodologies such as: Identifying the Drivers of Industrial Clusters, from Edward W. Hill and John F. Brennan [2000]. And the comparison and analysis of the existed methods and alternative models as Porter’s Cluster Strategy versus Industrial Targeting [Douglas Woodward, 2005] have to lead to the development of a model to look into the capacities of the suppliers and its flows. The result of the investigation would show the benefits of clusters policy.

Methodology for Cluster Initiatives Analysis Chapter 1. Introduction

cluster to develop according to the drivers of the aerospace industrial cluster. All this focused on what a supplier in target region offers and what it should develop in order to satisfy the demand of the target Industry and its supply chain. Comparing and pooling with the benchmarking region for the set of the recommendations for the cluster initiative.

1

11...444... Problem Statement

Develop a general methodology supported on the composite of the regional economy, reconditioning the existing variables to a standard model. Identifying a target region and a target industry; setting the drivers to conduct the analysis; comparing with a benchmarking region; and generating the recommendations needed for the cluster initiative.

1

11...555... Scope of the Investigation

Methodology for Cluster Initiatives Analysis Chapter 2. Literature Review

2

22... Chapter 2. Literature Review

2

22...111... Clusters

By the term cluster we understand the grouping together of elements within a domain, usually spatial. And there several applications for clusters (chemistry, computing sciences, art, astronomic, etc) but for further reference we will be speaking of Industrial Cluster.

There are several definitions of Industrial clusters here some of the most important:

Geographically concentrated networks and value chains of suppliers and/or knowledge institutes with the aim of developing innovations. [Hospers and Beugelsdikj, 2002]

Clusters are geographic concentrations of interconnected companies, specialized suppliers, service providers, and associated institutions in a particular field that are present in a nation or region. [Porter 1998].

Cluster is a geographical location where: [WK Porter’s Cluster]

o Enough resources and competences amass and reach a critical threshold, o Giving it a key position in a given economic branch of activity,

o With a decisive sustainable competitive advantage over others places, or even a world supremacy in that field.

Methodology for Cluster Initiatives Analysis Chapter 2. Literature Review

and the environment (trade, business, financial, investment) that surrounds them. So they can be classified by: [Christian H. M. Ketels, 2003]

1. Product or Service produced. This is the most common reference to a clusters, and usually there are many examples for this kind of cluster such as: automotive, financial services, tourism, etc. But in this cluster the geographical and dynamical location play a big role in the performance of each one.

2. Location dynamics restrictions. The choice of locating a cluster could be limited by two main reasons:

Need to be close to the customers, and, Need to be close to the natural resources.

Its necessary to identify the type of industry because affects the policies that rule the progress and the improvement.

3. Stage of development. There are two perspectives of this classification:

External business environment.

Mobilizing the potential through cooperation and internal activities.

Cultural factors, institutions, leadership is part of environment that affects the cluster’s development.

Methodology for Cluster Initiatives Analysis Chapter 2. Literature Review

Also the clusters are divided in:

Market Driven: Connect demand and supply side of economy to work more effectively.

Inclusive: Reach out to companies large and small, plus supporting institutions. Collaborative: Collaborative solutions to common problems.

Strategic – help stakeholders create a strategic vision for their region. Value-creating – improving depth and breadth of region’s supply base.

Many structures can surge of a cluster and it depends of the factors mention above, but a general structure proposed by Michael C. Carroll and Neil Reid is shown in the next figure:

Figure 1: Cluster Diagram, Michael C. Carroll and Neil Reid, 2003.

Where the S’s are the suppliers; the C’s the customers; the G’s the government and the

Nucleus

C3

S2

S1

S4

S5

S3

C1

C2

C4

C5

G1

Methodology for Cluster Initiatives Analysis Chapter 2. Literature Review

As it was mentioned this is a general structure, there is an infinite way of structure a cluster, and it would depend on the needs and the resources (Individual role). And some of the advantages that a cluster offers are:

More participation on the industry activities, such as technology, information, inputs, customers and channels.

Increase productivity for be sharing common tasks. Increment the capability.

Encourage the innovation Improve relationships. Reduce Costs.

In addition, the Clusters simultaneously links three traditionally independent economic development function: Retention, Expansion and Attraction. The synergy could be reach with the cluster strategy.

There are specific methodologies to build and develop clusters and the most important is the cluster-based economic development strategy that it would be analyzed further in this research.

Clusters and the Aerospace Industry

Methodology for Cluster Initiatives Analysis Chapter 2. Literature Review

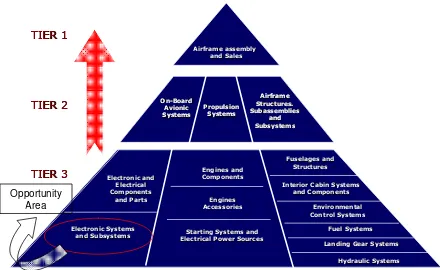

[image:16.612.81.521.194.464.2]Economic concentration of the industry is very high: its barriers of entry are very high given the capital commitments required to redesign and produce aircrafts. Competition among the few is however strong [Freedman M., 2000]. The industry has shown to be hierarchically structured in what is called “tiers”. The figure below how companies fit into these tiers.

Figure 2: Hierarchically Structured for a Aerospace cluster. 2005

Source: Jorge Noisi, Maguinda Zhegu, Aerospace clusters: Local or Global knowledge suppliers?

Usually, when new companies enter the aerospace industry, they’ll do so entering tier 2 and 3; and even if these new companies get most of their revenues from the aerospace industry, they will also offer their products and services to a large range of other industries given the entry barriers. [Jorge Niosi, 2005].

Actually, the aerospace industry is forming clusters, and in example we have the Silicon

! "

! "

#

#

! "

! "

#

#

Methodology for Cluster Initiatives Analysis Chapter 2. Literature Review

The cluster formation could bring to the location and to the industry a gain-gain relationship. And it would significant the solution of many strategic decisions that have to be taken.

2

22...222... Cluster initiative

Cluster Initiatives (CIs) are organized efforts to increase growth and competitiveness of cluster within a region, involving clusters firms, government and/or the research community. Cluster initiatives have become a central feature in improving growth and competitiveness of cluster. Based on the work of the professor Michael E. Porter, government leaders, industry leaders and academic leaders are creating new forms of partnerships in all the parts of the world. [GreenBook, 2003]

The Global Cluster Initiative Survey [GreenBook, 2003]

The Global Cluster Initiative Survey 2003 identified more than 500 cluster initiatives around the world, primarily in Europe, North America, New Zeeland and Australia. 238 completed the on-line survey, representing a broad range of technology areas. The survey covered all the four components of the Cluster Initiatives Performance Model (described later).

Methodology for Cluster Initiatives Analysis Chapter 2. Literature Review

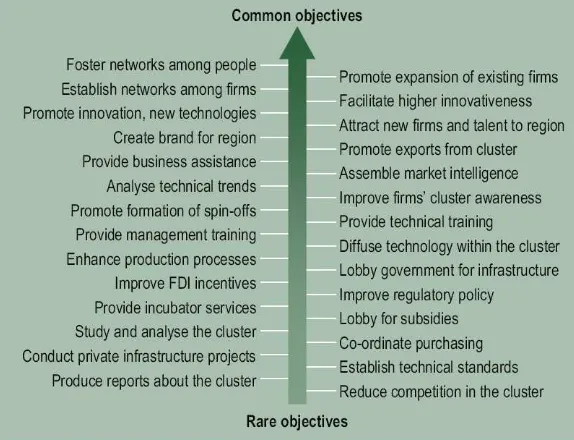

[image:19.612.161.448.135.355.2]The next figure represents the Cluster initiative objectives listed in order of frequency obtained by the GCIS, 2003.

Figure 4: Cluster initiative objectives, Source GCIS, 2003

[image:19.612.182.430.469.685.2]Methodology for Cluster Initiatives Analysis Chapter 2. Literature Review

2

22...333... Background of previous work

A Methodology for Identifying the Drivers of Industrial Clusters: The Foundation of

Regional Competitive Advantage [Edward W. Hill, John F. Brennan, Cleveland State

University, 2000]

The article presents a theoretically based method for identifying the clusters of industries in which a region has a competitive advantage. The method combines cluster analysis with discriminating analysis, using variables derived from economic base theory and measures of productivity, to identify the industries in which a region has its greatest competitive advantage. These industries are called driver industries because they drive the region’s economy. The driver industries are linked to supplier and customer industries with information from a region-specific input-output model to form industry clusters. After introductory comments about cluster-based approaches to understanding regional economies, the authors present an overview of their method and the variables used. They then apply this method to the Cleveland-Akron Consolidated Metropolitan Statistical Area.

An Industrial Cluster Study: As a Basis for the Aegean Region’s Development Policy

[NESE KUMRAL, CAGACAN DEGER; Turkey 2003]

This study tries to identify manufacturing high point industries of the Aegean Region’s provinces, in order to form a basis for future studies about Aegean Region’s clusters which may provide a foundation for Aegean Region’s development policy.

The steps in which the study goes through are as follows: Step 1) Identification of provincial manufacturing high points

Methodology for Cluster Initiatives Analysis Chapter 2. Literature Review

What are the mechanisms driving the success of the US Silicon Valley? [Jarunee

Wonglimpiyarat, 2005]

The paper explores the mechanisms driving the success of the US Silicon Valley. This study analyzes the development of Silicon Valley, governmental programs for which innovations have been financed, and some of the specific characteristics and/or factors that contribute to the success of the valley. It is discussed cluster fostering capacity, the effective use of resources in universities and research centers, supporting infrastructure, along with the culture of risk acceptance and venture capital are catalysts for the economic development at Silicon Valley. Here we can see Porter's competitive Diamond Model strategy is used as a basis to examine the activities in the US Silicon Valley; in here, the study attempts to fill a gap in practical venture capital management research, which is almost nonexistent, and provide valuable insights for policy makers.

Porter’s Cluster Strategy Versus Industrial Targeting [Douglas Woodward, July 1, 2005]

Methodology for Cluster Initiatives Analysis Chapter 2. Literature Review

Deconstructing clusters: chaotic concept or policy panacea? [Ron Martin, Peter Sunley,

2003]

The paper talks about deconstructing the cluster concept (established by Porter’s Cluster Theory) in order to show and accent the most important issues about the topic, such as: promoting national, regional, and local competitiveness, innovation and growth. It also describes the cluster concept, its theory, its empirics along with its benefits and advantages, and how it is used in policy-making. The paper also argues for a much more careful and meticulous use of the concept, especially within a policy context: the cluster definition should carry a public policy health warning.

The Cluster Initiative Greenbook [Orjan Solvell, Goran Lindqvist, Christian Kete;

Foreword by Michael E. Porter, 2003]

Methodology for Cluster Initiatives Analysis Chapter 2. Literature Review

2

22...444... Direct and Indirect application of previous work

Although the previous papers emphasize on the clusters and the Cluster Theory, there is little and poor literature about aerospace cluster beyond the borders of the United States. In spite of this lack of information, there are general approaches for clusters development and they could be applied as a general model. As Porter mentioned, there are not identical clusters even if they were on the same industry. The factors or the key factors that describe a cluster depend and are based on the regional economy and the localization of the facilities.

These general models and frameworks apply directly and indirectly the development of clusters, an also for the aerospace industry, the project would be take as basis the following concepts and models.

Different Approaches to Economic Development [Michael E. Porter, Christian H. M.

Ketels, 2004]

The selection of a policy and the decision between a cluster policy and an Industrial policy (traditional) would have some advantages and disadvantages, and the final result depends on the area and its resources.

Industrial Policy Cluster Policy

Targets areas of perceived market demand Leverages existing assets, history, and geographic location

Intervenes in free competition (subsidies, protection, etc.)

Enables competition to be more sophisticated

Requires sustained financial commitment by the public sector

Requires sustained participation by all actors

Has a high failure rate; short term impact with low sustainability

Methodology for Cluster Initiatives Analysis Chapter 2. Literature Review

However, there also economic, political, and economic policy reasons why cluster selection would not be the best choice even when there are well intended cluster efforts.

Porter’s Cluster: Theory and Practice [Douglas Woodward, 2005]

Porter has mentioned that clusters should be the core to any competitiveness agenda, including developing and developed countries. In real life, many developed countries in the Organization for Economic Cooperation and Development have conducted studies in which clusters have been the central topic. Europe, has embraced the cluster concept, the same as numerous U.S. states. Before the Silicon Valley phenomena, Connecticut served as the best example of a state that has adopted the Porter approach. Some developing countries have also enclosed Porter’s cluster model to establish regional and national development policies.

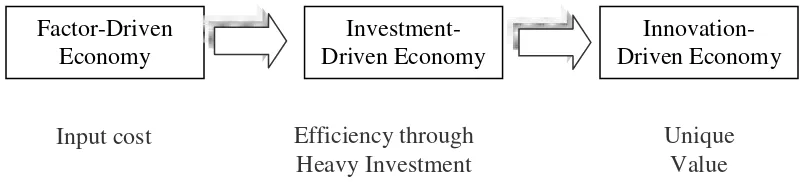

Porter also argues that this embraced development theory conceptualizes the economy as “factor-driven.” On the contrary, comparative advantage of countries when involved in international trade has been traditionally determined by such factor endowments as land, natural resources, labor, and the population. It’s known that South Carolina enjoys plenty of labor available for low-skill industries, but they share this wealth with other regions and other developing countries.

Methodology for Cluster Initiatives Analysis Chapter 2. Literature Review

[image:25.612.105.506.202.293.2]1980s, South Carolina’s relative per capita income started deteriorating, and it is suggested that the state sold itself as an economy of a low-wage, low tax and cheap land image. The purpose of Porter’s report was to assess how South Carolina could migrate from this factor and investment-driven traditional economy, to one supported on incentives, industrial targeting and investment promotion.

Figure 6: Porter’s Stages of Competitive Development, 2003

To the majority of the observers of regional development, the well known model is the one in Silicon Valley, California. But, surprisingly, Porter uses California’s wine clusters around Napa Valley and the Central Coast as his principal examples of innovative region. He suggests that the unique-value wine regions of California are not the result of natural resources. But on the opposite, Porter affirms that the success of the California wine region is based on its ability to innovate, adapt, raise productivity, and create unique, value-oriented and export-oriented products.

Porter claims that this approach to policy making is different than Industrial policies; he wants to re-orient policy to focus on microeconomic development, which is on a firm level. The country and regional competitiveness theory follows from earlier work on firm competitiveness and strategic advantage [Porter, 1998]. Debating that macroeconomic stability is necessary, but not the only factor needed to be present, Porter contends that micro-foundations for development have been ignored for a long time. Because of this, he has developed a ranking of countries based on the drivers of micro-level competitiveness for the World Economic Forum.

Factor-Driven Economy

Investment-Driven Economy

Innovation-Driven Economy

Input cost Efficiency through

Heavy Investment

Methodology for Cluster Initiatives Analysis Chapter 2. Literature Review

What was found case after case is that when clusters are established, they consistently elevate firm competitiveness, permitting the regional economic base to go through globalization and technical adaptation. These sets of companies might broaden beyond just one type of industry, but they are joined in different degrees of reciprocal interest and geographic proximity. By copying standard urban and regional theory, Porter highlights that competitive clusters foster through positive externalities (in part because of agglomeration advantages) which lead to cost savings. Clusters also avail to upgrade managerial and labor force skills and increase the marketing/customer relations. Potentially, clusters will boost local competition, productivity, new business formation, and innovation - leading to a cycle of development.

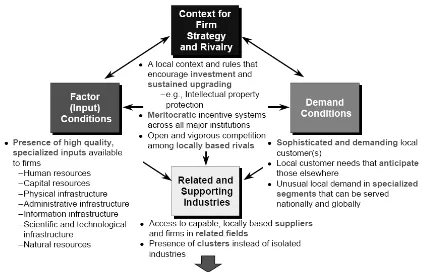

The cluster theory has become the central organizing principle for economic development. Nearly every analysis of industry clusters begins with Porter’s diamond, a characterization of his four key drivers of competitiveness.

In the Porter diamond model mentioned above, clusters advance through four dimensions:

(1) Strong and sophisticated local demand;

(2) A local base of related and supporting industries exist in the local economy to support the export industry;

(3) Favorable factor (resource) conditions;

(4) A competitive climate driving firm productivity.

Methodology for Cluster Initiatives Analysis Chapter 2. Literature Review

Figure 7: The Porter Diamond Framework, 2003

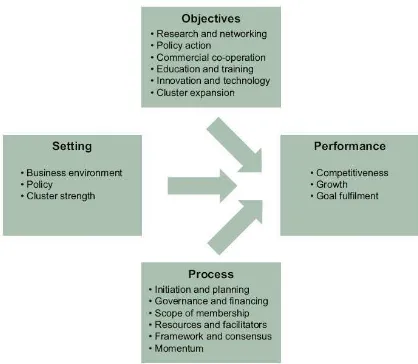

The Cluster Initiative Performance Model (CIPM)

The Cluster Initiative Performance Model (CIPM) is based on four components: (1) Three drivers: The social, political and economic setting within the nation (2) The objectives of the cluster initiative

(3) The process by which the cluster initiative develops (4) The performance of the clusters

Methodology for Cluster Initiatives Analysis Chapter 2. Literature Review

Methodology for Cluster Initiatives Analysis Chapter 3. Methodology

3

33... Chapter 3. Methodology

3

33...111... Methodology framework

When focusing on the clusters approach and the economy development, there are some models which are worth to analyzing. The most common and well-known is Porter’s Cluster Strategy. Michael E. Porter; (born 1947) he is a Bishop William Lawrence University Professor, located at Harvard Business School where he leads the Institute for Strategy and Competitiveness. Professor Porter is a leading authority on competitive strategy and the competitiveness and economic development of nations, states, and regions. Among his achievements there is the implementation of clusters theory for the development of economies, he is also considered a guru when a cluster approach referring.

In the Aerospace Industry clusters is a new topic and there are a few cases of clusters for the Aerospace Industry, but it doesn’t mean that there is not deep research on the subject. The most famous case is Silicon Valley, in California. In this place, was established the best high-tech cluster for the Aerospace Industry. It was built for the aerospace defense (military industry) and most of the information about it remains confidential.

3

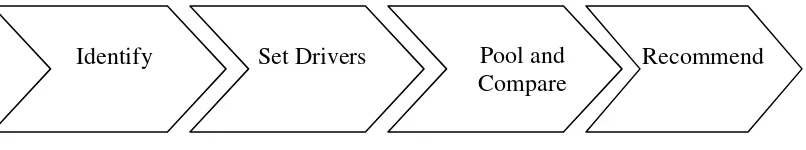

33...222... Description of the Methodology

There are neither official guidelines nor standardized approaches to cluster analysis in one region. Reason for what this methodology is created. This intends to set a standard for analyzing industrial cluster initiative feasibility in one specific region for a specific industry, and to use the information for economic development planning and analysis.

Methodology for Cluster Initiatives Analysis Chapter 3. Methodology

Target Industry is known

Target Region (area) is known

This methodology viewed as a multi-stage process to evaluate regional industry cluster in one region, establishes the parameters or indexes to measure throughout a long term the performances and the potential of the area, highlights the requirements for cluster industry and weighs the assets offered by the region, and finally establishes the specific recommendations for the cluster initiative in the area. These steps were combined in this methodology of four steps.

Once the target region to develop and the target industrial cluster are established, this methodology of four steps could provide a guide for the analysis of the specific industry cluster in the area. The sequence of the methodology arises from the logical steps to develop an ordinary analysis. This establishes the base of the methodology that could be summarized in the next steps:

1. Define and describe type of industry and the industry cluster region.

2. Establish the drivers for industry cluster.

3. Setting the requirements of the industry is necessary to pool them with the assets of the region based on the drivers and compare with other region (Benchmarking).

Methodology for Cluster Initiatives Analysis Chapter 3. Methodology

[image:31.612.94.497.123.198.2]The methodology is described by the next figure and follows by the explanation of each stage of the cluster analysis.

Figure 9: Path of the methodology.

3

33...222...111... Identify

Define cluster

Clusters are groups of inter-related industries that drive wealth creation in a region, primarily through export of goods and services. The use of clusters as a descriptive tool for regional economic relationships provides a richer, more meaningful representation of local industry drivers and regional dynamics than what traditional methods do.

In the first stage of the analysis we will describe the industry of analysis, define or categorize the cluster for the analysis for the specific industry. In order to define a cluster it is important to determine which industries constitute it and define the characteristic to base it on. There are three most common characteristics and they are:

1. Interdependent

The target industry must have interdisciplinary relations to be possible to define and create a cluster. Also the dependency in the relations should be strong. For example, in a supply chain the links between the firms have a dependency relation. In the case of clusters that are part of the supply chain of the industry, the dependency exists

Identify Set Drivers Pool and Compare

Methodology for Cluster Initiatives Analysis Chapter 3. Methodology

2. Export – Oriented

The view of the objective of a cluster is to mainly is to produce and manufacture mainly for exports, where is highly dependent on the local or regional economy to achieve its purpose.

3. Wealth Generating

Obviously the main objective of any organization is to generate wealth; a cluster is not the exception. Cluster methodology is not only focused on its own good, also it looks for the economy growth of the region. It promotes employment and activates the commerce trade incrementing the exporting. From the point of both sides (clusters and local economy), the goal is growing in a win-win relation.

These characteristic drives us to the analysis and to the next step on the methodology.

The first big step is to research an industry overview and find the biggest asset of the region of analysis. This could be made through the investigation of previous works on the same industry for the area. Also the statistic and general information of the region help to develop this summary that would be helpful to set the last step on the methodology.

The output of this step must result in to blocks:

Methodology for Cluster Initiatives Analysis Chapter 3. Methodology

Cluster

Industry drivers

Supplier Industries (Buy) Customer Industries (Sell)

Technology Labor

Once obtained these two important blocks of information we proceed to the next step of the methodology.

3

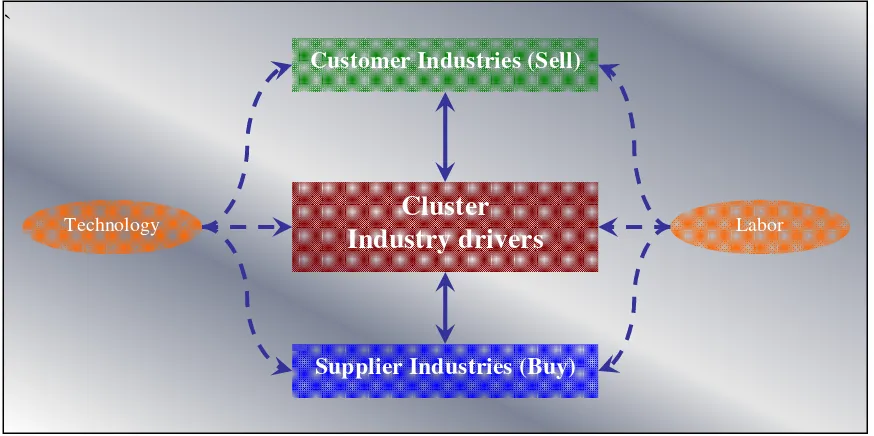

33...222...222... Set Drivers

Establish the drivers for industry cluster.

Set the parameters

In the previous stage we define and specify the target industry, also the type cluster and the cluster definition were described. The first stage also provides the information or data to perform this step, this mean, to set the parameters that are needed to structure an industrial cluster.

Following the idea of Hill and Brennan (2000) of the structure of an industrial cluster, the roll of the drivers for the Industry is explained in the next figure:

[image:33.612.88.525.440.658.2]`

Methodology for Cluster Initiatives Analysis Chapter 3. Methodology

Where the cluster relationships can be built around buy-sell relationships (also known as customer-supplier relationships or forward and backward linkages) between industries in the complex (cluster), the use of common technologies among establishments in the driver industries and other industries in the cluster, or scarce occupations or a very particular skill set that exists in the regional labor market.

And in this stage of the methodology we define the industry drivers (parameters) to assessed industry performance, quality of the clusters and the growth potential component.

The drivers are indexes extracted from the characteristics of the cluster defined in the previous step. The information obtained from these indexes allows us to rank the industry using a comprehensive measure that embodies many of the goals of economic development.

The models and definition for each index of performance are:

Location Quotients Technique

The Location Quotient Technique is wide used in economic base analysis methods. This technique compares the local economy to a reference economy, in the process attempting to identify specializations in the local economy. The location quotient technique is based upon a calculated ratio between the local economy and the economy of some reference unit, in this case the specific industry.

Methodology for Cluster Initiatives Analysis Chapter 3. Methodology t x x N t i x x N t x x R t i x x R x where x N x N x R x R LQ t it t it t it t it x in time National Total ) ( in time Industry in National ) ( in time Regional Total ) ( in time industry in Regional ) ( iable Target var ) ( ) ( ) ( ) ( = = = = = =

The most common Target value is the Employment. So the Location Quotients measures the degree to which a region has a concentration of employment in the industry, relative to the nation.

Ratio of employment shares: regional industry i’s share of total regional employment relative to national industry i’s share of total national employment in the time t.

For an Industrial Cluster the LQ is a measure of regional employment specialization (or concentration) and assert that disproportionately high concentrations of employment in the industry is an indicator of a good cluster economies, especially if the LQ is accompanied by a growing share of national employment in that industry over time.

Interpreting Calculated Location Quotients:

Interpreting the Location Quotient is very simple. Only three general outcomes are possible when calculating location quotients. These outcomes are as follows:

1

1

1 = >

< LQ LQ

Methodology for Cluster Initiatives Analysis Chapter 3. Methodology

LQ < 1.0 = All Employment is Non-Basic

A LQ that is less than zero suggests that local employment is less than was expected for the given cluster industry. Therefore, that industry is not even meeting local demand for a given good or service. Therefore all of this employment is considered non-basic by definition.

LQ = 1.0 = All Employment is Non-Basic

A LQ that is equal to zero suggests that the local employment is exactly sufficient to meet the local demand for a given industry. Therefore, all of this employment is also considered non-basic because none of the goods or services is exported to non-local areas, and it is not meeting one of the characteristic of a cluster.

LQ > 1.0 = Some Employment is Basic

A LQ that is greater than zero provides evidence of basic employment for a given industry. When an LQ > 1.0, the analyst concludes that local employment is greater than expected and it is therefore assumed that this employment is basic. This industry then must export their goods and services to non-local areas which, by definition, make them Basic sector employment and a cluster targeting.

Competitiveness measures

Methodology for Cluster Initiatives Analysis Chapter 3. Methodology

Here the ratio of per employee payroll, in industry i in specific time, is defined by the next relation: t i E E t i P P i where E P EP it it it it i in time Industry in mployment in time industry in ayroll industry Target = = = =

Whether the EPi ratio is used on Regional or National approach the components of the relation only changes to regional or national accordingly.

The Competitiveness plays an important roll in cluster development because it improves and drives the growth of the specific industry and also to the specific region.

Centrality measures:

Methodology for Cluster Initiatives Analysis Chapter 3. Methodology

Change in local importance of the industry (employment):

∆ − = ∆ − = = = = ∆ = − = ∆ ∆ − ∆ − ∆ − ∆ − t ER t ER t ER t ER i where ER ER ER ER L t it t it t it t it i in time employment regional Total in time employment industry Regional in time employment regional Total in time employment industry Regional years in Period Industry Target Input-output information: es nalPurchas TotalRegio hases dustryPurc RegionalIn atio PurchasesR nalSales TotalRegio s dustrySale RegionalIn SalesRatio = =

Methodology for Cluster Initiatives Analysis Chapter 3. Methodology

Export-orientation measures:

As one of the principal characteristic for cluster and its development, the export-oriented measure must be included in the analysis. And for measure exports this methodology uses two ratios:

Share of industry output that is exported:

Divide exports by total output to derive the share of total output that is exported from the region, where the subscript i represents the specific industry:

i Y i X where Y X SOE i i i i i industry the of output Total industry the of export Total = = =

Share of local exports accounted for by the industry:

Calculate the industry’s share of total exports from the region by dividing the total industry’s exports by total regional exports:

Exports Regional Total industry the of export Total = = = X i X where X X SER i i i

Methodology for Cluster Initiatives Analysis Chapter 3. Methodology

Once setting the parameters that compose the base of the analysis the next step is to find the requirements for the Industry and the assets of the regional or local economy. Do not forget that the parameters measures should be computed every period of time (usually each year is used) in the case of the development of an industrial cluster. As a reminder, the main objective of these parameters is to evaluate the performance of the cluster development and improvement, as well as the growth and potential growth of the industry a nd the local economy. Also, the parameters are the mathematical base for any cluster analysis.

Once established the drivers for the specific industrial cluster in a local economy we continue with the analysis and the evaluation of the parameters to make an appropriate comparison among the industrial requirements and the assets of the region. All these comparisons involve the aforementioned four factors described. Consequently it guides us to the next step of the methodology.

3

33...222...33.3.. Pool and Compare

Pooling and Benchmarking.

The cluster analysis places industries that have similar characteristics into groups. As stated before, the target industry is already known. Therefore, the discriminant analysis that associates these groups of industries with the descriptive (or explanatory) variables identifies which variables are most closely associated with each group of industries [Hill, Brennan, 2000]. In this case for the aerospace Industry, give us the combination of five characteristics:

Methodology for Cluster Initiatives Analysis Chapter 3. Methodology

3. They have relatively large local importance, inputs or outputs (showing that they are at the heart of an industrial complex).

4. They have large LQ’s (showing a specialization in product markets, a sign of the existence of cluster economies).

5. The region has an increasing share of national employment in that industry (a sign of increasing market share).

These characteristics help understand the four factors described in the previous step of the methodology and the application that concerns to the cluster analysis to measure the performance of the cluster development.

The discriminant functions were extracted of the case study of Brenan and Hill (2000), and adapted for this study in specific. Also the percentage of variation was adjusted to fit this model of six discriminant functions:

Percentage of Total Contribution

Function 1: High LQ 36.46

Function 2: Increasing local/national

importance 24.91

Function 3: Export oriented (High) 20.70

Function 4: High relative earnings 11.67

Function 5: Increasing input-output ratio 3.13

Function 6: Increasing share of local exports 3.13

Methodology for Cluster Initiatives Analysis Chapter 3. Methodology

With the percentage of variation, each factor can evaluated by its ratio, and make a conclusion and the appropriate recommendations that is the next step of the methodology.

The Benchmarking analysis has to be done with the same drivers applied in a different region, in the best of cases, with the optimal, by experience or known, region or the area that has the best practices in the industry. The best practice is to refer to a region in which the most common activity is the industry by itself.

There are two ways to perform the comparison, the first one is to make the analysis with the total percentage and evaluate the asset for each region. So recommendations and suggestions can come out to draw a conclusion for the region. The second one, and the recommended, is to compare each of the functions (the drivers) between the areas to be benchmarked. This could lead to a better comparison and more accurate recommendations. To set a standard, the methodology joins the two ways of comparison, first compares each driver for both areas and as a result of that benchmarking emerges specific recommendations, and second the general recommendation based on the total percentage and the general comparison.

The best option is to observe the comparison through a table, or matrix of comparison that it will describe the drivers and the areas; show the differences between the areas in a better way that only mentioning them.

The output on this step on the methodology besides the evaluation of the drivers is the comparison matrix between the areas to set the appropriate recommendations in the next step of the methodology.

Methodology for Cluster Initiatives Analysis Chapter 3. Methodology

3

33...222...44.4.. Recommend

Recommendations

Finally the last stage on the methodology is to create a set of recommendations based on the drivers and the benchmarking previously done.

The recommendations must be divided in two parts: the specific recommendations and the general recommendations.

Specific Recommendations

They must group all the six functions and the four drivers and give a specific recommendation for each one of the areas that are being evaluated. Using the comparison matrix of the previous step and based on the benchmarking performed, one must compare and evaluate the points, disadvantages and advantages of one region compared with the other. It is important that the recommendations must follow the projects and the economic proposal for the area at issue. Also the specific recommendations should follow the best practices compared in the benchmarking and in the investigation of the area performed in the step number one of the methodology in the specific topics of the drivers and functions.

General Recommendations

Here is where the proposal to develop a cluster is defined. Which way must the cluster initiative follow, and the feasibility of a cluster in the area should be answered in the general recommendations.

Methodology for Cluster Initiatives Analysis Chapter 3. Methodology

Finally the cluster initiative should be evaluated year after year with the driver’s development for the analysis. They measure the performance and the development of the cluster initiative.

Writing down the recommendation is the output of this last step of the methodology, concluding at the same time with the methodology and the evaluation. Lead us to the application of the methodology for a better understanding.

Methodology for Cluster Initiatives Analysis Chapter 4. Analysis

4

44... Chapter 4. Analysis

4

44...111... Analysis

Once established the methodology, it is necessary to implement it. In this chapter the application of the methodology in two areas (one target region, and the benchmarking region), is performed. The methodology has to follow step by step each one of the stages as described before, detailing and reporting the stage’s findings.

The following figure represents the steps or the methodology, and it describes the sequence to follow as standard in this kind of cluster analysis.

Figure 11: Path of the Methodology Steps.

Having the path to follow, the analysis begins on the first step of the methodology.

4

44...222... Identify

The first process on the methodology is to identify the objective or the goal of the cluster analysis for this particular situation, answering the following questions:

How well is the target industry known?

o The specific area(s) or sector(s) of the industry that should be considered

to revise for the cluster analysis (or all the Industry).

o The inside process of clusters of the industry (or sectors of the industry).

Identify Set Drivers Pool and Compare

Methodology for Cluster Initiatives Analysis Chapter 4. Analysis

How well is the target region known?

o The assets of the region (describing the region highlighting the important

points).

o Describe the benchmarking region.

Dividing this step in two blocks the analysis starts:

4

44...222...11.1.. Target Industry

The target industry for this research is the Aerospace Industry. Using the information of this investigation previously described for the Aerospace Industry the sectors or the opportunities areas for cluster analysis are defined.

Methodology for Cluster Initiatives Analysis Chapter 4. Analysis

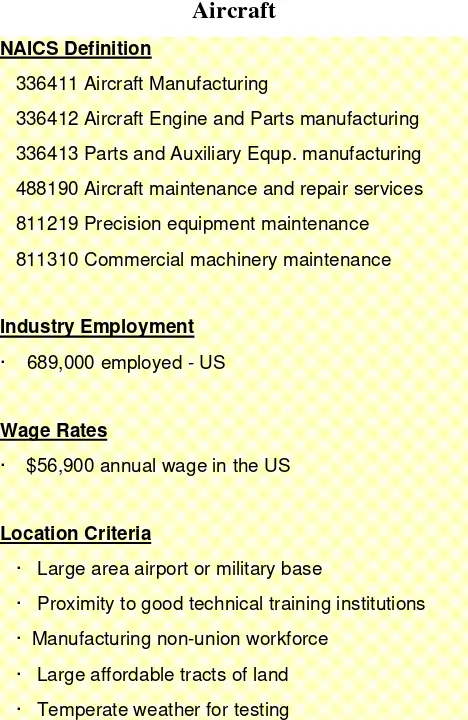

Industry Overview

Aircraft

NAICS Definition

336411 Aircraft Manufacturing

336412 Aircraft Engine and Parts manufacturing

336413 Parts and Auxiliary Equp. manufacturing

488190 Aircraft maintenance and repair services

811219 Precision equipment maintenance

811310 Commercial machinery maintenance

Industry Employment

· 689,000 employed - US

Wage Rates

· $56,900 annual wage in the US

Location Criteria

· Large area airport or military base

· Proximity to good technical training institutions

· Manufacturing non-union workforce

· Large affordable tracts of land

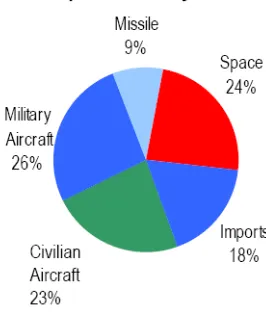

[image:47.612.189.423.95.455.2]· Temperate weather for testing

Methodology for Cluster Initiatives Analysis Chapter 4. Analysis

Figure 13: Aerospace industry Overview. Employment & Wages; Source: BLS

Methodology for Cluster Initiatives Analysis Chapter 4. Analysis

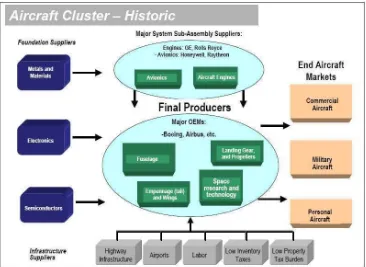

[image:49.612.124.490.133.400.2]Once the target industry is defined, the sector has to be established and the Sector is the Manufacturing process, the next figures explain the historic and current manufacturing process:

[image:49.612.119.492.427.697.2]Methodology for Cluster Initiatives Analysis Chapter 4. Analysis

Once the industry and the sector are defined, the research also gives the industry requirements, which are important in clusters analysis.

Industry Requirements

Economic Conditions: A sizeable aircraft industry cluster benefits from end-producer

demand and a local pool of skilled workers. Technical and trade schools are needed to educate and train workers. Maintenance facilities can draw aircraft across large regions due to relative short flight times.

Aircraft parts manufacturing are large-scale, low margin operations whose profitability is greatly influenced by recurring costs. They are large users of electricity and natural gas and pay large amounts of property taxes. Any location decision will be heavily influenced by tax rates, utility costs, and prevailing wage rates. Due to the number and diversity of employees these operations are fiercely sought after and command large incentive packages. Typical incentives are similar to the automotive industry and have included tax abatements, tax credits, worker-training grants, and infrastructure improvements.

Structural Assets: Aircraft and aircraft parts manufacturers are typically medium-to

Methodology for Cluster Initiatives Analysis Chapter 4. Analysis

An excellent transportation system including both interstate and rail access, in addition to a commercial airport, will also be required. Port access sometimes is required to ship large subassemblies such as wings.

Facility Requirements for an Aircraft Manufacturer:

Size 75,000 sq. ft. 250,000 to 400,000 sq. ft.

Acres 15 acres minimum 40-75 acres

Employees 100-200 employees 600 employees

Water 250,000 gallons / day 600,000 gallons / day

Wastewater 125,000 gallons / day max 450,000 gallons / day 8,000 kw Demand 26,000 kw Demand

4 mil kwh/month 13 mil to 16 mil kwh/month

Natural Gas 30,000 mcf / month average I mil Therms a year

Telecom T-1 minimum T-1 minimum

Investment ($) (typical U.S. facility)

Building/Land $10 million $25 million

Equipment $15 million $125 million

Other: Production workers: 3 shifts, 7 days/wk 15 miles of Interstate Water does not need to be treated Rail is required

Electricity: dual substations, International Sea Port a plus possibly on separate grids Within 60 miles of commercial airport

Aircraft Manufacturing Facility Typical Requirements

Electricity

[image:51.612.88.529.174.441.2]Subassembly, Small Aircraft Large Aircraft Manufacturer Activity

Table 3: Aircraft Manufacturer requirements. Source: Angelou Economics.

Workforce: Semi-skilled and skilled workers are required for aircraft parts

manufacturing, including many engineers and drafters. Mechanics and aircraft technicians will be needed for any maintenance facility. Skilled machinists are required to make parts that are not mass-produced.

Methodology for Cluster Initiatives Analysis Chapter 4. Analysis

10-year Relative % Jobs Growth Growth Requiring Forecast Level Bachelor's

11-0000 Management occupations 146450 9.49% 12.10% –

11-1021 General and operations managers 25660 1.66% 18.40% H 48%

11-9041 Engineering managers 25140 1.63% 9.20% L 76%

13-0000 Business and financial 125400 8.13% 21.30% –

15-0000 Computer and mathematical 132440 8.58% 34.80% –

15-1032 Comp. software engineers sys. software 30960 2.01% 45.50% VH 81%

17-0000 Architecture and engineering 283970 18.41% 8.60% –

17-2011 Aerospace engineers 4750 3.05% -5.20% VL 82%

17-2141 Mechanical engineers 31570 2.05% 4.80% VL 77%

17-2071 Electrical engineers 23270 1.51% 2.50% VL 80%

17-3021 Aerospace eng. And operations techs. 7120 0.46% 1.50% VL 16%

17-3024 Electro-mechanical technicians 560 0.33% 11.50% L 17%

19-0000 Life physical and social science 119630 7.75% 17.20% –

19-2012 Physicists 4660 0.30% 6.90% VL 94%

19-2032 Materials scientists 2180 0.14% 8.60% VL 91%

51-0000 Production occupations 271650 17.61% 3.20% –

51-2092 Team assemblers 34200 2.22% -1.60% VL 5%

51-2022 Electrical and electronic equip. assemblers 29930 1.94% -18.30% VL 6%

51-4041 Machinists 25360 1.64% 8.20% VL 4%

51-9061 Inspectors testers sorters and weighers 24810 1.61% 4.70% VL 13%

51-2011 Aircraft structure rigging and sys. assemblers 21960 1.42% -9.40% VL 5%

51-2023 Electromechanical equipment assemblers 13110 0.85% -8.30% VL 6%

AIRCRAFT MANUFACTURING

[image:52.612.90.524.90.385.2]SOC Code Occupation EmploymentIndustry Employment% of Cluster

Table 4: Aircraft manufacturing working force requirements. Source: BLS

Research & Development: R&D activity in the aircraft manufacturing industry abounds,

though it generally focuses on product development rather than later-staged manufacturing processes. Major funding sources for underlying aircraft technologies come from the Department of Defense and NASA. The majority of industry research is conducted in-house at private research and design facilities.

A new thrust of R&D in the aircraft industry is in constructing aircraft from advanced composite materials. These materials are preferred because of their extremely lightweight, yet high strength properties.

Methodology for Cluster Initiatives Analysis Chapter 4. Analysis

4

44...222...222... Target region

Once the industry is defined is necessary to continue to the second block of the methodology. And the second block refers to the target region. It should describe the region and the opportunities areas of development referring to the target industry. Also it has the descriptions of the general environment (social, cultural, political) that influence the economic aspect.

The Target Region in this problem of the research is Central Mexico, specifically the city of the Queretaro, given its close distance to Mexico City and all the industry growing around, also the network industry formed in the surroundings. Furthermore, industries like ITR and Honeywell are already doing aerospace engineering design in the city. Another interesting fact is the recent announcement that Bombardier Aerospace is establishing a world-class manufacturing facility in Querétaro. [2005].

The information about the target region is presented below; also the general environment of the national surround is shown. This helps understand the region’s assets and the general environment of the country.

Mexico and Queretaro City

Generally speaking, Mexico has been showing a clear demographic transition: in addition to overcome the high mortality rates from past decades, right now it has been experiencing noticeable changes which mean a rapid and growing urbanization, a steep reduction in fertility and the aging of its population.

Methodology for Cluster Initiatives Analysis Chapter 4. Analysis

In Queretaro State, the population has remained stable during the first half of the 20th Century, but since the beginning of 1950, the state has shown an accelerated growing trend, and it has become part of the state’s features. It was estimated that by 2004, the population would be 1 572 722 inhabitants. But in the other side, the population of Queretaro City grew more than 8 times what it was in 1950 having 641 386 by the year 2000. Of this population, 91.4% was concentrated in 10 localities of the city.

From what can be seen in the last paragraph, both populations, (the state and the city of Queretaro) showed a similar growing trend which was accentuated between years 1960 and 1980. It is important to mention that the mean annual growth rate recorded of Queretaro City has always been higher than the state one.

According to the data from the 2000 census, the distribution of the population by ages in Queretaro municipality was:

Population / Age Distribution

0 – 14 32.3 %

15 – 59 61.1 %

60 – older 6.6 %

Table 5: Distribution of the population by ages in Queretaro

It was estimated also, that for year 2004, the population from ages 15 and 59 was going to be 65.4% of the total population, while the children population would be reduced in 4.6% compared to the previous period.

Methodology for Cluster Initiatives Analysis Chapter 4. Analysis

The structure by age and gender in any state is a decisive factor for social changes. The age trend transformation phenomenon will mean a more advantageous relationship between the dependant population (children younger than 15 and elders over 60), and the working population. This phenomenon allows having a transitory competitive advantage or “demographic bonus” in the decades to come, because the population of working age will grow at a higher rate than the dependant population.

In the recent four to five years, the index of dependant population in the city of Queretaro has had a shrinking trend. It shows a decreasing variation in 10.9% points which means there is a growth in the population working age.

Work environment and employment office

Generally speaking, the city of Queretaro has a stable work environment, which has been reflected in a low rate of personnel rotation and very few strikes in the companies in the last few years.

In the labor market, people looking for jobs used the services of the city Employment Office as a help method to find a job. Last year, the number of applicants directly served in the office was 5 267, and the number of actual jobs offered were 3 857. As a complement to this, and trying to drive new job creations, three editions of the Job Fair were held. This event attracted 2 800 job applicants and 63 companies who offered a total of 970 job vacancies.

Education

Methodology for Cluster Initiatives Analysis Chapter 4. Analysis

Queretaro has 31 research centers which run with national funds from the State of Queretaro and from federal initiatives along with private funding. In this R&D centers there are 1003 specialists which represent the 71.3% of all the researches of the State of Queretaro.

Higher education institutions contribute with as much as 47.2% of the scientists and researchers in the municipality. Of these, 193 scientists belong to the National System of Researchers.

Given the data from INEGI, the secondary sector contributed with 34.5% of the State of Queretaro Gross Product in 2003; the manufacturing sector contributing with a 1.3% real growth compared with 2002.

This growth is related to the evolution of some of its manufacturing branches which are metal products, machinery and equipment, rubber products and plastics.

The City of Queretaro has a total of 1 936 manufacturing industries, which represents a 48.4% of all the manufacturing plants in the state of Queretaro.

The composition of the productive plants regarding their size is the following:

Methodology for Cluster Initiatives Analysis Chapter 4. Analysis

The municipality has some important transnational companies on the following field:

Metal products, machinery and equipment:

o American Car Equipment, Auma Tec, Arvin-Meritor, Brose, Bosal, CNH,

Cardanes, Frigus Bohn, Grammer, ITR, Kostal, Ronal, Tremec, TRW, Valeo and Walker, in the branch of car parts

o Bticino, Construlita-Phillips, Industrial Gesca, Mabe, Samsumg and

Watlow, in the electric and electronics division

In the year 2004, the secondary sector, which includes the divisions of manufacturing industry, construction and mining, created 26.4% of the total number of jobs in the city, which translates in the employment of 79 461 people. From these pool, 77.7% are workers in the manufacturing industry, so, after commerce, this area is the second most important activity in the economy of the city.

The City of Queretaro has a total of 10 industrial parks or industrial zones. It’s relevant to know that all of these parks belong to the private sector.

New Industry Regulations

In 2004, the City of Queretaro began a new project called SATI which stands for Systems for Speeding up the Formalities for the Industry. This project seeks to coordinate different governmental agencies which are involved in the authorization of the establishment of a new manufacturing industry.

Methodology for Cluster Initiatives Analysis Chapter 4. Analysis

The government of the City of Queretaro has design a support structure which allows it to help new industry settlement in the city, by two fundamental operational units: the Business Link and the Department of Industry and Investment Attraction Services.

The Business Link receives potential projects from businessmen and investors; after analyzing them, they offer adequate options for them to develop their projects. To do this, the Business Link center networks with universities, federal and State governmental agencies, consulting firms, financial institutions and consulting firms.

All this effort has shown that from January to December of 2004, the Business Link center has serviced 327 companies in various areas such as: business opening, formalization of business, training of employees, financing help, and consolidation of exportable offer.

All the actions mentioned above have the objective to attract foreign investment, and to become a magnet for foreign companies to install their branches in Queretaro. For that matter some other activities to incentive potential investors have been performed:

Customized services in the new company installation procedures. Support for the facility site selection.

Support with service providing networks.

Incentives with personnel training programs as long as the company hires these people.

Migration topics advising.

Methodology for Cluster Initiatives Analysis Chapter 4. Analysis

Due to the production specialization of Queretaro, 36.3% of all new companies belong to the metal mechanics, car part branch and aerospace industry; 18.2% to basic metal industries, and 9.1% food and beverages. Speaking about the attracted capital, 50% of the investments were foreign, mainly from Spain, Germany, United States of America, Italy and the most recent from Canada which is represented by Bombardier Aerospace.

Aerospace Industry

In October 2005, Bombardier Aerospace announced its establishment in Queretaro of a world-class manufacturing facility. This decision represents a $200 million US investment in equipment, buildings and initialization costs for a seven-year horizon.

Production processes in this new plant include the manufacturing and assembly of wire harnesses for aircraft. Later on, by the end of 2006, it is planned that the facility in Queretaro will be involved in the manufacturing of major structural aircraft components which are now manufacture by other suppliers.

The new job creation and employment numbers are projected to reach 300 skilled and trained manufacturing workers and reach 600 by the end of 2007.

It is thought that after this investment in Queretaro, the Mexican Federal Government will get involved in the required aviation regulations with the international community, in the creation of educational programs for the aerospace industry and government programs that will help aerospace research and development centers.