Commodity and asset pricing models : an integration

Texto completo

Figure

Documento similar

An increase in the ad-valorem commodity tax will increase output per firm, decrease the number of firms and decrease total output of oligopolistic firms if the inverse

For example, in (Ju´lvez, Bemporad, Recalde, & Silva 2004) hybrid control techniques based on Mixed Logic Dynamical systems (Bemporad & Morari, 1999) are applied to

Some of these works deal with specific issues, such as quantification of the consumption of components in addition to that from the interfaces (e.g., CPU, screen, memory) [123],

It is interesting to remark that, if we compare the evolutionary results with the Bertrand game, we see how in the evolutionary model, from both the point of view of firms (which

(c) TunnelLiFi uses a photodiode to receive LiFi signal, mixes it with carrier signal from TDO (without ampli- fication), and transmits the mixed signal over a wireless medium, which

Table 6: Assessment of the likelihood of pest freedom following evaluation of current risk mitigation measures against Thrips palmi on Momordica charantia fruits from Mexico

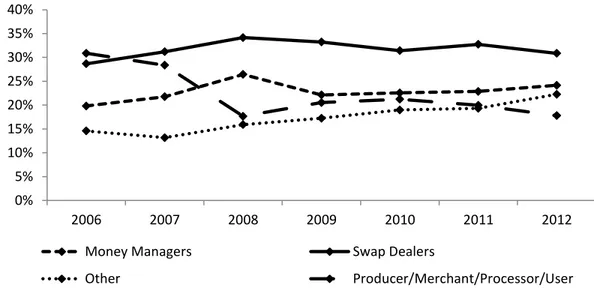

Although this essay does not examine a direct relationship between the financialization of the commodity market and non-energy raw material price formation, it does

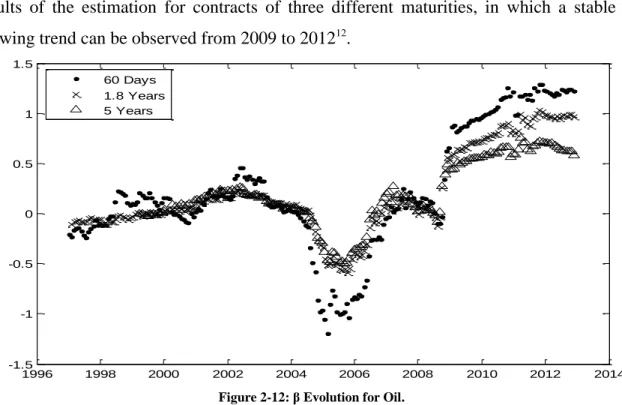

The good results of small scale factor models with idiosyncratic dynamics indicate that both, own commodity market dynamics and sectoral communality are relevant to forecast short