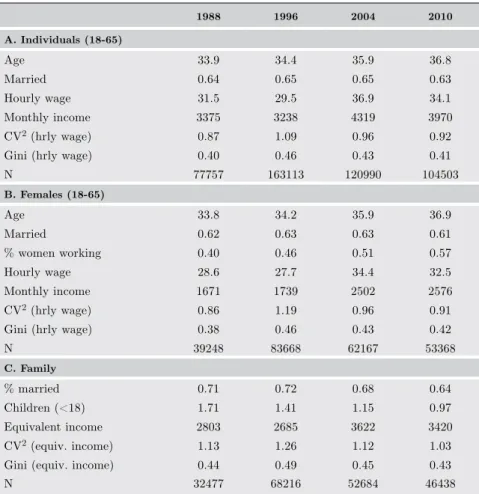

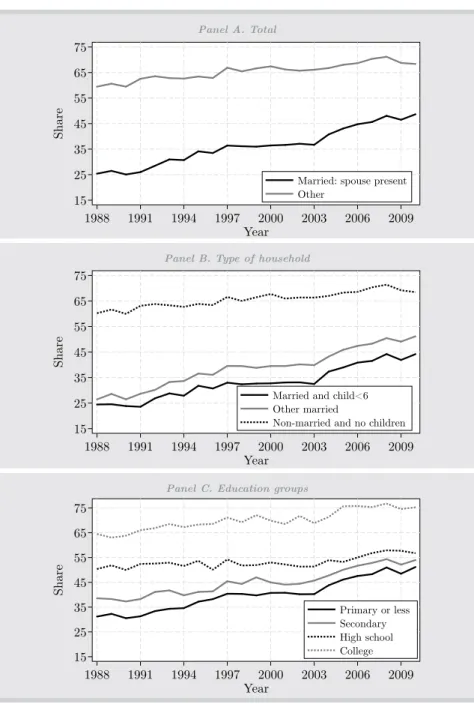

Family income inequality and the role of married females' earnings in Mexico : 1988 2010

Texto completo

Figure

Documento similar

The coefficients of the proxy for household income are negative for kerosene, solar and others implying that with an increase in income, households are less likely to

If the share of own contribution in household income has a positive effect on own private consumption relative to other members, it is interpreted as evidence against the

The Dwellers in the Garden of Allah 109... The Dwellers in the Garden of Allah

For instance, (i) in finite unified theories the universality predicts that the lightest supersymmetric particle is a charged particle, namely the superpartner of the τ -lepton,

In this paper we measure the degree of income related inequality in mental health as measured by the GHQ instrument and general health as measured by the EQOL-5D instrument for

Even though the 1920s offered new employment opportunities in industries previously closed to women, often the women who took these jobs found themselves exploited.. No matter

We analyzed associations between city-level income inequality and labor women’s empowerment with overweight/obesity by gender in a large sample of Latin American cities and

The first reform increases the average (effective) tax rate on personal income (labor and business income) to all income levels above the exempt income level.. I find that total