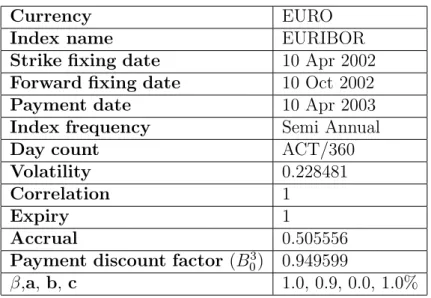

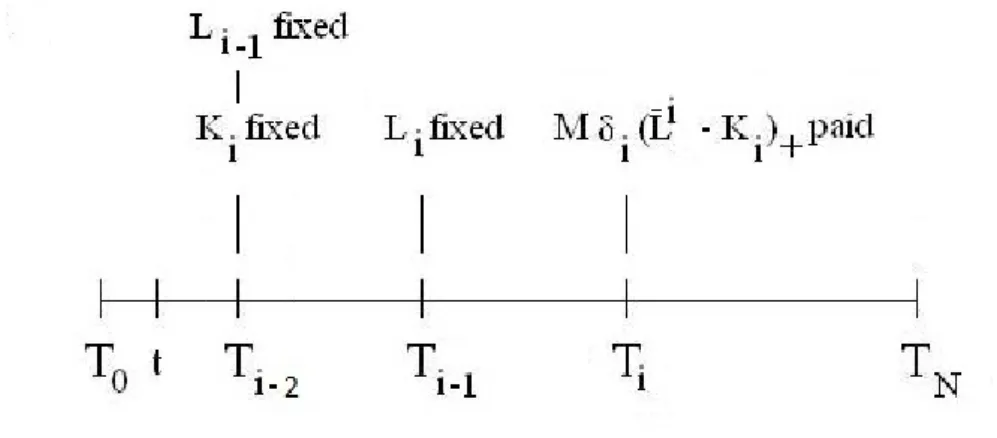

TítuloNumerical methods to price interest rate derivatives based on LIBOR market model for forward rates

Texto completo

Figure

Documento similar

In this chapter, a numerical model for the optical properties of nanoporous anodic alumina-based rugate filters (NAA-RF) using transfer matrix method (TMM) with the effective

In chapter 3, the overview and challenges of integrative –omics analysis and the main statistical methods that have been used for data integration is described and in chapter

In this work we study the effect of incorporating information on predicted solvent accessibility to three methods for predicting protein interactions based on similarity of

The validation of the temperature drop and cooling efficiency of the cooling pad numerical model is the main objective of this paper, and, in order to get this

The validation of the temperature drop and cooling efficiency of the cooling pad numerical model is the main objective of this paper, and, in order to get this

Our analysis of how the international market contributes to price discovery process of cross-listed stocks has been facilitated by the multi-market price discovery models of

No obstante, como esta enfermedad afecta a cada persona de manera diferente, no todas las opciones de cuidado y tratamiento pueden ser apropiadas para cada individuo.. La forma

The expansionary monetary policy measures have had a negative impact on net interest margins both via the reduction in interest rates and –less powerfully- the flattening of the