Relationship between changes in regulation, corporate governance, and firm performance: Mexico’s case

Texto completo

(2) Copyright by Heriberto Garcia Nunez 2006.

(3) RELATIONSHIP BETWEEN CHANGES IN REGULATION CORPORATE GOVERNANCE AND FIRM PERFORMANCE: MEXICO'S CASE.. By Heriberto Garcia Nunez. Dissertation. Presented to the Faculty of the Graduate School of Business and Administration And Leadership (EGADE). Instituto Tecnológico y de Estudios Superiores de Monterrey in Partial fulfillment of the Requirements for the degree of. Doctor of Philosophy in Management. Instituto Tecnológico y de Estudios Superiores de Monterrey December, 2006..

(4) RELATIONSHIP BETWEEN CHANGES IN REGULATION CORPORATE GOVERNANCE AND FIRM PERFORMANCE: MEXICO'S CASE.. APPROVED BY THE MEMBERS OF THE DISSERTATION COMMITEE. Alejandro Fonseca Ramirez (Chair). Alejandro Ibarra Yunez. Ricardo Flores Zambada. DIRECTOR OF THE DOCTORAL PROGRAM. Alejandro Ibarra Yunez.

(5) DEDICATED TO MY BELOVED WIFE DALIA OUR BEATIFUL DAUGHTERS AND SON SALIHA, SAMIRA AND HERIBERTO..

(6) ACKNOWLEDEDGMENTS. This dissertation could have not been possible without the patience, encouragement and dedication of my committee: Alejandro Fonseca, Alejandro Ibarra and Ricardo Flores. They worked extra time to ensure the quality and focus of the final product. Their comments, support and motivation helped me to never give up. I would like to add special gratitude to Alejandro Fonseca. He supported me in the use and application of quantitative methods, also his advice and guidance to improve the research methods. To Alejandro Ibarra for his careful revision and correction, also his advice in many theory details that enabled me to present a much better work. To Ricardo Flores who always believed in me, also in the original research idea, his support, motivation and training, helped me to complete this endeavor. Finally, I am thankful to my friends and colleagues who in some way helped me to keep on track. Five years of additional effort to pursue a doctoral degree required being surrounded by exceptional persons, my family, my committee, my job partners and my colleagues. I am thankful to God to put me in the middle of all those exceptional group of persons.. V.

(7) ABSTRACT The present dissertation is dedicated to study the regulation of corporate governance practices and performance relationships. Several studies have been conducted around the world, based on how the good corporate governance practices impact the performance of the firm. Good corporate governance is related to the protection of the investor rights, and could be established by changes in law, regulation procedures, contracts, control, and normative procedures or product market influence. The present research is related to the regulation, law changes around corporate governance practices in Mexico, and how those changes influence the performance of the firm. The Mexican economy is affected by globalization, financial market integration, and potential investment opportunities around the world; part of the answer of those changes is regulation and investor protection rights.. vi.

(8) CONTENT ABSTRACT. vi. ACKNOWLEDGMENTS. v. LIST OF TABLES. CHAPTER 1 INTRODUCTION AND OBJECTIVES OF THE RESEARCH 1.1 Purpose, performance and governance 1.2 Research and Related Topics 1.3 Objectives 1.4 Research questions 1.5 Organization of the Dissertation. 1 1 3 6 8 8. CHAPTER 2 THEORETICAL FRAME WORK 2.1 Agency theory 2.2 Ownership and control 2.3 Corporate governance practices 2.4 Internal and external corporate governance control mechanism 2.5 Legal and contracts approach 2.6 A different point of view The Transaction Cost Theory. 11 11 15 17 20 24 26. CHAPTER 3 ANTECEDENTS OF THE RESEARCH 30 3.1 Previous research on firm performance 30 3.2 Previous research on corporate governance practices and performance 34 3.3 Previous research about changes in legislation, corporate governance, and economic performance 40 CHAPTER 4 MEXICO'S CASE; CHANGES IN REGULATION AND CORPORATE GOVERNANCE PRACTICES 48 4.1 Antecedents and previous corporate governance practices 48 4.2 Changes in legislation and the impact in corporate governance practices. Present evidence and cause effect relationship 52 4.2.1 Board of Directors 53 4.2.2 Evaluation and remuneration functions 59 4.2.3 Audit function, control and financial information 60 4.2.4 Finance and planning 62 4.2.5 Disclose information to the shareholders Transparency 63 4.3 Summary of Governance practices and Performance 63 CHAPTER 5 FRAMEWORK AND HYPOTHESIS 5.1 Performance definition 5.1.1 Operative financial ratio vii. 72 72 73.

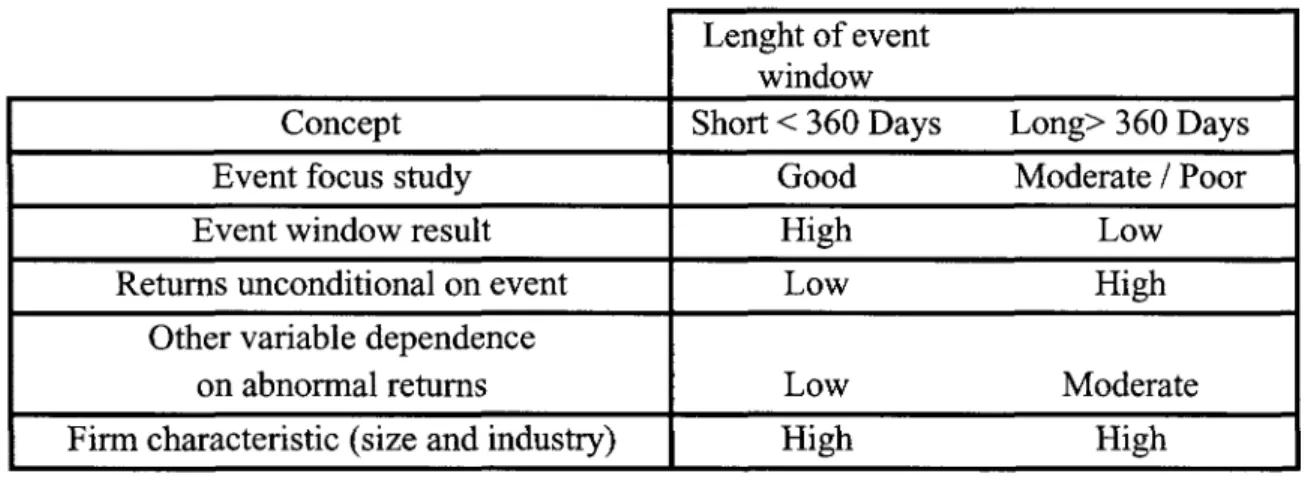

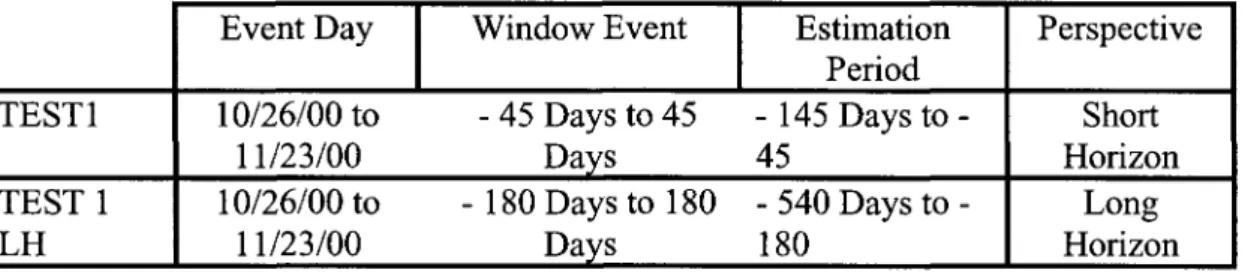

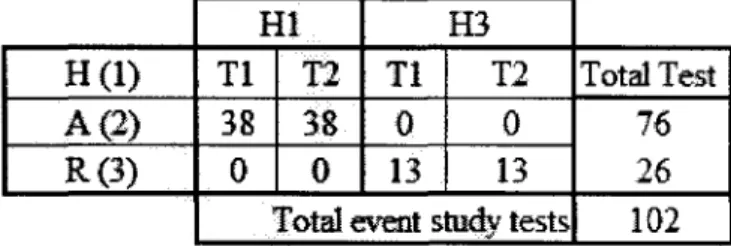

(9) 5.1.2 Market financial ratios 5.2 Legal changes, new governance practices and firm performance 5.3 Noise in performance and governance practices. 5.4 Local firms and foreign stock companies 5.5 Hypothesis. 75 76 81 83 86. CHAPTER 6 DATA AND METHODOLOGY 6.1 Data sources and sample 6.2 Research design and methodology 6.2.1 Mean and variance 6.2.2 Event Studies Technique 6.3 Linking research questions, hypothesis and statistical test. 92 92 93 94 96 100. CHAPTER 7 DISCUSSIONS, RESULTS AND CONCLUSIONS 7.1 Mean and variance paired sample statistical results. 7.2 Event study results 7.3 Tobin Q ratio 7.4 Future Agenda. 104 107 109 109 110. REFERENCES. 138. BIOGRAPHICAL SKETCH. 155. viii.

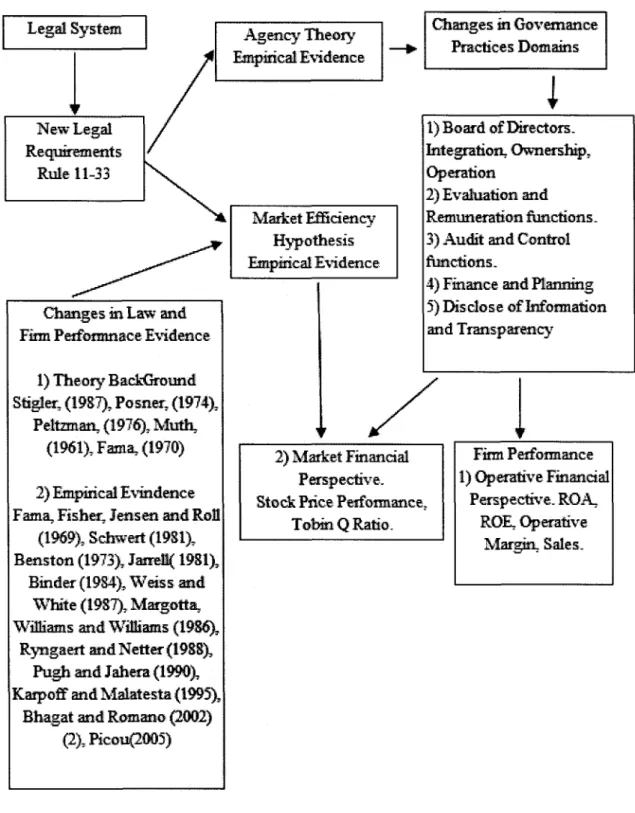

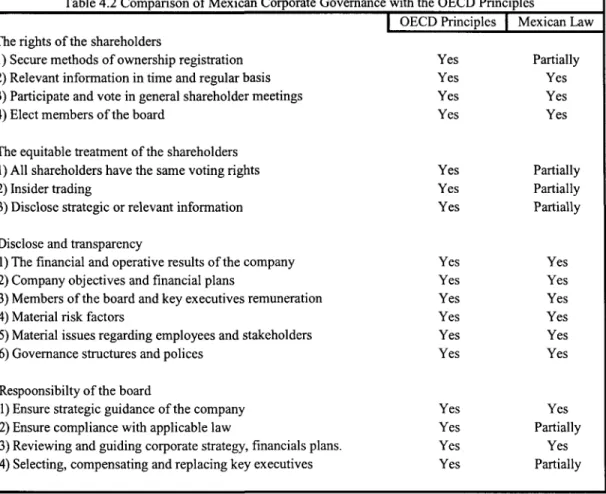

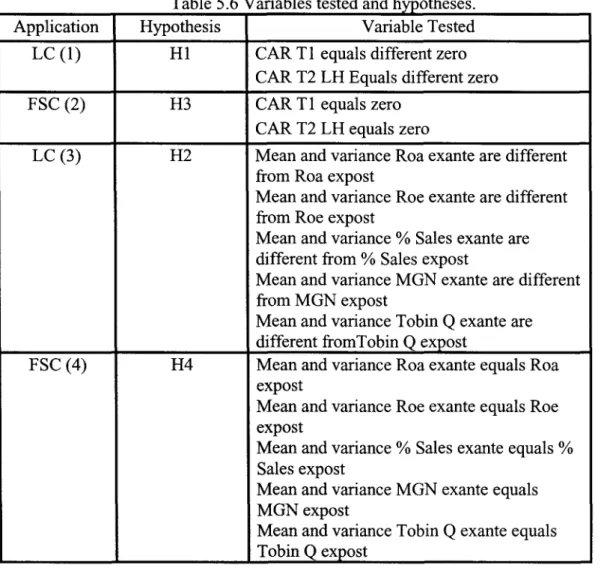

(10) LIST OF TABLES Figure 2.1 Market value of not necessary expenditures.. 14. Figure 2.2 Implications of the rule 11-33 in corporate governance practices.. 25. Figure 3.1 Complete process of the research. 47. Table 4.1 Rule 11-33 and governance changes.. 51. Table 4.2 Comparison of Mexican corporate governance with OECD principles. 53 Figure 4.3 Empirical support of each domain of corporate governance.. 65. Table 4.4 Empirical research and CBGP.. 66. Table 5.1 Formulas used in the statistical analysis. 75. Table 5.2 Variables used and longitudinal perspective. 81. Table 5.3 Denotes additional variables that can affect firm performance. 82. Diagram 5.4 New regulation agency theory and market efficiency.. 91. Table 5.5 Evidence of how new regulation affect stock prices.. 90. Table 5.6 Variables tested and hypothesis.. 89. Table 6.1 Variables and research methodology. 93. Table 6.2 Data sample by economic sector, local and not local companies.. 95. Table 6.4.1 Event day short and long term horizon perspectives.. 98. Table 6.5 Event day, window and estimation period for Test 1 and Test 1 LH.. 99. Diagram 6.6 Chapter 6 synthesis.. 102. Table 6.3 Distribution by companies and industry.. 103. Table 7.A Concentrates global results for event study test. 104. Talbe 7.B Concentrates mean and variance results.. 105.

(11) Appendix 1 Statistical results for mean and variance. 111. Table 7.1 A Summarizes hypotheses H2 for local companies.. Ill. Table 7.1 A Summarizes hypotheses H4 for foreign stock company.. 112. Table 7.1 T Test results for operative and financial ratios.. 113. Table 7.1 F Test result for variance of operative and financial ratios. 115. Table 7.2 How they perform before and after the rule 11-33 Mean results.. 117. Table 7.3 How they perform before and after the rule 11 -33 Variance results. 120. Appendix 2 Event study statistical results. 124. Table 7.4 A Event study hypothesis HI and H3.. 124. Table 7.4 Event study statistical results. 125. Appendix 3. 131. Results for sector and company. ix.

(12) CHAPTER 1 INTRODUCTION AND OBJECTIVES OF THE RESEARCH. 1.1 Purpose, Performance and Governance.. The purpose of this dissertation is to test changes in law and regulation related to governance practices, and the implicit impact in corporate performance. Recent empirical evidence shows dramatic changes in regulation related to governance practices, those changes in governance practices attempt to improve internal and external control mechanisms to the firm. Additionally recent empirical research shows strong cause-effect relationship between better governance practices and firm performance. Corporate governance deals with mechanisms to assure efficient return of the financial resources toward the suppliers of finance (Shleifer and Vishny, 1997). Changes in law and regulation related to corporate governance practices, can affect the process of decisions, the use and application of the resources and perhaps corporate performance (La Porta, Silanes, Shleifer and Vishny, 1999). Corporate performance can be measured from an operational or a financial perspective (Venkatraman and Ramanujan, 1986). Corporate governance practices are related to how the corporate strategy decisions and the use of resources are linked in time (Myers, 2003). Those practices are related to how the company competes successfully and assures payback to the suppliers of the financial resources. Corporate strategy decisions are interrelated to the success of the firm; this implies that actual decisions will affect the future of the company (Barney, 1997)..

(13) Success of the firm is related with operational and financial performance. Corporate strategy decisions are taken by the board of directors. And those decisions will affect the use of resources, product market, and financial decisions. When corporate governance practices change, then their relationship with the operational and financial performance of the company is affected. There is a direct relationship between being competitive and the payback of the resources. Being competitive means solving the supply demand today, and at the same time solving the demand problem for tomorrow. Changes in governance practices can emerge as a result of several implications, the first one is the economic control change. The second is related to the company competition (product market and financial market) as well as technological changes, and the last implication is due to changes in law and regulation faced by the company. Also changes in governance practices can be studied as internal and external control mechanisms (Denis, 2001). Evidence from a recent research shows strong cause-effect relationship between internal and external control mechanisms, stock price performance and operative performance (Marciuakaityte, Szewczyk, Uzun and Varma, 2006). The internal and external control mechanism can be related to the decision making process, specially to the board of directors, monitoring committees, and administrative law tools to assure good governance practices. (Esty, 2006). For the Mexican economy of the last decade, Mexican product markets had been opened to globalization processes and faced several changes in law and regulation. One special issue has been the insertion of Mexican companies to the economic globalization, related.

(14) to changes in corporate governance practices implemented for public companies. Evidence from the World Bank shows the same path around other emerging markets (Klapper, Love, 2005). The purpose of this dissertation is to test those changes related to law and regulation, as they affect corporate governance practices and corporate financial performance for the Mexican public companies. There are several forms and levels to test the relationship between corporate governance practices and financial performance which will be explained in detail in the chapters 4 and 5 of the present research document. This dissertation aims to answer the following questions: a) Do changes in law and regulation provide financial assurance to the shareholders interest (wealth)? b) Is there is a relationship between changes in law and regulation, economic performance, and corporate governance for Mexican public companies? as a firm?, as a sector or industry? c) Were law and regulation internalized? And how do they work? d) Is there is a change in law and regulation and perhaps performance of the firm, it is different between industries or economic sectors? The present research document analyzes the Mexican norm 11-33 and how it is related to a public company from a financial performance perspective.. 1.2 Research Performance and Governance. According with previous studies and empirical evidence, there is a cause-effect relationship between governance practices and firm performance. Governance practices can be attributed to diverse activities to perform better decisions. Performance is related.

(15) to the financial markets perspective and operative financial results. The cause-effect relationship can vary according with the impact of those activities related to governance practices. Those activities are related to the agent-principal relationship. There is an inevitable attribute of a public corporation, which is the implicit separation of ownership and control (Berle and Means, 1932) as part of agency theory. According to Jensen and Meckling (1976) the agency relationship is related to a contract under which, the principal engages other persons called agents to perform some service or activity according to the specific interest including authority and decisions. The agent is called the management, and the principal, the shareholder or the finance supplier. Conflicts between principal-agent relationships mean self interest, opportunistic behavior or incompetence of the management. These can result in a suboptimal shareholder wealth (Jensen and Meckling, 1976). One form to mitigate these risks is the adequate corporate governance practices. There are several classifications related to the problem of agency and the potential solution for the problem as it is described by Shleifer and Vishny (1997) and Denis (2001); 1) legal and regulatory process related to the use of information 2) internal control mechanisms to the use of debt, financial structure, attributes of the board of directors, executive compensations, and minority interest 3) external mechanisms related to stock and the price mechanism, as well as product markets mechanism. In a global point of view, there is a relationship between the legal system, the corporate governance mechanism, and economic development (La Porta, Lopez de Silanes, Shleifer and Vishny, 1999; Kepler, Love, 2005; Cornelius, 2005). The positive.

(16) relationship between the investor's protection mechanism and economic development, can also be affected by the ownership of the firm. The concentration of ownership is higher when the investor protection rights are deficient, when the concentration of ownership is low then the investors' protection rights are clear, well established, and accepted by the investors. According to Romano (1996), a legal and contract approach is the only way to understand corporate governance, the relationship of the ownership, and the economic performance of the company. But as a part of the globalization and economic integration many changes around legal systems, governance practices and protection of the shareholders rights had emerged as a result of economic damage to the shareholder wealth (Romano, 2005; Myers and Ziegenfuss, 2006; Payne, 2006). The emphasis of the present research is to address the legal and regulatory perspective that affects firm performance. By law every single firm has a board which is legally responsible for the management of the company. For the shareholder the law can protect 1) Their interest and relationship in the corporation and with corporate insiders, 2) The legal relationship with outsiders, particularly creditors (Roe, 1994). The legal and regulatory changes in corporate governance practices affect at the same time the performance of the firm. Changes in corporate governance practices refers to the board of directors structure and decisions processes, compensations of the higher rank executives, internal control mechanisms to avoid opportunism and relevant disclose information, and transparency issues. Many empirical researches around the world conclude the cause-effect relationship between governance practices and firm.

(17) performance (Chiang, 2005; Klapper, Love, 2005; Ting, 2006; Nahar, 2006; and Ku, Fu, Lai, 2006, for Mexican case, Castaneda, 1998 and 2000). Until now, several studies establish a cause-effect relationship between governance practices and firm performance, specifically in mature financial markets where the investor protection rights and legislation are relative advanced compared to emerging financial markets. Furthermore, governance practices can be divided into several issues called major domains, related to shareholders rights, minority rights, disclose and transparency and board responsibility. Most evidence found in previous research shows strong cause-effect relationship between either of any domains and firm performance, but scarce research is related to direct cause-effect relationship between changes in law, changes in governance practices procedures and firm performance. Additionally, scarce research is found related to emerging financial markets where improvement in legislation and governance practices has been experimented in the last decade, due to financial markets integration, globalization process and open economy environment.. 1.3 Objectives. The main objective of this dissertation is to study the relationship between changes in legislation or regulation, how it affects new corporate governance practices and then economic performance of the firm. The study is applied to listed companies in the Mexican Stock Exchange (BMV). Two concepts are involved in the relationship; the.

(18) first one is related to the new legal and regulatory mechanism in corporate governance practices and processes decisions and the second one is economic performance, before and after those changes in law and regulation. For the first one, in 2000 the Mexican stock market commission (CNBV) issued the rule 11-33 which required that all firms listed in the stock market disclosed their compliance with the Code of Best Corporate Governance Practices CCE(1999). According with the Mexican Business Council (CCE), the new rule implies several changes to the governance practices, specially related to 1) Composition, functions, and size of the board of directors; 2) Compensation and evaluation of the executives; 3) Audit and financial information; 4) Finance and planning process; 5) Relevant information disclose for the shareholders and external creditors. Before the implementation of the rule 11-33, the concept of corporate governance was treated in the law, but with no specific regulation about corporate practices. For the second objective (the economic performance concept), the inquiry involves two perspectives, the operative financial ratios and financial market indicators of companies. Operative financial ratios, according with previous research shows that the performance of the company is related to the Return of Assets (ROA), net profit margin over total assets, and net profit margin over equity (ROE). The financial market perspective is related to changes in stock prices and the Tobin Q ratio during a specific period. Positive marginal changes in stock prices mean better performance. At a global level, the performance of the Mexican Price Index (IPC) is included as is related to the implementation of the rule 11-33..

(19) 1.4 Research Questions.. For the Mexican public companies, is there a relationship between changes in law, good corporate governance practices and operative or economic performance of the firm? Is there a relationship between financial market valuation and good corporate governance practices? In both cases, is there a relationship between good corporate governance practices and firm value? Good corporate governance practices require a set of issues related to investment, executive compensations, use of debt, audit and control mechanisms and other relevant use of resources inside the company. This research studies how affect those practices directly to economic performance of the firm. For the Mexican Case, the relationship between changes in law, corporate governance practices and economic performance is studied in its structure and dynamics.. 1.5 Organization of The Dissertation. Corporate governance research is not an easy task, because the relationship between changes in law, better corporate governance practices and economic performance must be studied from different perspectives and research methodologies. Chapter 2 is dedicated to establish a based ground theoretical framework, including key variables of the study according to agency theory and implications for a public company. Also analyzed is how the agency theory may help to reduce the risk.

(20) related to opportunistic behavior of the management and internal and external governance mechanisms. The final part of chapter 2 includes the legal and contractual aspects of the agency theory and how they are linked to ensure a better economic and operational performance. This particular chapter presents a global vision of the theory of transaction cost as part of the additional potential answer to the research problem. Chapter 3 concentrates in reviewing previous research related with performance and governance and presents recent research about empirical evidence around the lawgovernance-performance problem. It presents previous and recent work related to change in legislation, normative changes in governance practices, the relationship with performance and risk. At the end, the variables analyzed in the study are described and justified. Chapter 4 concentrates on the Mexican case. It describes how the corporate governance mechanism works and the previous legislation for public companies. It also covers normative rules for governance practices and its impacts on the following dimensions: board structure, compensations, audit and financial information, planning process, and information for the shareholders. Chapters 2 through 4 describe the last empirical and theoretical stage about the regulatory and legal situation about governance practices and performance. Chapter 5 presents defined variables that measure the performance, the governance and how they are related. It also presents details of the longitudinal study around variables..

(21) Chapter 6 concentrates on the research of methodology used and the structure of the data. Chapter 7 discusses the results, conclusions of the dissertation and the future agenda for corporate governance in Mexico. The present study contributes to how regulations affect the activities inside the firm and its performance. Changes in corporate governance practices imply several modifications in how the firm is managed. These changes affect the future of the firm. For the Mexican case, the rule 11-33 is part of The Mexican stock market integration to globalization process. With the present study the implications of the rule 11-33 and the performance for public companies will be studied, and how the financial market perceives changes in regulation. The contribution of the present study will help to better understand how regulation can affect the Mexican financial market, the performance of the firm, and the integration of the Mexican stock exchange to the globalization process.. 10.

(22) CHAPTER 2 THEORETICAL FRAMEWORK. This chapter provides an overview and ground based agency theory, the control decision process and the ownership relationship. It also describes the corporate governance solutions to the agency problem. It provides a basic background, an overview of the agency theory, the ownership support, and the control process for public companies. The problem and control processes can be mitigated, in part by the corporate governance practices. The principal contribution of this chapter is on how the agency theory is directly linked to the rule 11-33.. 2.1 Agency Theory. There is a conflict between management and shareholders due to different characteristics and interests according to Jensen and Meckling (1976). The separation and control of the firm generates potential opportunistic behavior of the management and additional agency cost due to monitoring and control of the firm. There is an inevitable attribute for the public corporation, which is the implicit separation of ownership and control (Berle and Means, 1932), that emerge to the problem of agency. According to Jensen and Meckling, (1976) the agency relationship is related to a contract under which the principal engages the agent to perform some type of service or activity according to his/her specific interests, including authority and decisions. The agent is called the management, the principal, the shareholder or the finance supplier.. 11.

(23) During the process, the principal will motivate the agent to perform specific objectives, using several means such as compensations, monitoring, and measure of the agent's behavior. By using those mechanisms the principal can assure his/her own wealth in the long run. The agent is, however, motivated by self-interest and is assumed rational additionally to being risk averse. The situation can also result in a conflict between the objectives of the principal and the self interest of the agent. The agency conflict has been analyzed since Adam Smith (1776) and Coase (1937) and has emerged as an important framework to help researches understand the nature of the principal-agent relationship. Different perspectives have been analyzed since then. The corporation can be a nexus of contracts as Jensen et al perceived or as a system of volunteer exchange as Alchain and Demsetz (1972) concluded. According to the agency theory, the corporation is viewed as a "nexus of contracts" between agents, the principal and other people interested in the firm, such as banks, public institutions or venture capitalists. Conflicts of interest can arise due to the implicit relationship between these parties. A conflict may also arise due to different people with different expectations (agent principal). One possible solution of this conflict is a contract, but in a day-to-day relationship, it is quite impossible to write a complete contract with explicit planned behavior of the agent and principal relationship. Because one of the possible solutions is a contract, but contracts have considerable limitations, then other potential solutions may arise during the process. The first solution to the problem is the separation of ownership and control.. 12.

(24) This section concentrates in establishing the theoretical background about the conflict between the agent's principal relationships and how could it affect the value of the firm. The basic definition of the conflict between, the agent and the principal is the potential economic loss of the principal. This potential loss is caused by the agent. Potential loss can be identified as a loss of wealth, value of the firm or inefficient application of cash flow according with Marnet, 2005. The potential loss can be caused by agent opportunism (not necessary operative expenditures), agent incompetence, agent corruption, inadequate decision process or inadequate disclose information process. At the end of the process the potential loss will be reduced to loss of principal wealth as is described by Maniam, Subramaniam, Johnson (2006) Consider figure 2.1 that describes the initial stage, when a single owner or entrepreneur is the only owner of the firm and then is in the process to include additional owners to the firm. The vertical axis corresponds to the firm value or wealth, which is a result from a level of unnecessary expenditures. The definition of not necessary expenditures corresponds to suboptimal use of cash flow. In the horizontal axis, the manger-owner faces day-to-day non necessary expenses one point between the (VO, F0) line. VO point is the value of the firm, because it is impossible to have 100% optimal use of cash flow, then in point A utility curve shows the feasible optimal value. The slope is -1 due to following assumption; when the suboptimal use of cash flows or not necessary expenditure is equal $1 then same amount will decrease the firm value. Related to the agency theory, suboptimal use of cash flows or unnecessary expenditures denotes opportunism of the managers expending in personal benefits rather. 13.

(25) than typical business expenditures, also denotes incompetence of the manager to maximize the use of cash flows, both cases affect the wealth of the principal. At this level the owner-manager decides at any point from (VO, FO), the not necessary expenditures will be at full self cost, this means that he decides on his own, how affects his own wealth.. VO V*. ^. 16 a>. :>V2 o Q)V1. ^. ^. ^. \c ^ ~ ^ ^ ^. Slope = - «. - -. iTV4. v. ^^~~"^. \ ^ 0. F*. F3. F2. Slope = -QT. Slope = -1 FO. Market Value of Not necessary expenditures Figure 2.1. But the owner-manager can sell equity to an outside buyer. Suppose the owner sells shares (0<a <1), shows a utility cost of B or C and retains himself a a, then no longer the not necessary expenditure will be paid at full self cost and the value of the firm will decrease at less speed. The buyer will be paid the optimal value V*(l- a ). In this case, the movement will be from point A to point B, and the reduction of V* to V2 or V3 will be the agency cost to be absorbed to mitigate the problem. In other words, the difference between V* to V2 or V3 is related to the owner manager situation and it is equivalent to the claim acquired by the outside buyer.. 14.

(26) The cost associated is the agency cost. The principal-agent relationship gives rise to three types of costs for the principal according with Denis (2001) a) The Monitoring cost, incurred to control the behavior of the agent b) The Bonding cost, associated with the resource allocation by the agent to satisfy the principal preferences and c) The cost arising from a divergence between the agent decision and the value maximizing decisions, leading to reduce the residual claim. The principal establishes a governance mechanism to monitor the activities and firms performance.. 2.2 Ownership and Control. The agency problem is due to the separation of ownership and control. To the ownership because the absence of entrepreneur and also the absence of manager owner. Additional control established by the principal ensures not opportunistic behavior of the agent. Monitoring activities would ensure that the agent will provide correct behavior to maximize the wealth of the owners. The Principal will specialize in the optimization of her own wealth by using a portfolio of assets. The Agent will specialize in the decision making process to increase and ensure the wealth of the principal. The principals diversify their wealth through a variety of firms, using portfolios. These provide spontaneous, non-exposure of one firm financial loss. Spontaneous nonexposure is related to the minimization of the effect of the entire portfolio due to single financial loss. As the principal diversify their wealth over a number of firms, the cost associated with the risk bearing function declines dramatically, but in the process the day to day control of the firm is partially lost. Theory suggests the ability to transfer the cost. 15.

(27) associated (agency cost) due to ownership and control to different principals, resulting from risk diversification and minimization of the loss (Fama & Jensen, 1983a). This approach provides four elements between the risk bearing and decision making. According to Fama & Jensen, (1983b) the decision process follows four steps in broad terms; the first one is called Initiation, and is the generation of a proposal for resource utilization and structuring of new contracts. The second one is Ratification of the decision to be implemented. The third one is Implementation, and is the execution of the ratified decisions. The last one is Monitoring, which is the measurement of the decision performance of agents and implementation rewards. The organization is divided into the decision management which is related to initiation and implementation and the decision control which is related to ratification and monitoring. Both perspectives are performed by different agents. The responsibilities of management are seen as maximizing shareholder wealth subject to the constraint that the other claimant interests are satisfactorily met. According to Bearle and Means (1933) a) earning maximum profit with minimum associated cost or risk b) distribution of those profits among the owners c) maintaining market conditions favorable to the investors, but this is not always true. Managers also have their own set of interests, and this can be translated to the grade of compensated effort in the workplace, exposure to risk not measured (asymmetric information problem), and time-horizon investment (Jensen and Smith, 1985). From and agency theory perspective, the agent wealth is tied up to the performance of the single firm and perhaps it may take under risk decisions according with the actual return, affecting at the same time the shareholder wealth (Fama, 1980).. 16.

(28) The manager wealth is tied up to the future value of their compensations; this means stock options or similar future variable compensations (Mork, Schleifer and Vishny, 1989). Self interest, opportunistic behavior or incompetence of the management can result in a suboptimal shareholder wealth. One way to mitigate this problem is the adequate corporate governance practices. In Figure 2.1, change in ownership structure represents utility curves from point A to point B or C, but at the same time agency costs emerge as part of the new ownership structure. Large companies take advantage of this situation, with considerable ownership dispersion but at the same time, loss of control. Agency costs increase due to loss control, so that different mechanisms of control must be implemented to minimize opportunism and other related agency problems. There are several classifications around the problem of agency and several potential solutions according to Denis (2001) 1) Legal and regulatory instruments and mechanisms related to the use of information 2) Internal mechanisms related to the use of debt, governance practices, board of directors, executive compensations, and minority interest rights 3) External mechanisms related to stock and product markets. 2.3 Corporate Governance Practices. The agency problem can be mitigated by implementing a mechanism of control such as an independent audit firm (Watts and Zimmerman, 1978, 1979), or normative and. 17.

(29) internal rules inside the firm (Romano, 2000). Part of the answer to the implemented mechanism of control inside the firm, is governance practices. Adequate corporate governance is not an easy task. Corporate governance can be implemented from a shareholder perspective and a legal-regulation perspective. Implementing corporate governance to mitigate agency conflict, may require law and regulation. This means duty of care and duty of loyalty (Romano, 1996) on its part. The shareholder perspective implies product and capital market competition, labor market for the top management, and board of directors performance (Singh and Harianto, 1989). The corporate governance definition from an economic perspective is a set of institutional arrangements to align interests of management and shareholders. According to Williamson (1984) and for Zingales (1998) the exposition of ex post quasi rent of the firm is related to several constraints. The complete set of constraints over future residual cash flow is the set of corporate governance. The constraints are related to how management and shareholders can have access to the residual claims of the future. The constraints can be established via contracts, law or internals controls. Shleifer and Vishny (1997) define corporate governance as a relationship between investments and the mechanism of how the suppliers of finance can assure the return of their investments. This means that those mechanisms of corporate governance assure that the investors will receive an adequate return and motivate the managers to obtain the best return for the investors. Those mechanisms are related to contracts, law, regulation or internals controls. Corporate Governance according to the Cadbury Committee (1992) is a complete system related to how the public firm is controlled and the management to perform,. 18.

(30) according to the shareholders and the supplier of finance. The system is related to the decision process in investments, the use of debt, the resource allocation decisions, law and regulation, internal control mechanisms, and executive compensations. The Organization for Economic Cooperation and Development OECD (1999) has introduced a set of corporate governance standards and guidelines. These concepts cover five major areas 1) The right of the shareholders 2) The equitable treatment of shareholders 3) The role of shareholders in corporate governance 4) Disclosure and transparency 5) Board responsibility. In the same perspective La Porta, Lopez de Silanes, Shleifer and Vishny, (1997) emphasize the importance between the interaction of law, finance, and the role of the corporation in economic development. La Porta et al perspective is, according with the OECD, over the fundamental relationship between economic development, legal systems, and the financial structure. If the legal systems cannot offer legal protections for external investors, then the entrepreneurs will hold large ownership to align their interests away from the shareholders. By law every single firm has a board of directors, which is legally responsible for the management of the company. For the shareholders the law can protect 1) their interest and relationship with corporate insiders and the corporation itself; 2) The legal relationship with outsiders; particularly creditors (Roe, 1994). The legal approach to corporate governance is related to how the shareholders can access legally the residual claims of the company (Fama and Jensen, 1983b). According to La Porta et al the legal system can be particularly important for the investment decision, and shareholders can choose over several countries around the world. Legal. 19.

(31) systems can be identified as common or civil law, with two approaches to the corporate governance system. It can be quite different; it can also affect the economic development of the country, and perhaps the economic performance of the company. Empirical evidence shows a strong positive relationship between common law and economic performance of any country.. 2.4 Internal and External Corporate Governance Control Mechanisms. Jensen (1983) finds out different categories of corporate governance, 1) The legal and regulatory mechanism 2) The internal control mechanism 3) The external control mechanism and 4) The product market competition. For the present research we exclude the product market competition. The internal control mechanism, refers to the inside actions focused to reduce the conflict between the management and shareholders interest. The primary solution is an adequate board of directors. Agency theory establishes management to improve firm performance by reducing managerial waste or by improving managerial performance via different monitoring mechanisms. As a result, board independent decisions increase shareholders wealth. The board of directors is primarily responsible for the major and long term decisions inside the firm; by definition they assume decisions and duties with bounded rationality and decision making bias (Cyert and March 1963 and Simon, 1945). The managers present new business proposals, new investments and market opportunities to. 20.

(32) the board of directors. They would accept any proposal that enhances the firm value and reject any that would destroy it. But not all accepted proposals enhance the firm value. Because the long term decisions require long term resources and investments, any problem related to the success of the decision could put the shareholders and stakeholders in a risky situation. The board of directors must meet certain requirements to ensure minimum risk exposure to the shareholders and stakeholders. This requirement at least could be addressed according to Weisbach and Hermalin (2000) related to 1) board composition and diversity; 2) a board independence committee; and 3) The board leadership structure. On the other hand, managers require make those proposals real. This means that managers must ensure that new proposals enhance the firm value. Part of the compensation of the executive is related to those new proposals and the success of the new venture, in a deep sense increasing firm value. According to Core, Guay and Larcker, (2001) and Murphy (1999) there are at least two conflicts of executive compensation, the first is the level of executive pay and the second is the relationship between the pay and firm performance. The level of pay is related to the board of director's duty. But the relationship between pay and firm performance is restricted by time. One solution to the time problem is the ownership stock compensation and stock options compensation. The empirical evidence shows as pointed out by Murphy et la and Core et al that there is a positive relationship between executive compensation and firm value, using any variety of stock compensation. Several additional benefits emerge. For example, there is no cash requirement in the short run for the company, also there is. 21.

(33) associate taxation benefits, and as a part of the long term compensation long time enrolled human capital, and at the end increases of the executive wealth. The third form of governance control is increasing the number of the nonexecutive owners. Non-executive owners refer to any shareholder, who holds up to 5% of the common stock. This means that it could be a single person, investment bank, corporation or institutional investor. According to Shleifer and Vishny (1997) the importance of non-executive owners has increased due to the role that they play in the firm. In the last decade, they changed from a passive role to an active role, after ethical problems faced in the corporate world. Also the non-executive owners are known as outside blockholders or stakeholders. They usually hold small blocks of shares and their ownership is stable over time, they like to know everything about the company, and in some cases they can enroll over the operation. This new movement is called activism, and has increased dramatically in the last decade. Karpoff (1999) and Romano (2000) argue especially on new forms of institutional investors, who are interested in the performance of the firm; the empirical evidence shows that activism generates small changes in board of directors and executives. The last internal governance mechanism is the use of debt. When the firm uses financial instruments, approved by the board of directors, the future cash flow conflict is partially solved. Management is forced to keep the cash flow needed to payback the debt, according to Shleifer & Vishny (1986) and Dewatnpont &Tirole (1994). Management and the board of directors will select different shareholders and stakeholders depending on their authority over the firm. Authority can be established by legislation, contracts, or. 22.

(34) normative procedures. Shareholders are tied up to legislation and the potential residual claims, but debt financers, other minority or stakeholders can hold or share specific contracts and clear normative procedures about the management and board of director actions. Part of the solution from the last paragraph is the attitude that management and board of directors holds in the optimal use of debt. According to Friend and Lang (1988) and later Berger, Ofek and Yermack (1997). The agent's wealth is tied up to the corporate capital structure and shareholder value. Then to ensure future compensations and stock options most financial decisions avoid the use debt to be less than optimal. Still another kind of control mechanism is outside the firm, which relies on the financial and labor markets. The financial market is a response of the external control mechanism, but has a limitation as a corporate governance mechanism, because not always it is effective in time and does not imply increase of shareholder value. According to Holmstrom and Kaplan, (2003) evidence shows that firms performing poorly will be targets of takeover attempts and managers with poor performance will be fired. Both situations affect the shareholders and the managers, because takeovers mean loss of control over a new management. In agency theory, perspective management must focus in stock price rather than in external control mechanisms. In an agency theory perspective, management must focus on stock prices rather than in external control mechanisms. The present document concentrates in internal control mechanisms, legal and regulatory control. Rule 11-33 denotes a regulatory requirement to the Mexican public. 23.

(35) companies; these new requirements affect governance practices inside the firm as well as the performance and potential improvement.. 2.5 Legal and Contracts Approach. This part of the chapter establishes the importance of the legal and contracts approach. After the decade of the 90s La Porta, Lopez de Silanes, Shleifer and Vishny, (1998, 2000) demonstrate the application of the law and the enforcement of the legal systems, which are tied up to the economic performance of any nation. Because the simplest way of governance is linked to the law and regulatory mechanism, the legal systems are the fundamental variable to initiate investment or a financial process in a single firm or country. La Porta et al, found several differences between legal systems, economic development, and ownership structure. This evidence shows that financial markets and investor's protection have a direct relationship to legal application and economic development issues. According to Posner (1993) any transaction that involves assets or economic transactions requires a relational contract and a legal system. By definition, an organization must experience an additional cost. Corporate governance at a primary level is the result of legal, regulatory, and normative procedures. On a second level it must meet the requirements of legal contracts, internal normative procedures and regulatory external institutions. The third level is related to industries, businesses or supplier requirements.. 24.

(36) Rule 11-33 involves a new regulatory level that includes changes in internal and external normative procedures. The figure 2.2 shows different inside and outside implications for a firm or system.. Figure 2.2 Corporate Governance Issue Rule 11-33 To Inside the firm Implication inside the firm Contractcs (Employees, Suppliers, Clients) Disclose if is substantial economic important Use Debt (contracts Assets) Disclose and limited From Outside Law Normative Procedures Financial Market Product Market Stakeholders. At global level or system level Change Governance Practices New Decision making process Additional Information requirements Minority and external entities protection. Source: CNBV (2000). According to Hart (1995), legal and contractual rights are additional variables to a cash flow perspective. When managers act at their own benefits, this means not a pecuniary own benefit, but the contractual rights and legal normative procedure help investors to reduce claims, replace the asset or begin a legal procedure. At this point, investors perceive critical differences between the legal procedure (law enforcement) and the way they execute their own contractual rights (governance legal procedures). According to figure 2.2 the present dissertation analyzes the legal and contractual approach before and after the rule 11-33 and the implications of the situation for the investor rights and legal procedures, where the legal procedures can affect the internal processes of the governance practices. In the same line Bebchuk(1994) establishes empirical evidence about the control of the company in the financial market. When the. 25.

(37) company controls changes from one company to another then the minority and stakeholder investors rights rise, this means new control and normative procedures decrease the perception of risk and increase stakeholders rights. Grossman and Hart (1988) found that when corporate control changes. The rights of the old investors suffer several changes, and legal rules and investor's legal protections are needed to ensure that the legal system is efficient from both legal procedures and enforcement perspectives. Finally, Milton and Raviv (1988) established a clear distinction between the majority investor rights and how they are affected by the minority shareholders and other stakeholder interest. In this case legal rules and normative procedures throughout the governance practice, help to mitigate damage to other non majority investors. Rule 11-33 imposes several issues around the investors' rights, institutional legal requirements, and modifications of the internal governance practices. In the same line changes to shareholders rights, creditors rights (stakeholders), enforcement, legal procedures and ownership structure. In summary, for Mexican companies the rule 11-33 implies several changes that can affect minority rights, governance practices and additional responsibilities for the management. This is important due to the ownership structure of the actual Mexican financial market.. 2.6 A different Point of View : The Transaction Cost Theory.. 26.

(38) At this point, the answer of opportunism and lack of control of the agent relies on the agency theory problem. Additional or parallel theories analyze the same problem with different perspectives and conclusions. According to Williamson (1985) the theory of transaction cost (TTC) involves tree dimensions at the same time, economic, legal, and organizational. But the unit of analysis is quite different. Agency theory involves the organizational level (ownership and control) and TTC involves procedure or transactions (frictions inside the firm). The agency theory analyzes how contracts between agent and principal helps to mitigate to opportunistic behavior of the agent, and also analyzes how organizational decisions (inside the board of directors) must maximize the shareholder wealth. The problem analyzed includes the agent, principal, board and management as unit of analysis. In the other case, TTC analyzes how the hierarchy works due to legal and contractual procedures inside the firm, also the economic cost to ensure the politics and processes in the hierarchy is a sunk cost that can not be eliminated. The politics and process helps to ensure a governance structure in organizational hierarchy. Williamson (1984), established that a modern organization must meet limited rationality, manager opportunism, and specificity of economic assets. To control these variables, organizations must be economic and competitive with a good governance structure to ensure the future of the firm. Governance structures require an internal regulatory control mechanism and a balanced decision process. One solution of the TTC is the adequate governance structure and hierarchy organization. In terms of questions and answers to the present research, TTC helps to analyze the governance problem but at department or economic unit, not the organizational level. Also the TTC is a response. 27.

(39) from an economic efficiency perspective, assuming additional economic costs to maintain the hierarchy and the organization structure internally not a response from regulatory or contractual process, necessarily. The TTC establishes a governance structure due to implicit economic cost of coordination and cooperation of human resources inside the organization, not a regulatory or contractual procedure. According to Williamson (1988) and Menard (1998) there is a significant different analysis of the same problem (opportunistic behavior and agent control mechanism) between TTC and Agency Theory. Specifically in the unit of analysis, dimensions, cost of concern, and contractual issues. At a global level, both perspectives rely on the governance structure to solve part of the management opportunistic behavior problem. The present document concentrates only on the agency perspective, because the unit of analysis is organizational or at the firm level. Rule 11-33 involves a legal system and firm analysis. Agency theory best fits the theory to analyze the regulatoryperformance problem. According to the governance practices inside the rule 11-33, they are prevalent in some form as a tendency around the world and fit with the agency theory potential solutions. The regulatory-performance problem at a system or firm level has been already solved in different countries with the agency theory perspective. This chapter established an overview and ground based agency theory. The agency problem involves several problems, opportunistic behavior of the agent, agent incompetence and agent corruption. The problem can be mitigated via adequate governance practices. Governance practices can be implemented in several forms, the. 28.

(40) present research analyzed how regulation impacts the governance practices. Rule 11-33 is a particular form of regulation as a response of the Mexican Financial Market to ensure adequate governance practices and ensure shareholders wealth via regulation and law enforcement. Also rule 11-33 helps to attract foreign investment and the financial systems being competitive among other countries with the same tendencies. Finally, the agency problem is not the only theory treatment to the opportunistic behavior of the agent, agent incompetence or agent corruption. Also the theory of transaction cost can help understand the same problem from a different perspective and treatment. Due to different perspectives, posture of solutions and problem analysis procedures, agency theory is the best fit theory treatment to the problem. The problem of regulation, governance practices and firm performance has been analyzed in several forms, several financial markets and several countries from an agency theory perspective. This chapter contributes to use the agency theory perspective to answer why regulation can affect governance practices and perhaps firm performance. Also this chapter helps to understand how the rule 11-33 affects governance practices inside the firm.. 29.

(41) CHAPTER 3 ANTECEDENTS OF THE RESEARCH. This section refers and summarizes the literature around legal changes, governance practices and firm performance; the entire chapter has been divided into three sections. The first one briefly describes the performance problem; the second part studies the relationship between performance and governance practices, and the last part of the chapter focuses on the regulation-performance problem. This particular chapter attempts to describe the state of the art on both empirical and theoretical research about the regulation, governance changes and performance.. 3.1 Previous Research on Firm Performance.. Performance and the future success of the company are present. For Barney (1997) success of the firm is the solution today of the future demand of the company; during the process the value of the firm must increase. According to Venkatraman and Ramanujan (1986) performance can be divided into two major domains. The operative performance is related to the measurement of specific variables of the organization. Usually these variables involve the productivity measure of different functional areas. The second domain is related to the financial performance; most of the organizational activities are registered in the financial statements and are also linked to accounting rules. From a global perspective, operational performance can be ruled by the management and financial performance to. 30.

(42) the accounting rules. For the present research the use of financial data to measure performance is being discussed. Barney (1997) defines three levels of performance, normal performance, below normal performance, and above normal performance. Performance is how the assets of the firm are productive compared with other similar assets, and also refers to the perspective in time of those assets by the shareholders. Financial performance is the relationship between the expected value and the economic value. Financial performance is being discussed, because at the final stage financial data is the key variable to invest or sell the asset in the financial markets. Three major problems exist related to measure organizational performance. March and Sutton (1997), first refer to the instability of the performance advantage. Any better practice is adopted rapidly by competitors; second the measure is exposed, this means that there are other implicit variables (usually not included and not measured) that could affect performance; third the short term effect, any change related to a better performance would affect also the performance in the long run. For the present research performance will be measured from a financial performance domain. This implies certain important considerations. First, as mentioned before, the financial perspective is guided by accounting rules, then the measure is past due. This means that variables either not measured or included could exist; and third there is the time perspective problem. From a financial perspective, the companies in the present research are not only ruled by the accounting rules, but also by different external institutions and legal requirements. Due to their public characteristics, they need to ensure the veracity and the. 31.

(43) quality of information. (Watts and Zimmerman, 1979). The problem of not measured variables or not included ones, as well as the time perspective are implicit problems of the research. The financial domain also has two implicit perspectives. The outside perspective is how the market perceives the value of the firm. If the company performs or creates value below the actual asset value, then the market will automatically set the new value. This perspective is linked to the movements in the stock price. The inside perspective refers to the financial statements or operative financial variables that accountants and the auditors report to different authorities or interested entities. During this process human behavior and market pricing are not related, but they are intrinsic variables, (Stewart,2002). The present research establishes a relationship between financial performance and corporate governance practices. Empirical previous work shows that financial performance is divided in inside and outside perspectives, both related to governance matters, and supported with empirical works as shown the next two sections. Recent empirical research adopts many variables, most of them easy to follow and easy to measure. For the market, outside or shareholder perspectives link the performance of some explicit variables such as the Tobin Q ratio, market-to-book ratio, price-stock performance, earning per share (EPS) and depending of the objective of the research, any abnormal or reaction of those variables to some event or particular circumstance. In this path Klapper and Love (2005), Sundaramurthy, Rhoades, and Rechner (2005), Rubach and Picou (2005), Ting (2006), and Li, Lam, Qian, Fang (2006), are recent contributions.. 32.

(44) The outside perspective of financial performance is based on previous work related to stock performance and to the ownership structures (Demsetz and Lehn, 1985), management issues (Mork, Shleifer, and Vishny, 1988), and board compositions (Hermalin and Weisbach, 1991). They include variables such as stock price, market price earnings per stock, dividend policy, Tobin's Q ratio, and stock options to employees. These variables have a deep sense in the market perspective of the asset value or firm value, but with limitations of the market behavior Ball (2002). The outside perspective about firm performance can also include market and exogenous variables such interest rates, industry behavior or competition and macroeconomic events, that can add noise to the performance measures. Most of the research around governance practices and performance relationship mix the outside perspective and the inside perspective. The inside perspective permits to conclude the specific behavior of the firm in some period of time, due to operative and day to day variables. This allows to understand directly the board of directors performance, CEO performance, and directors behavior. Most research in this line is related to compensation, ownership structure, board of directors performance, and financial stressed firms or restructuring of firms. In this path Perry (2005), Petra (2005), Kang and Kumar (2006), Nahar(2006) and Shen, Hsu, Chen (2006) are major contributions. The measure of performance is related to operative financial ratios, such ROA, ROE, Sales, R&D, Operative Margin, EBITDA or any change of those variables in some period of time. The inside perspective of performance relies on economic and financial data from the firm. The variables related to the inside perspective include sales, assets, operative. 33.

(45) profit, use of debt, financial ratios, as well as all those variables that could be found in the financial statements. Previous work related to the use of these variables is extensive and ground based around the world for companies, in China (Shen, Hsu and Chen, 2006), Germany (Lehman, Warning and Weigand, 2004), Malaysia (Leng, 2004), and Taiwan (Chiang, 2005). Part of the definition of performance relies on the efficiency concept as it is described by Jensen (2001). The economic value of the firm is created as a set of outputs valued by customers at a rate more than the value of the inputs that the firm consumes. Also Caves (1992) and Green and Mayes (1991) conclude that the importance of efficiency is related with outputs and inputs. The output-input relationship is used in most financial ratios.. 3.2 Previous Research on Corporate Governance Practices and Performance. This part of the chapter attempts to explain recent evidence of how changes in governance practices can improve firm performance. Empirical evidence shows that better corporate governance practices from different points of view seem to improve operative and financial performance. Governance practices can be viewed in five major domains. Recent empirical research seems to focus in particular characteristics of the board of directors, compensation and ownership structure. Every particular domain or construct linked and studied in the firm performance problem. Corporate governance studies differ mostly in the variables that attempt to be included in five major domains, as The Organization for the Economic Cooperation and. 34.

(46) Development (OECD) (1999) guidelines propose 1) The right of the shareholders 2) The equitable treatment of shareholders 3) The role of shareholders in corporate governance 4) Disclosure and transparency 5) Board responsibility. Several perspectives and variables can induce to measure governance practices. Agrawal and Knoeber (1996) include two perspectives, the inside mechanisms such as; the shareholder insider, institutions, large block holders, where is the outside mechanism includes debt policy, labor market, and corporate control. Recently and in the same line is Chiang (2005), with specific domains related to performance-governance practices. Such domains are formed by the following concepts: the structure of board of directors, size of the board and CEO duality, independent directors and CEO, structure of the ownership, proportion of management, institutional shareholders and information transparency. Gompers, Ishii and Metrick (2003) created a governance index based on 24 rules showing the governance practices in five following domains; 1) Delay of the procedures related with decisions and control, 2) protection related to the management of the firm, 3) voting rules with the procedure and alternatives to the shareholders, 4) other related issues to shareholder protection and 5) state perspective related to law and the mechanisms of judicial procedure. Drobetz, Schillhoffer and Zimmermann (2003) designed a corporate governance rating based on 30 proxies or variables, which are divided into five major domains, 1) corporate governance commitment, 2) shareholders rights, 3) transparency, 4) management and 5) supervisory board matters and auditing. All this previous work shows. 35.

(47) significant evidence in establishing a relationship between governance practices and firm performance. Yeh, Lee, & Ko (2002) researched the prevention of fraud. Good corporate governance practices are positively related with financial performance. In the same line Black, Jang and Kim, (2002) established that an organization with better corporate governance practices can perform a better operating and economic activity. They also found a strong causal relationship between market value and the corporate governance index. They used a different but traditional set of financial variables; Tobin Q ratio, market / book value, and market / sales value. Chiang and Chia (2005) established that corporate governance practices related with size of the board, institutional board of directors, institutional blockholders, financial transparency, information disclosure, and board of directors control mechanism, all of them affect the economic performance of the firm. As is described in the present section the five major domains established by the OECD (1999) guidelines represent the most common governance practice constructs. Each domain has been analyzed and studied on its impact on firm performance. Several reasons emerge to use the OECD governance format. The guidelines of the OECD represent almost every issue implemented in the rule 11-33. Also most of the guidelines offered by the OECD have been converted in some countries as law or regulation procedures. Some research referenced in the present document is also related or based on previous OECD research. Also the OECD is the only organization with experience, research and historic evolution in governance practices.. 36.

(48) Shen, Hsu, Chen (2006) use the ownership structure, measuring the percentage of ownership showed by the board of directors, the CEO and highest rank position of employees, and the relationship with firm performance. The empirical study reveals a strong positive relationship between those variables. Other domains have been analyzed. For example, issues about board control, board diversity, board independence, CEO compensation, board compensation and board size all have been studied and analyzed on their impact on firm performance. Most empirical research about specific governance practices and performance shows strong positive relationship. Kang, Kumar and Lee (2006) perform empirical tests measuring and studying the relationship between a CEO incentive program additional to governance practice mechanisms, and firm performance. The new governance practices include additional control and risk management related to decision making processes. They find a positive correlation between governance practice procedures, firm performance and CEO monetary incentives. CEO compensation seems to be linked only with financial performance, according with Epstein and Roy (2005). They evaluated the committee reports for the US largest corporations and conclude that most of the CEO compensation is only linked with financial performance, specifically those internal and operative variables, changes in sales, operative margin and EBITDA. They also argue that many of the CEO responsibilities are not correctly evaluated, such as customer relationships, strategic planning, operations, and risk and control management. This can end in a short term decision process to grant bonuses and other benefits, given that CEO is thinking in. 37.

(49) financial performance rather than other important variables such as customers, suppliers and employees. In the same line, Jiraporn, Sang Kim and Davidson (2005) studied the relationship between CEO compensation, shareholder protection rights and firm performance and found a strong positive correlation. The shareholders rights where studied from a perspective of voting rights, governance index changes, and protection of minority rights. They conclude the existence of positive relationship between CEO compensation, additional changes in governance practices and firm performance. Characteristic of the board of directors seem to lead the most studied issues in recent years. The characteristic of the board of directors seems to affect the firm performance directly. Indeed size, responsibility, diversity, compensation and independence are the most analyzed issues in recent years. The board responsibility domain, includes CEO compensation, CEO duality, directors stock ownership, and operational committees. Kuo, Fu and Lai, (2006) research the domain board control and changes in responsibility, and finds strong positive relationship with compensation and granted stock bonus. The variable board control and responsibility include director ownership, supervisor ownership, board size, number of supervisors, chairman ownership and CEO duality. The variables of CEO duality, independence of the board of directors measure as a number of external directors and additional operational audit committees also is studied. For Petra (2005) board composition is defined by the number of external directors, directors and shareholders at the same time, and number of directors. Also Perry and Shivdasani (2005) research the characteristics of the board of directors, which. 38.

(50) include inside directors, outside directors, size and independence. Both studies conclude a strong positive relationship with firm performance. However, there is another point of view. For Sundaramurthy, Rhoades, and Rechner (2005), using a meta analysis research methodology for a set of empirical studies using governance practices, ownership structure and firm performance, and measured as outside and inside firm performance, find out no significant evidence between variables. They argue that most of the problem (theory and previous similar works) can exist in short time longitudinal studies and SEC public information standards. In the same path, previous work related to board remuneration and firm performance also concludes no significance between variables. A research performed by Dogan and Smyth (2002), finds out mixed results because some other variables around board or ownership and firm performance show a positive relationship. For Nahar (2006) there is strong positive relationship for board of directors, CEO and ownership structure and firm performance, but deny any relationship between director or high compensation to employees and firm performance. The problem seems to concentrate on CEO and board of directors performance and compensation. This recent research establishes a new agenda for the theory because an incentive is always related to high compensation employees, CEO and board of directors, not only to the CEO. Finally, Rubach and Picou (2005) study how new regulation and legislation standards and new guideline governance practices can influence firm performance behavior. These new particular and more specific requirements by the SEC and level of responsibilities seems to improve firm performance but they not find any abnormal. 39.

(51) returns in the short term analysis and firm performance improvement related with this particular event. As a conclusion governance practices related to compensations and board of directors characteristics help to improve firm performance. Rule 11-33 implies several changes that empirical previous work concludes on its significance with performance. But several research problems can emerge 1) the longitudinal problem. 2) Incentives not always can help in certain hierarchy levels in the organization. 3) The abnormal return (short term model) after several regulation requirements, not always are linked to firm performance. The present document saves those research problems with long term empirical financial analysis; rule 11-33 establishes a complete periodic revision of high ranking employees, CEO and the board of directors agenda. Also event study methodology will use long term and short term abnormal returns analysis to mitigate previous research problems in short term event study.. 3.3 Previous Research about Changes in Legislation, Corporate Governance and Economic Performance. Regarding the previous section conclusions, recent research around governance practices (measured by any domain or construct) and firm performance seems to conclude on a positive and strong relationship. The present research attempts to include how changes in legislation and regulation improve corporate governance practices and then firm performance. Limited research has been found around the regulationgovernance-performance problem.. 40.

(52) Regulation-governance-performance problems result particularly important to Mexico due to: 1) Product and financial market integration with the globalization trend, 2) Foreign investment choice to other alternatives around the world, 3) Protection and regulation the financial markets according with the global trend and global agency problems in mature financial markets. My contribution is how regulation improvements affected the governance practices in Mexico and then test the final firm performance impact. Governance practices are influenced by market mechanisms, product or financial markets, internal normative procedures, control of resources, and the legal system. This part of the chapter tries to link the changes in legislation or legal requirements, corporate governance practices, and financial performance. Changes in legislation and regulatory procedures began in the last century. Firend and Herman (1964) point out the importance of regulation around public firms and financial agents. The paper is based on a special study about securities markets and how new policy proposals can regulate securities markets, financial agents, publics firms and authorities. From a governance perspective, later Gregory (1999) points out the importance of regulation in governance practices and guideline codes. Several institutions and organizations recommend the adoption of those practices by firms before some of those practices became a part of the legal requirements and regulatory procedures. As is mentioned early in the chapter, protection rights are part of the OECD guideline. Modigliani and Perotti (1997) research the problem of minority shareholder rights around the world, when part of the firm growth can either be through debt or rise new capital. When the enforcement of judicial mechanisms and regulation are poor, the. 41.

(53) most vulnerable financial instrument are the securities and then the financial corporate lending is the dominant instrument in financial markets. Lombardo and Pagano (2000),found that the total stock market returns are correlated with an overall measure of judicial efficiency procedures and the rule of law, but also dividend yields, and earning price ratios are positively correlated with the same variables, judicial efficiency and the rule of the law. Later on, Lombardo and Pagano (2002), found out that legal institutions, called rule of law and judicial efficiency procedures can affect the market equilibrium and improve legal institutions and also affect equity returns depending on the institutional change. After the year 2002 legal and regulatory procedures increased dramatically around corporate governance practices due to economic damage to shareholders from WorldCom, Enron and Parmalat. The economic damage resultant from an ethical problem related to financial information, resources management, audit firms and boards lack of responsibilities. The result has been that changes in regulatory procedures and endurance over governance practices around the world, and new regulatory legal system can protect shareholders wealth in any financial market. Included are new attitudes and involvement of investment funds, minority shareholders and monitoring procedures around the firm. The legal system can affect corporate governance procedures and at the same time the performance of the firm. Regulation affects the following governance practices; 1) Shareholders rights 2) Information and disclosure 3) Decision process 4) Internal controls and financial information. The following section describes each of the governance practices and how they are affected by new regulations.. 42.

Figure

Documento similar

The expansionary monetary policy measures have had a negative impact on net interest margins both via the reduction in interest rates and –less powerfully- the flattening of the

Jointly estimate this entry game with several outcome equations (fees/rates, credit limits) for bank accounts, credit cards and lines of credit. Use simulation methods to

Here we can verify what we believe constitutes a paradox: the necessity of con- siderations of an ethical kind is imposed, but from that tradition of Economic Theory whose

In section 3 we consider continuous changes of variables and their generators in the context of general ordinary differential equations, whereas in sections 4 and 5 we apply

In the previous sections we have shown how astronomical alignments and solar hierophanies – with a common interest in the solstices − were substantiated in the

We advance the hypothesis that fraudulent behaviours by finan- cial institutions are associated with substantial physical and mental health problems in the affected populations.

The rates of correct classifications [%] within each classification problem obtained for the considered univariate and multivariate LR models and the corresponding Cllr values,

The aim of this paper is to analyze whether a number of firm and industry characteristics, as well as media exposure, are potential determinants of corporate social responsibility