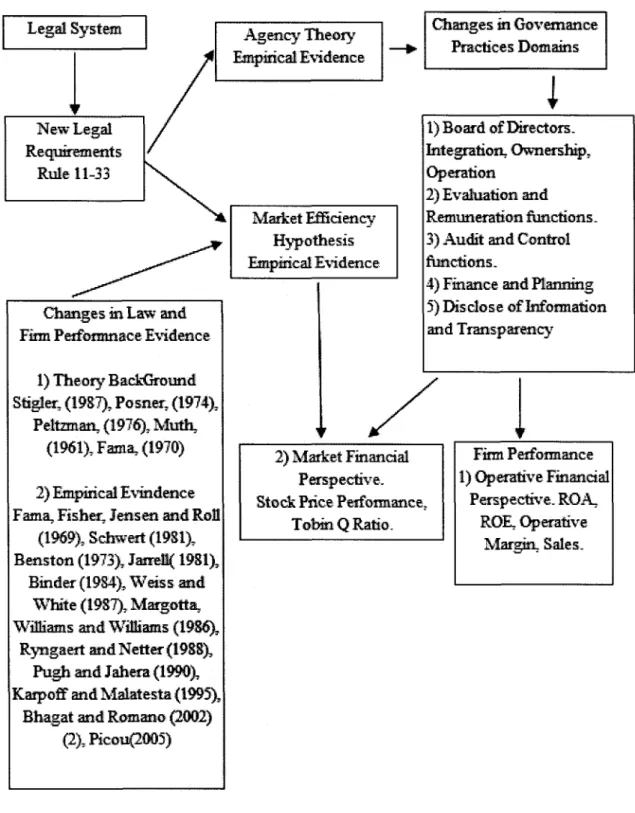

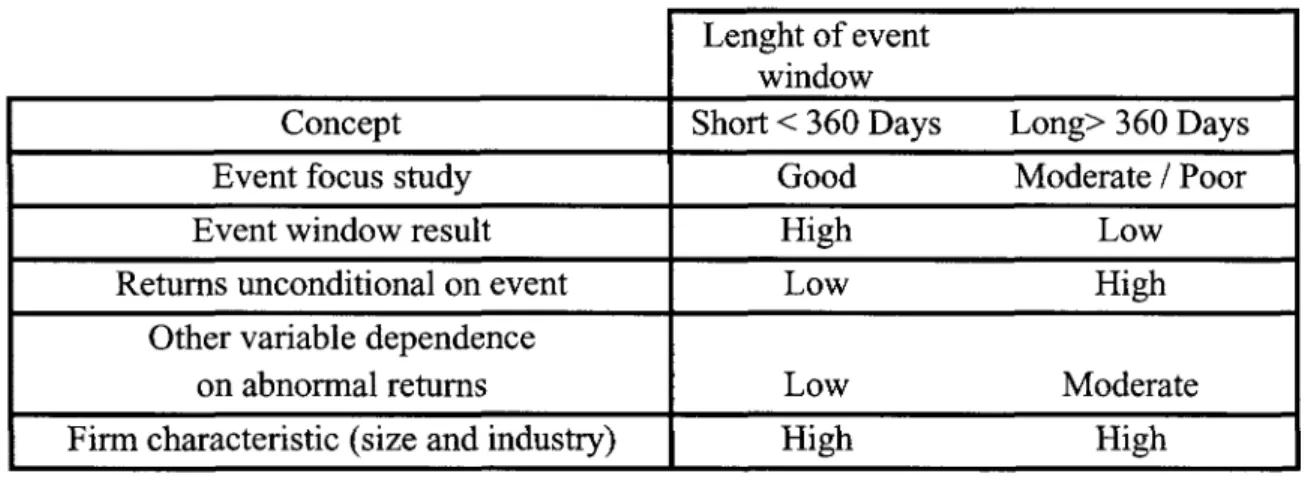

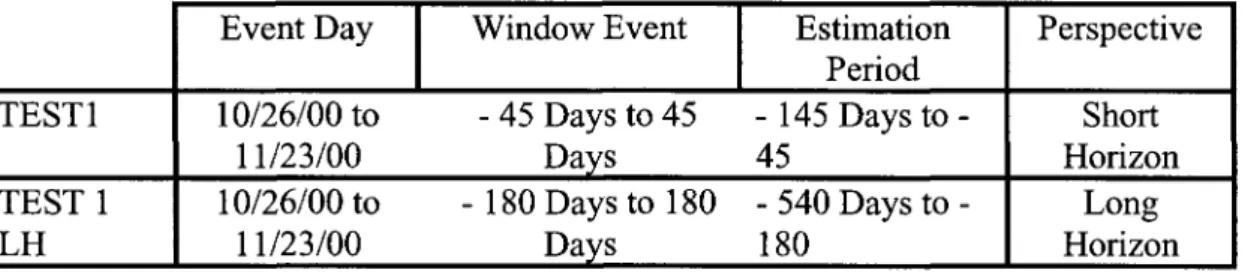

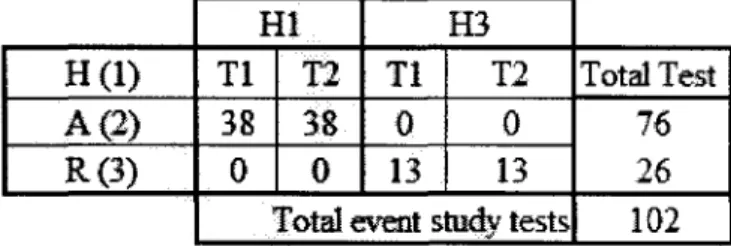

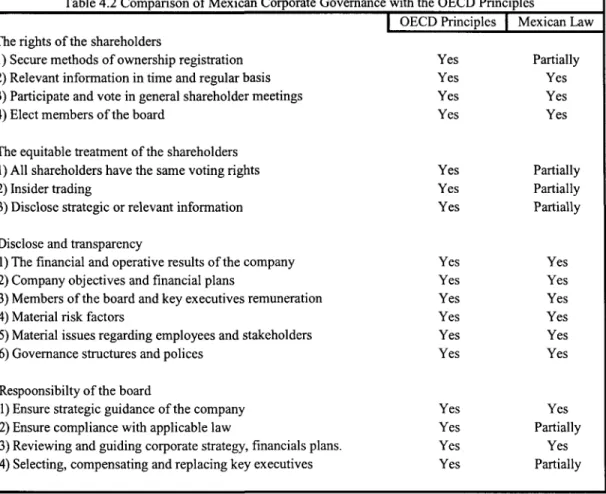

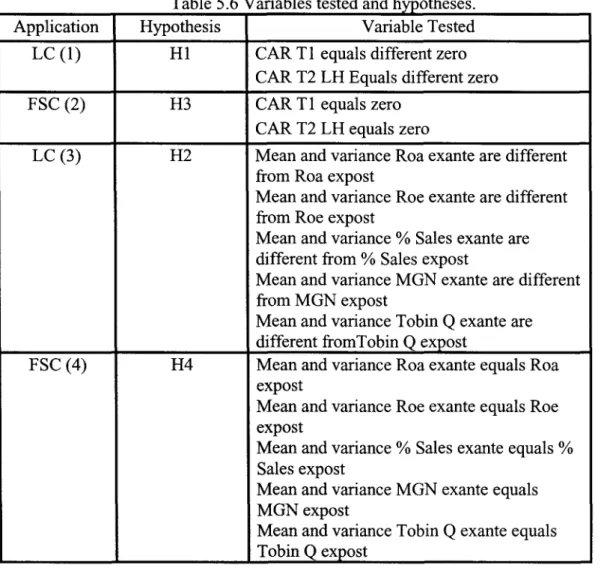

Relationship between changes in regulation, corporate governance, and firm performance: Mexico’s case

Texto completo

Figure

Documento similar

The expansionary monetary policy measures have had a negative impact on net interest margins both via the reduction in interest rates and –less powerfully- the flattening of the

Jointly estimate this entry game with several outcome equations (fees/rates, credit limits) for bank accounts, credit cards and lines of credit. Use simulation methods to

Here we can verify what we believe constitutes a paradox: the necessity of con- siderations of an ethical kind is imposed, but from that tradition of Economic Theory whose

In section 3 we consider continuous changes of variables and their generators in the context of general ordinary differential equations, whereas in sections 4 and 5 we apply

In the previous sections we have shown how astronomical alignments and solar hierophanies – with a common interest in the solstices − were substantiated in the

We advance the hypothesis that fraudulent behaviours by finan- cial institutions are associated with substantial physical and mental health problems in the affected populations.

The rates of correct classifications [%] within each classification problem obtained for the considered univariate and multivariate LR models and the corresponding Cllr values,

The aim of this paper is to analyze whether a number of firm and industry characteristics, as well as media exposure, are potential determinants of corporate social responsibility