Cooperative banking groups in Europe : comparative analysis of the structure and activity / Ricardo J Palomo Zurdo

Texto completo

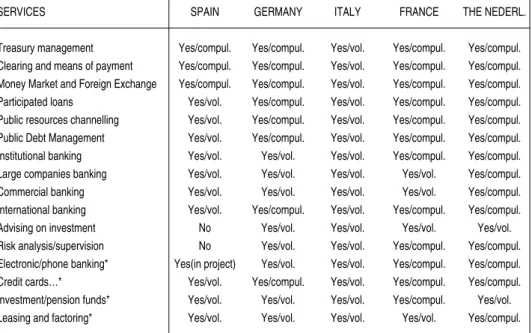

Figure

Documento similar

On the other side of the spectrum we could find a more-efficient and more professionalized banking system which entities were growing or had been restructuring

In particular, we use monetary policy as the basis for some policy challenges arising from changes in payment systems, while we rely on the economics of banking to analyse the

The suitability of the analysis of the social consequences led to by the image that is exhibited in television series on different social groups and issues has proved more

Relationship between the total cluster stellar mass and the photometric blue fraction for the ALHAMBRA cluster and group sample stacked into different redshift bins. The galaxy

In this respect we can classify institutions in three categories: Cooperation and development ( Union of Arab Banks,1974; Islamic Development Bank, 1975; Arab Monetary Fund,

Posteriorly, Oliver and Segev classified the groups which admit a fixed point free action on an acyclic (finite) 2-complex [10].. Our proof of Theorem 3.2 is built upon the results

The expansionary monetary policy measures have had a negative impact on net interest margins both via the reduction in interest rates and –less powerfully- the flattening of the

Jointly estimate this entry game with several outcome equations (fees/rates, credit limits) for bank accounts, credit cards and lines of credit. Use simulation methods to