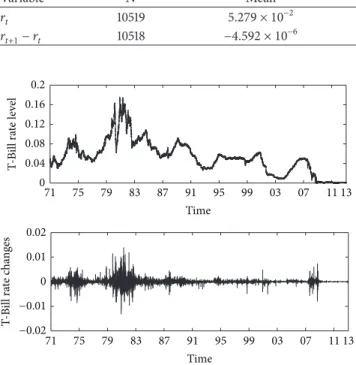

The Role of the Risk-Neutral Jump Size Distribution in Single-Factor Interest Rate Models

Texto completo

Figure

Documento similar

The expansionary monetary policy measures have had a negative impact on net interest margins both via the reduction in interest rates and –less powerfully- the flattening of the

Jointly estimate this entry game with several outcome equations (fees/rates, credit limits) for bank accounts, credit cards and lines of credit. Use simulation methods to

Given the much higher efficiencies for solar H 2 -generation from water achieved at tandem PEC/PV devices ( > 10% solar-to-H 2 energy efficiency under simulated sunlight) compared

TipC and the chorea-acanthocytosis protein VPS13A regulate autophagy in Dictyostelium and human HeLa cells.. Sandra Muñoz-Braceras a , Rosa Calvo a & Ricardo

Even though the 1920s offered new employment opportunities in industries previously closed to women, often the women who took these jobs found themselves exploited.. No matter

After the Spanish withdrawal from the territory in 1975, Morocco waged a brutal military campaign against the Polisario, and large numbers of people fled to refugee camps, where

In the “big picture” perspective of the recent years that we have described in Brazil, Spain, Portugal and Puerto Rico there are some similarities and important differences,

Graphical analysis compared between the two jumps (first jump and second jump) in the four experimental conditions (0%, 2.5%, 5% and 7.5%), for vertical takeoff speed (v (Y)CM