Capital goods imports and long run growth: Is the Chinese experience relevant to developing countries?

Texto completo

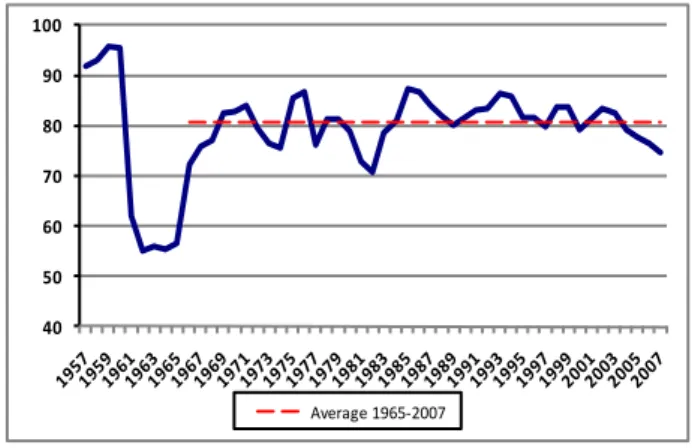

Figure

Documento similar

From the ILO EPlex indicators we have obtained, we cannot clearly see an inverse relationship between the employment protection and the

This expectation is based on the relationship between forecast errors of quarterly GDP growth and subsequent revisions to GDP-growth forecasts in the Funcas survey shown in Figure

This expectation is based on the relationship between forecast errors of quarterly GDP growth and subsequent revisions to GDP-growth forecasts in the Funcas survey shown in Figure

In addition, precise distance determinations to Local Group galaxies enable the calibration of cosmological distance determination methods, such as supernovae,

Government policy varies between nations and this guidance sets out the need for balanced decision-making about ways of working, and the ongoing safety considerations

The photometry of the 236 238 objects detected in the reference images was grouped into the reference catalog (Table 3) 5 , which contains the object identifier, the right

Different proxies for growth options ratio to the firm’s total value (GOR) (either MBAR (the market to book assets ratio), Q (Tobin’s Q), or RDsales (the ratio of R&D expenses

However, growth is not always good for a company, and firms should therefore always make sure that the real growth ratio is close to the sustainable growth ratio; otherwise, a